Prime

MTN lending grows to Shs401b, moving to within some commercial bank levels

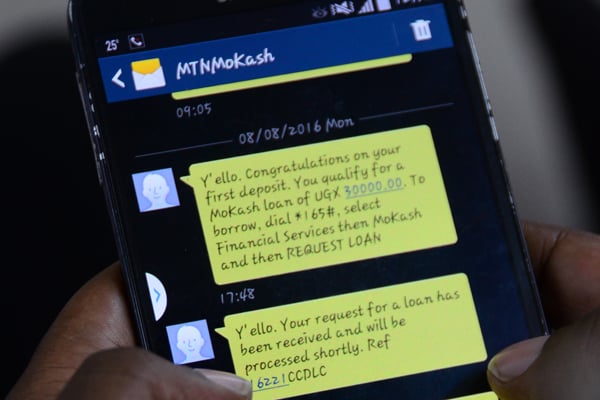

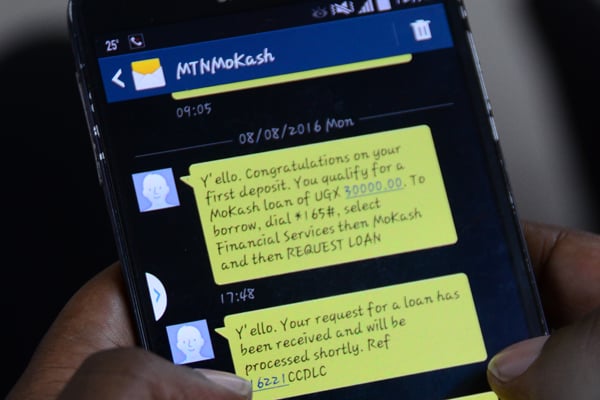

MTN has a number of micro loans, including MoKash. Photo / File

What you need to know:

- During 2022, MTN’s microloans increased in both volume and value, returning an increase of Shs91b worth of disbursed loans

MTN disbursed Shs401b worth of micro loans through 15.3 million applications for the period ended December 2022, according to details provided by Mr Richard Yego, the MTN Mobile Money managing director.

The details were part of a mini survey in which Monitor had sought to understand performance of the mobile money micro credit sector, which has become a key revenue earner for both mobile money companies and third party digital micro lenders.

Mr Yego indicated that during 2022, MTN’s micro loans segment had seen a big jump in both volume and value, which returned an increase of Shs91b worth of disbursed loans.

For instance, data indicates, during 2021, MTN approved 3.8 million loans against Shs310b, which was disbursed. However, the number of applications rose rapidly in 2022 to 15.3 million necessitating a rise in value to Shs401b.

Mobile money loans hold an interest of between 8 percent and 10 percent. Majority have a 30-day repayment without the option of rolling over.

Therefore, MTN and third party operators could have grossed between Shs35b and Shs40b in interest earnings.

The growth, MTN indicates, is expected to continue this year given that, during the quarter ended March, more than 6.3 million applications had been approved with a corresponding disbarment of Shs114b.

Mr Yego said the “big jump in volume seen in 2022 [was] influenced by the rollout of our new MoMo [Mobile Money] Advance facility, which alone, generated 10.2 million loans in 2022”.

MTN hosts micro loan and saving products, among which include MoKash and MoSente, operated through NCBA and Jumo, respectively.

Mr Yego also indicated that the 2021 disbursements were low due to poor repayment on MoKash, noting that many customers, who had been impacted by Covid-19, could not afford timely repayment.

“Consumers could not afford to repay because majority were not working. So, NCBA had to scale down on disbursements in 2021,” he said, noting that the launch of MoMo Advance early last year is expected to create new momentum given that it has potential to scale up much faster.

Airtel Money declined to provide details of its micro credit segment, citing lack of authorisation from Bank of Uganda, the mobile money regulator.

“Unfortunately this is not available at this point. [Bank of Uganda] has to first clear the financial results,” Mr David Birungi, the Airtel public relations manager, who said the telecom has three microloan products including Wewole, Quick loan and KCB agent loan, said.

Mr Yego also indicated that default rate on MTN loan products stands at just 5.2 percent, with at 94.8 percent of loans repaid within stipulated timelines.

Borrowers have a limit on the number of loans they can access at any particular time, provisioned under a MoKash and MoMo Advance or a MoSente and MoMo Advance pairing.

MTN also provides saving and investment products through MoKash, which Mr Yego said gross an average of Shs30b per month with at least Shs10b withdrawn a month.

Moving within commercial bank levels

Mobile money microloans have seen rapid growth in the last five years and are now moving to within lending levels of some commercial banks.

For instance, during the period ended December 2022, Post Bank reported an increase in loans and advances, which rose to Shs479.5b from Shs454.8b in 2021.

This was just slightly above the Shs401b, which MTN reported in the same period.

However, it was still way below large commercial banks such as Stanbic and dfcu, which during the period, grossed Shs4 trillion and Shs1.3 trillion, respectively.