200 quit currency trade as S. Sudan pound slips further

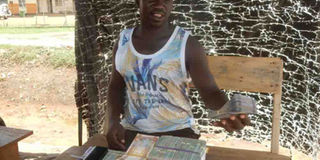

Mr Simon Izakare, a currency trader at the Elegu-Nimule border, goes about his business last week. PHOTO BY BILL OKETCH

Amuru- More than 200 currency traders at Elegu-Nimule border have reportedly quit the business following sharp depreciation of the South Sudanese Pounds (SSP) against the Uganda Shilling and US dollar.

Last Thursday, the SSP was trading as low as at Shs23 down from Shs650 in 2013, whereas one US dollar was trading at 16,000 SSP.

It is estimated that the beginning of the year, more than 300 people were trading in currency at Elegu but less than 100 have ‘survived’ the risky trade.

While critics say the economy of South Sudan has now “technically collapsed” and that no measures can rescue it, traders are calling for government intervention.

“The economy is now biting, people are suffering, prices of commodities have tripled. It’s only those in authority who can survive the current economic situation. Everyone in villages is crying out for help,” said Lojur Molu, a concerned South Sudanese.

Government officials in Juba, who earn about 1,500 SSP, cannot afford to feed their families and have opted to take their children and wives to refugee camps in Uganda, according to a senior Uganda police officer.

“In 2013, if a government worker was earning an equivalent of Shs700,000 as a salary per month, he would now earn only Shs2,000 if he continues to earn at the same rate,” the source told this newspaper last week, suggesting the crisis is compounded by the shortage of dollar.

“The government in Juba spent all its US dollars in the conflict,” the police officer said.

According to Investopedia, currency fluctuations are a natural outcome of the floating exchange rate system that is the norm for most major economies.

The exchange rate of one currency versus the other is influenced by numerous fundamental and technical factors. These; include relative supply and demand of the two currencies, economic performance, outlook for inflation, interest rate differentials, capital flows, technical support and resistance levels, among others.

Mr Simon Izakare, a currency trader, said the unstable currency has affected him so much.

“You sell at a cheaper price compared to what you bought at; I bought this one at Shs23 per one pound but I may end up selling at Shs20. That’s a loss of three Shillings per one SSP,” he said.

“It reduces your working capital; it reduces income so that means you will be running business at a loss,” he added.

According to Mr Izakare, many traders have started selling clothes and general merchandise as a survival mechanism.

Traders have attributed the falling SSP to the instability in South Sudan.

War broke out in the neighbouring country in December 2013. Much as there have numerous ceasefire agreements, instability has persisted.