Online businesses in the wake of new tax regime

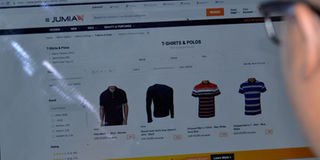

A man browses an online shopping platform. The tax that started at the beginning of this month, seeks to widen the tax base in the country. Below: A mobile money agent waits for customers. PHOTO BY ABUBAKER LUBOWA

What you need to know:

- Businesses that operate on online platforms are already feeling the pinch of the Shs200 tax daily tax on usage of social media platforms such as Facebook, Twitter, WhatsApp and Skype among others. The tax that started at the beginning of this month, seeks to raise Shs284 billion in revenue. But online businesses are not happy about it, Ismail Musa Ladu & Eronie Kamukama write.

For years, Ugandans around Kampala and Wakiso have been able to order food from a hotel or restaurant by clicking a mobile phone or computer button.

“I order for food from restaurants in Kampala every weekend because it is convenient and saves time, which helps me concentrate on other important activities such as reading,” Mr Conrad Mugabi says.

The 27-year old digital expert who has been using Uganda’s commonest online shop for the last three years, says he spends up to Shs30,000 which includes a delivery fee every weekend to get a plate of food at his doorstep.

So, what restaurants and hotels do is cook the food and Jumia delivers it. Today, it does 3,000 food orders a day. Jumia Uganda hit the market six years ago and brought together sellers hotels, airlines, employers, land and house proprietors. The company earns based on its commission which lies between 25 and 35 per cent of the items successfully delivered.

“These are applications. We do not own any content and we connect customers to services. We work with over 160 restaurants, over 1,000 hotels in Uganda and 500 airlines,” Mr Timothy Mugume, Jumia Food country manager, says.

With 1 million users so far, the online retailer has more than 200,000 active customers over its four ventures. Business has been profitable thanks to customers like Mr Mugabi.

But running an online business is quite expensive in terms of getting proper accounting and value for money, Mr Mugume admits. This is besides several infrastructural issues and high costs of labour as the company has to hire people to manage the various vendors and customers.

“Most of the times we do deliveries all over Uganda. However, the cost of delivery will get to increase depending on distance and facilities we have. Overall, all changes in economy get to affect us,” he says.

Social media tax

One such change is the recent development in the tax regime. Since the beginning of this July, access to social sites such as WhatsApp, Facebook and Twitter has been blocked unless users pay a daily tax of Shs200. For those moving money from one hand to another also have to pay one per cent tax for just doing that—transactions.

For online shops, mobile money and social media are a big component of the business. For instance, the social media advertising processes enable shops to get to as many specific customers as possible.

“The cheapest way to market online is to get your friends and family on Facebook or Instagram. In order to get more customers, some pay for online advertisement. A lot of the time, small online businesses are showing their product pictures and responding to clients,” a former online business owner says.

Online traders’

Online retailers are now already feeling the pinch.

“Over 60 per cent of our accounts have been opened through signing on Facebook. We have had measures where one can use email. So we are currently migrating a lot of people who have signed through Facebook to their email addresses so that they are not affected,” Mr Mugume says.

He describes the tax now disrupting consumer behaviour as a double tax especially because the company is already paying tax to communicate online across countries. Mobile money tax has been the biggest hit as it is already affecting preferences of payments on online shopping sites.

“We have had a decrease in mobile money payments which we were pushing for and people are more inclined to request for cash on delivery than for prepaid payments. Before we had about 40 to 50 per cent paying through mobile money. Now prepayment has dropped to 35 per cent,” Mr Mugume says.

He now thinks if the tax is maintained, it could have further impact. “This definitely affects jobs for people who are supposed to handle mobile money payments. We may not need to hire these people,” Mr Mugume says.

In light of the tax, online retailers are searching for a new formula. Jumia Uganda is now employing new twists such as reducing data costs with a free application download. Data costs already account for 20 per cent of the company’s operational costs.

“Most of the time we have to assess whether we can pay this tax for some of our customers because the cost is outweighed by benefits accrued from a particular customer,” he says. For mobile money, alternatives such as PayWay are now seen as the channel to use going forward.

