Our debt is sustainable - Kasaija

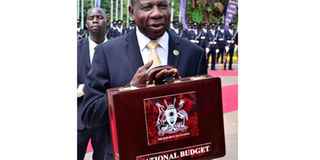

Budget. Finance minister Matia Kasaija displays the National Budget briefcase at Kampala Serena Conference Centre last week. PHOTO BY ALEX ESAGAALA

What you need to know:

- Ratio. The ratio of Public debt to GDP now stands at 38.1 per cent which is much lower than the threshold of 50 per cent beyond which public debt becomes unsustainable.

Kampala. Your Excellency the President,

The Right Honourable Speaker of Parliament,

His Lordship the Chief Justice,

The Right Honourable Leader of the Opposition

Honourable Ministers and Members of Parliament,

Your Excellencies, Ambassadors and Heads of Diplomatic Missions

Distinguished Guests,

Ladies and Gentlemen.

1. Madam Speaker, in accordance with Article 155(1) of the Constitution of the Republic of Uganda, I presented, on behalf of His Excellency, the President, the budget for Financial Year 2018/19 to Parliament on 25th March 2018. The budget was duly approved by Parliament on 1st June 2018, for which I very much commend Parliament.

2. So today, I am presenting just the highlights of the approved budget.

Introduction

3. Madam Speaker, the Financial Year 2018/19 Budget has been formulated based on the socio-economic achievements made in the recent past, and the challenges that we still face today. The right policies that the National Resistance Movement (NRM) Government has consistently developed and implemented over several years have led to key socioeconomic development gains.

4. Madam Speaker, the NRM Government has, to state the obvious, since 1986 laid a firm foundation for Uganda’s socio-economic development. Witness the following:-

i. Uganda is now at peace and without any civil conflict, which provides a suitable environment for investment. Security of persons and property reigns, although some criminal minded individuals want to disrupt this peace;

ii. The rule of law now permeates all spheres of life, with a sound

Judiciary and the enforcement of contracts being guaranteed by commercial law;

iii. Economic stability has been consistently maintained with the economy growing at an average annual rate of growth of 6.5 per cent for the last 30 years, together with fairly low inflation;

iv. Ugandan exporters now enjoy duty free access to both the East African Community (EAC), and East and Southern Africa (COMESA) markets, a few non tariff barriers notwithstanding;

v. Energy and Transport gaps, which are the major cost drivers for businesses are being seriously addressed.

5. Madam Speaker, as a result of these basics, the quality of life of most Ugandans and the standards of living of households in Uganda have tremendously improved. For Instance:-

i. Incomes have increased with average per capita incomes nearly doubling in the last eight years, from Shs1.35m in FY2009/10 to Shs2.68m in FY 2017/2018, in spite of a rising population;

ii. The number of Ugandan employees in the formal sector grew at an average annual growth rate of 6 per cent between 2010 and 2013 and the national unemployment rate declined from 11 per cent in 2013 to 9 per cent in 2017;

iii. 86.1% of the population are within a 5 kilometers access to health facilities compared to 83.3% in 2013;

iv. More families are living in houses built with permanent materials with 75 per cent of households living in iron roofed shelter in 2017 compared to 68 per cent in 2013;

v. Access to the national electricity grid has increased from 14 per cent in 2013 to 22 per cent today. In addition, 18% of households use solar power, and 6% use paraffin lanterns. A further 21% of households use batteries for lighting.

vi. Access to improved sources of drinking water has increased from 68 percent in 2013 to 78 percent in 2017.

vii. There were 10.2 million pupils enrolled in primary schools in 2017 compared to 8.7 million in 2013. In addition, disparities between boys and girls in both primary and secondary education have also reduced with the sex ratio in primary schools increasing from 0.96 in 2013 to 0.99 in 2017, and in secondary schools from 0.89 to 0.95 over the same period.

6. Madam Speaker, despite the demonstrable gains achieved by the mighty NRM Government over the years, Uganda still faces major development challenges which include the following:-

i. 68.9% of Ugandan households remain engaged in the subsistence economy. These households are highly vulnerable to risks such as drought that results from climate change. 43% of these households are engaged in subsistence agriculture,producing what they consume;

ii. Whereas income per person has increased, inequality between rural and urban areas has risen with rural poverty rising from 22.8% in 2013 to 25.8% in 2017, against a marginal increase in urban poverty from 9.3% to 9.4% over the same period;

iii. Agricultural sector growth has been low, growing at an average annual growth rate of less than 2 % over the last 25years, compared to population growth of 3% annually;

iv. Small and Medium Enterprises (SMEs), Manufacturing Firms and other Private Sector entrepreneurs are still faced with high costs of electricity and transport, limited and expensive financing and competition, mainly from cheaper goods from Asia;

v. Inadequate or inappropriate skilled labour failing to meet the manpower requirements for the job market;

vi. Low entrepreneurial knowledge and limited application of technologies in production processes, particularly in agriculture and industry;

vii. Limited availability of patient and appropriate long-term finance to start or boost SMEs and private sector investment.

7. Madam Speaker, in order to consolidate the progress the NRM

Government has achieved, and address the challenges we still face, I will elaborate the budget strategy later in my statement.

8. Madam Speaker, the Financial Year 2018/19 Budget theme is “Industrialisation for Job Creation and Shared Prosperity”.

We adopted this theme this financial year in consultation with the East African Community partners. It will guide the budget in both preparation and execution for the next three financial years.

9. Madam Speaker, in my presentation today, I will restrict myself to the following:-

i. Reporting on the performance of the economy;

ii. Presenting the Budget Strategy that addresses our development challenges and propels Uganda into Middle Income Status;

iii. Updating Parliament on the performance of key selected sectors in financial year 2017/18 Budget, and the priorities for the coming financial year; and

iv. Highlighting the financial year 2018/19 revenue measures to enhance domestic revenue mobilisation and key priority expenditure allocations.

