Know why you are not financially independent yet

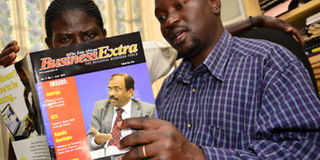

Henry Ssengonge (L) explains something to Margaret Ssebagala in Kampala. Photo by Domonic Bukenya

What you need to know:

Path to financial freedom. The more knowledgeable and experienced you are in financial matters, the fewer mistakes you will make

Recently, I overheard a conversation between two friends sharing their frustration about not being able to lose weight despite repeated efforts at dieting and exercise. What was most telling about the conversation is that they both admitted they were not consistent or disciplined in their efforts. This encounter reminded me of my own struggle with getting disciplined about regular exercise and how I never saw any lasting results, until I made a deliberate effort to weave it into my daily routine.

A lot of the material I read on exercising recommended joining a group of like-minded individuals as a way of ensuring accountability for each other. I joined a group of ladies and the plan was that we would run every day after work for a distance of eight to 10 kilometres.

Unfortunately, it turned out that this group of ladies were not as desperate as I was to lose weight and get fit. In a few short weeks, the group had disintegrated and I was basically on my own. That is when I decided I would walk home from work; a distance of nine kilometres.

This strategy actually worked very well, the only catch was that I did not see any tangible results until after about five months. During those five months, I received both negative and positive comments and as is to be expected, the negative ones far outweighed the positive ones.

The principle of commitment, persistence, dedication and discipline applies to any achievement we will ever attain, including financial freedom and wealth creation. Everyone I know wants to be financially free and dreams of a life free from financial worry.

Commit to your goals

Unfortunately, not many of us are willing to admit that we are not committed to making this goal a reality. One day, my financial mentor asked to see what books I had in my library and then he asked me how much I spend on my wardrobe. Interestingly, I am not one who spends a lot of money on what I wear, that said from the results of that audit, I had a number of very new chic items in my wardrobe while I had not bought any book in more than a year and the few books that I had in my library (if you could call the collection I had a library) were not very enlightening on the subject of financial health and freedom.

My mentor’s words to me were “Grace I see you prefer to look smart as opposed to being smart (knowledgeable)”. Let me just say I was stung by that comment. His point was that my actions were speaking louder than my words; here I was saying I was serious about gaining financial independence and financial knowledge yet I was not putting my money where my mouth was.

I had not invested a shilling in getting knowledge, I had not attended any financial literacy course neither had I bought any book on personal finance or wealth creation to educate myself. Little wonder that I had made zero progress on my financial goals.

How do you spend your time?

At some point I was worried that he would ask me how much time I spent watching TV and what programmes I watched. What would he say if he knew I was addicted to those Spanish Tele Novas? Don’t get me wrong, please go ahead and knock yourself out watching TV and for sports fans religiously following your club (Man U have finally sacked their team manager!).

Just remember that if this time invested in watching TV is done at the expense of investing time in getting financially literate, then you need to manage your expectations around creating wealth and being financially free.

Just like getting physically fit, obtaining financial freedom is a function of time invested in the pursuit of this goal. It takes dedication, persistence, commitment and discipline.

The writer is Standard Chartered Bank’s head of financial markets in East Africa.