Secure your business with internal controls

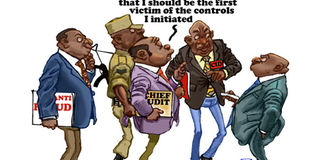

An illustration of how companies can secure their businesses with internal controls. ILLUSTRATION BY DANNY BARONGO

What you need to know:

- Any business worth its name should aim at instituting a system of strong internal controls, Ronald Kasasa writes.

Most growing businesses have to fend off all manner of threats including competition, economic challenges, rising costs of goods or human resources—the list is endless. One major threat businesses often do not think about until it happens is fraud. Fraud, internal or external, thrives best where internal controls are absent or simply weak.

Understanding fraud and managing internal controls was one of the subjects recently covered in the ongoing dfcu Business clinics in partnership with Enterprise Uganda for Small and Medium Enterprises.

Any business worth its name should aim at instituting a system of strong internal controls that ensure it achieves long-term profitability targets and maintains reliable financial and managerial reporting. Internal controls ensure that systems and personnel operate in a manner that both limits the occurrence of fraud and deals with it effectively if it happens. Below are some of the simple ways in which businesses can guard against internal fraud:

Know your employees

The lengths to which businesses go to know their customers and suppliers should be the same diligence applied to knowing the people they hire.

Simple background checks before entrusting an employee with any part of the business will go a long way in saving an organisation potential loss by not hiring the wrong people in the first place.

Whistle blowing channels

Whether in the form of hotlines or web-based portals, reporting lines should be secure enough to guarantee the anonymity of staff members, suppliers or customers reporting fraudulent activities. The organisation should also ensure that the personal and job security of anyone using the reporting lines are not at any risk.

Dual-signature on company cheques

To protect company assets, have at least two authorised signatories to all company cheques. The reason is simple - two people must agree that a payment is appropriate and legitimate, reducing employee and management theft and preventing fraud.

Segregation of duties

If one person has cheque -signing authority, they should not have bank reconciliation authority. You always want two pairs of eyes reviewing the information.

Empower your employees

Every organisation should take on the responsibility of creating clear anti-fraud guidelines for its employees and contractors. Regular meetings to explain and reinforce the importance of control systems will help a company minimise the risks that come with fraudulent behaviour while empowering staff to identify and report suspicious activities.

Insure your company against fraud

Once they become public knowledge, fraudulent actions can cause irreparable damage to the reputation and finances of an organisation. While having an insurance policy against such situations might not single-handedly repair the first. It can help the company lessen the financial loss that inevitably follows dishonest business dealings.

If you think your business is fraud proof, remember banks or other financial institutions will want to see stronger evidence of internal controls before they lend you money.

Ronald Kasasa is the head of business banking – dfcu Bank.