II. Financial Year 2017/18 Economic Performance and Medium Term Economic Outlook

10. Madam Speaker, in the Financial Year 2017/18 the economy has been influenced by both global and domestic developments.

Global developments

11. Madam Speaker, growth of the global economy is estimated at 3.9% in 2017, up from 3.2% in 2016. This is mainly due to recovery in advanced world economies, and rising commodity prices including the price of crude oil resulting in increased trade volumes.

Economic Growth

12. Madam Speaker, economic output is estimated to grow by 5.8% during this financial year, higher than the performance of 3.9% last year. The size of the economy is now Shs101.8 trillion equivalent to $27.9 billion. This growth was the result of the following:

i. The Services sector which grew at 7.3% compared to 5.4% last financial year. This performance was mainly as a result of improvement in the financial, Information and Communications and trade sub-sectors.

ii. The Industrial sector which expanded by 6.2 per cent compared to 3.4% last financial year due to good performance in construction and agro-processing, and recovery in the Mining and Quarrying sub-sectors.

iii. The Agriculture sector whose growth doubled during the year to 3.2% compared to 1.6% last year. The improved performance was mainly due to better weather conditions, control of pests and diseases and targeted Government interventions, particularly seed distribution and provision of better extension services.

Domestic prices

13. Madam Speaker, despite the increase in the global price of oil this year, inflation has remained stable and in single digit.

Annual headline inflation is projected to average 3.6%. This is mainly due to the increased supply of agricultural output, coupled with sound economic policy management.

Private sector credit and interest rates

14. Madam Speaker, the stock of outstanding Private Sector Credit increased from Shs11.9 trillion in March 2017 to Shs12.8 trillion in March 2018, recording an annual growth of 7.8%, which is higher than 6.1% a year earlier.

The recovery of private sector credit signifies improvements in economic activity, business confidence, and increased private sector demand for credit partly due to lower interest rates. This recovery in private sector credit would have been stronger if the banks were not overly risk averse. The Central Bank Rate (CBR) was reduced from 11.5% in March 2017 to 9% in March 2018, with lending rates falling from 22.5% to 20.1% over the same period. Non-performing loans nearly halved from 10.5% of gross loans in December 2016 to 5.6% in December 2017.

International trade

15. Export earnings rose by 9.6% to $ 3.93 billion in the period July 2017 to March 2018 from $3.59 billion a year earlier.

This increase was mainly on account of a rise in the export volumes of beans, coffee, tea and maize. Over the same period, exports to the rest of the EAC grew from $792.3 million to $943.5 million; while exports to Europe grew from $415.8 million to $466.1 million.

16. Madam Speaker, on the other hand imports increased by 16.4% valued at $5.7 billion in the period July 2017 to March 2018 from $4.9 billion over the same period the previous year.

This was attributed to the increase in the prices of oil imports and the increased inflow of capital goods to support domestic investment, particularly in oil and gas, electricity and roads.

International reserves, exchange rate

17. Madam Speaker, despite some disruptions in our export markets in the region, international reserves continue to accumulate. By March 2018, our reserves were $3.6 billion which could finance 5 months of our future imports.

18. The Ugandan Shilling was relatively stable against the US dollar during the first half of 2017/18. The Shilling marginally weakened against the US dollar by only 0.6 per cent having moved from a monthly average of Shs3,601.5 in July 2017 to Shs3,623.3 in December 2017. This outcome on the exchange rate was mainly due to, among others, increased export receipts especially from coffee and tea.

However, since March 2018, the shilling has lost ground against the US Dollar on account of increased demand from the energy, oil and manufacturing sectors.

Domestic revenues

19. Madam Speaker, despite the revenue shortfall this year, domestic revenues have improved on an annual basis on account of increased capacity to collect taxes.

During the financial year just ending, tax and non-tax revenue is estimated at Shs14.5 trillion, equivalent to14.2% of GDP.

20. Madam Speaker, transferring the administration of Non-Tax Revenue to Uganda Revenue Authority has significantly improved revenue collection from this source, estimated at Shs430 billion this year compared to Shs354 billion last year.

Expenditures

21. Total government expenditure during this financial year is estimated to amount to Shs27 trillion equivalent to 26.5% of GDP. Excluding domestic refinancing, development expenditure this year amounted to 44% of the budget. The absorption of externally borrowed funds doubled to about 75%, although disbursements were less than programmed, leading to under-performance of the development budget. This improvement is attributed to the continuous implementation of reforms in public investment management and strengthened supervision of projects. Government is working with the development partners to increase the capacity of Ministries, Agencies and Local Governments, in these areas.

Budget deficit and its financing

22. Madam Speaker, the fiscal deficit this year is estimated at 4.8% of GDP, a 0.9 percentage point increase over last year’s level.

This is a result of an increase in development expenditure and other investments, which rose to 8.8 per cent of GDP, up from 7.9 per cent last year. The deficit was financed largely by both concessional and non-concessional loans, and to a lesser extent through domestic borrowing, which increased from Shs612 billion last year to Shs1.690 trillion this year.

Public debt

23. As at March 2018, public debt stood at $10.53 billion of which $7.18 billion is external and $3.35 billion is domestic. The ratio of Public debt to GDP now stands at 38.1 per cent in nominal terms. This is much lower than the threshold of 50% beyond which public debt becomes unsustainable. Our public debt is therefore sustainable over the short to medium term, even when we include the financing required for priority projects in the pipeline.

24. In line with the Medium Term Debt Strategy, our borrowing strategy is to contract concessional loans while restricting commercial loans to the financing of infrastructure and self - financing projects. This will help to ensure long-term debt sustainability.