NSSF raises rates to 7%

Kampala

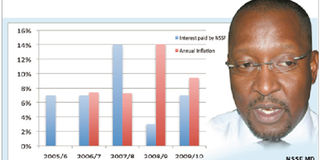

Some 450,000 contributors to the National Social Security Fund can grin after the institution yesterday announced a higher interest payment on members’ savings than for the previous year. The NSSF chairman, Mr Vincent Ssekkono (right), said in a statement that they will pay a 7 per cent interest, contrasting with the 3 per cent paid out the year before, due to “improved financial performance”.

This, however, is slightly below the annual inflation rate that closed at 9.4 per cent. “The Minister of Finance, Hon. Syda Bbumba, has in accordance with the National Social Security Fund Act, and after consulting with the NSSF Board, declared an annual interest rate of 7 per cent to be paid to contributing members for the financial year 2009/2010,” read the statement.

Under the law, the minimum interest that the Fund can pay to members is 2.5 per cent. The returns for 2008/9 financial year had a close brush with that threshold, flagging danger signs to contributors as the pension institution reeled from one investment and cash scandal to another.

Yesterday, chairman Ssekkono offered some relief to wary members, announcing “we intend to pay more in future as the earnings from the Fund’s investments improve”. Labour activists seized on the pronouncements to demand that NSSF management, which meets with workers’ representatives today, double the interest pay to 14 per cent next year.

Mr Usher Owere, the chairman-general of National Organisation of Trade Unions, which brings together some 1.2 million private sector formal employees, said “I thank the new NSSF team because they took over when the Fund had a lot of problems.” “That they have increased the interest rate from 3 to 7 per cent within a year is impressive. But they should give 14 per cent in 2010/11 financial year.”

Clear-cut task

While inaugurating Mr Ssekkono’s board in April last year, Ms Bbumba directed it to cut perennial losses at the Shs1.6 trillion-worth institution and spruce up its image haunted by unending tales of “corruption scandals”.

At the time, the team of then MD David Chandi Jamwa, now facing prosecution for alleged financial impropriety while in charge of NSSF, along with the Edward Gamwa-led board had joined the growing list of former executives exiting in disgrace. Mr Jamwa’s successor, Mr Richard Byarugaba, said yesterday the Fund performed better this year as a result of windfall from equity investments and profitable financial instrument deals.

Tough past

The year before Mr Byarugaba joined, NSSF made huge losses as the value of Kenyan telecom giant Safaricom shares, in which the Fund invested heavily, tumbled on the bourse. This year was a different story and perhaps a juicier one for newcomer Byarugaba as the Fund reaped good cash from that venture. “The equities have done better this year than in the previous year,” he said in a telephone interview. “But we have also made money by investing in Bonds, Treasury Bills and Term (fixed) bank deposits.” Parliament established NSSF in 1985 to provide social security services to private sector employees.