Regressive tax

But generally throughout Uganda, there is sustained pressure from the public, protesting the social media and mobile money transaction levy, a move that has compelled the government into considering amending sections of the law mandating collection of the tax that has since been termed as a “regressive tax”. But until that happens, the taxes on social media and mobile money still apply.

While discussing the matter, Mr Venansius Baryamureeba, a computer scientist was short of calling the legislation “useless”.

“This Act will not help in the effort to create jobs. People are doing business in those social media sites and use digital transactions such as the Mobile money for business. This is a good thing. Why do you shut it down?” he wondered.

“Access to internet should be subsidised just as it is done on power (electricity) and other social goods.”

Private sector speaks out

In an interview last week, the director policy and advocacy at Private Sector Foundation Uganda, Mr Moses Ogwal, said the private sector whose members he said include those running online businesses, wants a progressive tax policy rather than regressive tax regimes as evident by the current tax regime, thanks to regressive provisions of the tax laws such as the one declaring taxes on social media and mobile money usage. This, he said, could encourage business informality and tax evasion.

Importantly perhaps, according to Mr Ogwal, tax policies that ignore principles of fairness and equity can kill innovation within no time. He says if there should be further taxation, it should be done on airtime, data and through income tax for telecom operators.

“Leave operational taxes out not to choke innovation. We have about 200 innovations in ICT in Uganda. How will they be implemented with such signals,” he said.

“Just over a decade or so ago, we didn’t have mobile money innovations and didn’t know that social media could be useful business tool. This means efforts should be spent creating environment that will spur more of such innovations rather than hindering creativity by way of taxation. The goal should always be beyond raising revenue.”

Hospitality

As for the players in hospitality industry which is a broad category of segment within the services industry that includes lodging, event planning, theme parks, transportation, cruise line and additional fields within the tourism industry, life will never be the same.

According to the leadership of the hospitality industry, it is natural that the latest taxes on social media and mobile money will take a heavy toll on the marketing element of the industry, which by all account is a lifeline of the sector.

“Online marketing is going to be expensive. The cost of using social media which has become part and parcel of our marketing tool, is going to go unreasonably high. This will be bad for our competitiveness. We really didn’t anticipate that the industry will be hit so much by this legislation,” the executive director of the Uganda Hotel Owners Association (UHOA), Ms Jean Byamugisha, said in an interview recently ahead of the 6th Annual Uganda International Hotel and Restaurant Expo due in early September.

Views on social media

Besides resorting to informal operations to keep in the business, the managing director of Global Taxation Services Ltd, Mr Albert Beine, last week, said: “Online businesses will continue to crop up, but this time will do so by passing the tax man using technologies that it has no control over.”

Mr Beine whose work includes tax advisory and compliance, argued that with the current tax on over-the-top content (OTT) such as Facebook, Twitter, WhatsApp and Skype among other things, online business owners, most of whom are young people, will simply employ already available technologies such as Virtual Private Networks (VPNs) to disguise their location and avoid the levy. This was first uncovered during elections two years ago when the government shut down social media.

Already, there is an app called Wala which has been around here for slightly over two months. This app provides a zero-fee financial platform enabling consumers to send money anywhere instantly for free and transact at no cost. After just weeks of being launched here, thousands have taken to it already.

With the current situation involving mobile money transaction and OTT, thanks to the imposed taxes, it is only a matter of time before this app becomes a platform of choice.

‘Pay tax on online business’

Online businesses are businesses and must register with URSB, URA and any other requirements under the law.

“Operating online does not preclude a business from being subject to Ugandan laws. As such, such businesses should also pay taxes like other businesses,” Ms Jacqueline Musiitwa, executive director Financial Sector Deepening Uganda.

There are many examples of countries such as the US, China with thriving e-commerce businesses. In Africa, Jumia has demonstrated that e-commerce has great potential for people to change how they shop. Facebook, the most popular social media platform in has also given the opportunity for businesses to reach markets beyond their boarders. That said, research found that “less than 30% of Africa’s e-ecommerce startups are profitable.”

Regulator’s take

Mr Godfrey Mutabazi, the executive director of the Uganda Communications Commission, when asked on the impact of the current legislation and its bearing on online businesses, said: “I really don’t think so {that it will have impact}. The government is continuously looking at the way this taxation can be implemented without causing inconvenience to the public.”