Low income countries to face unsustainable debt, says IMF

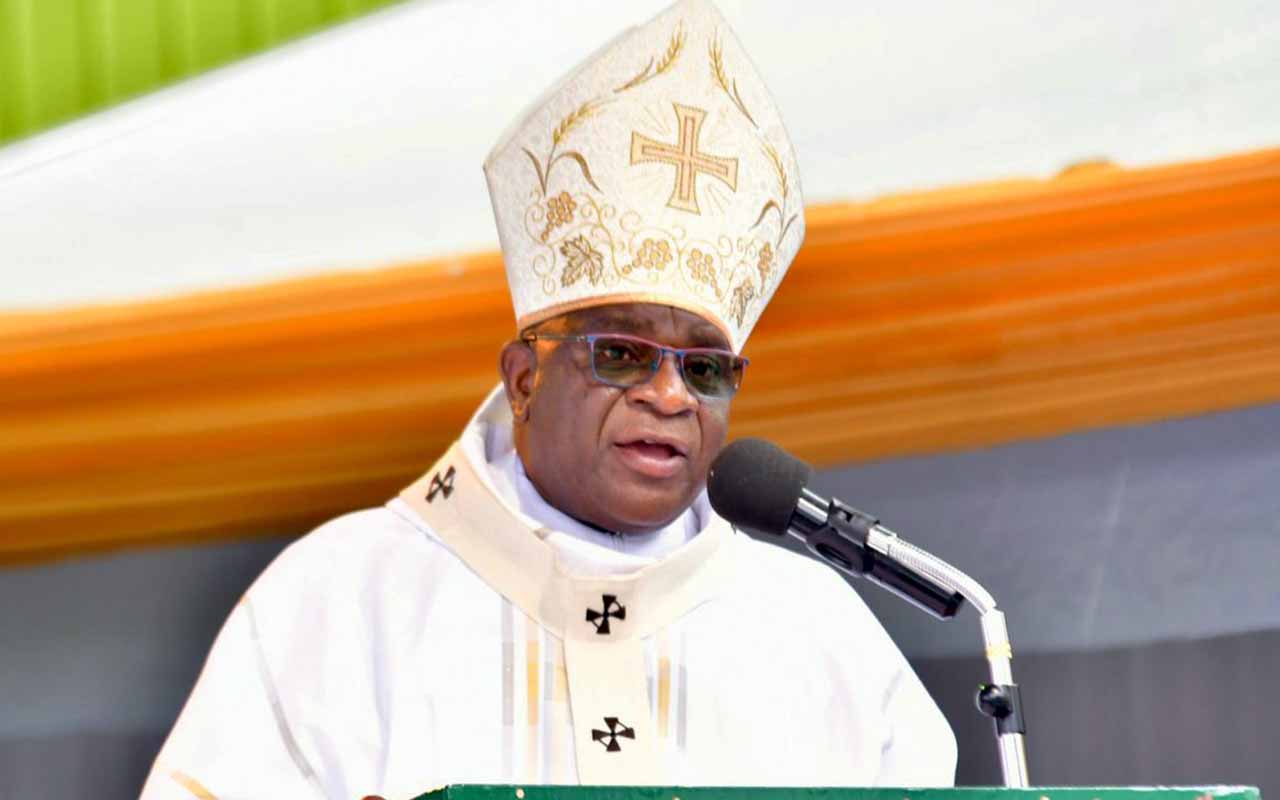

Ms Christine Lagarde, the IMF managing director

What you need to know:

- Ms Lagarde, said greater efforts are needed to make borrowing sustainable, which means that procedures must be prudently followed while taking on new debts.

Kampala. The International Monetary Fund has warned that many low income countries will face unsustainable debt burdens.

Speaking during the Sovereign Debt Conference, Ms Christine Lagarde, the IMF managing director, said public debt is at levels not seen since the Second World War.

“Emerging markets’ public debt is at levels last seen during the 1980s debt crisis. If recent trends continue, many low-income countries will face unsustainable debt burdens,” she said, noting that the build-up has a lot to do with the 2008 financial crisis and the post-crisis policy response.

Debt continues to grow in much of Africa and analysts have warned it grow out of proportion.

In Uganda, according to the Ministry of Finance, the country’s external debt increased to $10.24b (Shs31.181 trillion) as of December 2017 compared to $8.7b (31.664 trillion) by December 2016.

Domestic debt also increased to $3.3b (Shs12.180 trillion) as of December 2017 up from $3.2b (Shs11.712 trillion) in 2016.

Uganda’s debt ratio to the GDP ratio stands at 38 per cent slightly lower than the 50 per cent threshold set by the East African Community states.

Ms Lagarde noted that high debt exposure have left many governments vulnerable to sudden tightening of global financial conditions and higher interest costs, noting that low-income countries have resorted to borrowing from non-traditional lenders that are outside the Paris Club, which has exposed such countries to high interest rates and shorter maturity periods.

“We estimate that 40 per cent of low-income countries already face significant debt challenges,” she said.

Key speciality

Going forward, Ms Lagarde, said greater efforts are needed to make borrowing sustainable, which means that procedures must be prudently followed while taking on new debts. This is intended to stop distortions in attracting foreign direct investment as well as boosting tax revenues.