Targets for 2016/17 Budget may not be achieved - NPA

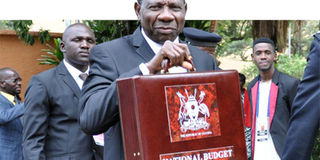

Information from the ministry of Finance shows that the economy, during the current fiscal year which ends on June 30. FILE PHOTO

What you need to know:

Other reasons why budget missed targets

· Poor utilisation of funds due to weak implementation of projects as planned

· Slowed economic growth.

· Supplementary provisions for food relief in light of the food shortages

- Information from the ministry of Finance shows that the economy, during the current fiscal year which ends on June 30, has been affected by the global economic slowdown. We delve into the issues that conspired to explain why government did not stick to its intended expenditure plan.

KAMPALA-With less than two months left to end this fiscal year, doubts are simmering up that the targets for the Financial Year (FY) 2016/17 budget may not be achieved.

Why? A series of factors colluded to explain why government did not stick to its intended expenditure plan.

Constraints such as from low domestic tax collection, slowdown in economic growth and poor implementation of projects among others, have derailed the overall performance of the national budget.

Information from the ministry of Finance shows that the economy during the current fiscal year which ends on June 30, has also been affected by the global economic slowdown.

In an interview with Prosper magazine last week, director Development Planning, at the National Planning Authority, Dr Partick Birungi, said the 2016/17 budget has been performing poorly based on an analysis of the first quarters of the FY 2016/17.

“The target for the financial year 2016/17 budget in the first two quarters was at 58 per cent which is generally low,” he said.

Dr Birungi said although the authority has not done the analysis for quarter three and four, there are signs that the budget target may not be achieved.

Expounding on why the target is being missed, Dr Birungi said there were three main factors including: slowdown in economic growth rate, unutilised funds due to weak implementation of projects as planned and budgeted for and lack of planning at the sectoral levels and the Ministries, Departments and Agencies.

“All these constraints have impacted negatively on the 2016/17 budget; slower growth in the economy has affected revenue collection, weak implementation has affected projects in education and health because there are activities for the planned funds. This is why there is sloppiness in budget target for the FY 2016/17,” he explained.

The growth projection for this Financial Year 2016/17 was revised downwards to 4.5 per cent from the 5.5 per cent when the budget was approved in June 2016. This was pegged on developments in the global economy and domestic factors.

Locally, the drought experienced across the country that affected agricultural production during the first half of the Financial Year 2016/17 also negatively impacted economic growth.

“Government’s consumption and investment programme for the first half of the Financial Year 2016/17 was largely under executed with only a 70 per cent performance against the programme levels and thus lower by over Shs3 trillion. This was due to poor performance on external development expenditure.”

Data from the Finance ministry shows that tax revenues for the same period registered a shortfall of Shs170 billion largely from underperformance in international taxes as a result of declining imports,” the Finance ministry said.

The managing director of Alpha Capital, Mr Stephen Kaboyo, in an interview with Prosper magazine on last week said 2016/17 fiscal year has not been ‘a walk in the park.’ Therefore, it comes as no surprise that a number of economic targets will not be met.

“Key among them is the revenue target. As of March 2017, URA indicated a shortfall of Shs240 billion, mainly in the domestic taxes category which is a reflection of subdued economic activity.

Mr Kaboyo said this persistent revenue underperformance has an impact on the budget outturn as the imbalance between revenues and expenditure will leave some budgeted items unfunded, a scenario that will force government to borrow from the domestic banking system, crowding out private sector and putting pressure on interest rates.

“It is very likely that during this last quarter of the fiscal year, government will be aggressively borrowing in the markets to fulfill their outstanding financing requirements,” he said.

Fiscal overview

The fiscal strategy for the Financial Year 2016/17 was focused on maintaining infrastructure investment, while being mindful of a sustainable level of public debt over the medium term and promoting excellence in public service delivery. Subsequently, government pursued an expansionary fiscal stance with the deficit increasing to 6.6 per cent of GDP in the Financial Year 16/17 compared to 4.8 per cent of GDP in the Financial Year 15/16.

The ministry said this was meant to enable government accommodate growing expenditure needs especially the scaling-up of public infrastructure investment.

Fiscal deficit

The overall fiscal deficit (including grants) for the first half of Financial Year 2016/17 stood at Shs1.82 trillion. This was lower than the programmed Shs4.502 trillion as total expenditure and net lending was below the programme by Shs3.455 trillion.

“Revenue and grants also registered a short fall of Shs773.3 billion from the programme as less than programmed project grants were received for the period,” said the ministry in the report.

Shortfalls in tax collections

The ministry said revenues and Grants Tax collections during the first half of the financial year posted a shortfall of Shs170.1 billion. This was largely manifested in taxes on international trade and transactions which performed at 92.7 per cent; and in direct domestic taxes which performed at 98.5 per cent from their respective programmes.

The shortfalls in direct taxes were realised in corporate taxes and withholding taxes as major corporate companies registered low profits during the period.

The performance of international trade taxes is attributed to a drop in imports which negatively impacted on import duty, excise duty and VAT on imports. The shortfalls in direct taxes were realised in corporate taxes and withholding taxes as major corporate companies registered low profits during the period.

On the upside, it said PAYE performed higher than the target and the outturn of the first half of the Financial Year 2015/16 by 12 per cent and 6 per cent respectively, largely due to increased compliance especially in the Public sector.

Indirect taxes were above their target in the first half with a surplus in VAT on locally produced goods. Local excise duty, taxes on other sub-sectors and services sector were below their targets.

Other reasons why budget missed targets

· Poor utilisation of funds due to weak

implementation of projects as planned

· Slowed economic growth.

· Supplementary provisions for food

relief in light of the food shortages

New funding

Under performance in expenditure was concentrated in development spending which was lower than the amount programmed by Shs1.697 billion. This presents a downside risk to the projected growth for FY 2016/17 which should have been supported by government spending on infrastructure development.