Business challenges affect global appeal for Uganda’s exports

What you need to know:

Reason for drop. The high cost of Uganda’s exports, among other challenges, is responsible for the drop in exports to European Union.

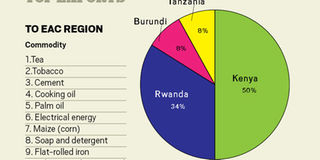

Uganda’s exports to the regional countries grew by eight per cent in the previous year, according to Uganda Export Promotion Board (UEPB) statistics.

The UEPB data further indicates that by close of last year, Uganda’s total exports to the East African Community (EAC) stood at $633 million compared to $581.4 million in 2012, translating into a growth of eight per cent.

This is a shift that has been happening over the years, implying that Uganda can do more business with its regional neighbours than lucrative markets such as the European Union nations.

As a result of the surge in volume of trade between Uganda and its neighbours, total export to EU took a slight tumble. According to UEPB statistics, the country’s total export to Europe hit $613 million (about Shs1.6 trillion) although it minimally dropped by two per cent by close of 2013.

Meanwhile, the country’s exports to China continue to gain momentum with the figures reaching $65.3 million (about Shs171 billion) by close of the previous year. Exports to US hover at $37 million (about Shs97 billion).

Exports

Exports such as tea, tobacco, cement, cooking oil and palm oil are on high demand in the neighbouring countries.

The ready market for maize, soap and detergent and plastic packaging explain why the regional countries are the leading destination for Uganda’s exports.

Despite the slight tumble in the volume of Uganda’s exports to Europe, cash crops such as coffee, flowers, tobacco, frozen vegetables, oil seeds, Vanilla and cobalt remained trendy in EU and US markets.

Chinese appetite for fish, leather of bovine, coffee and cocoa beans, among other supplies, is getting strong.

Why Uganda still net importer

However, industry players, analysts and the export body agree that given the country’s potential, the current export figures should be much higher. Currently, Uganda is a net importer.

The reason why exporters are not seizing export opportunities, according to the managing director of KK Foods, exporters of fresh produce, Mr James Kanyije, is the lack of incentives to industry players—both exporters and farmers.

He said: “Our exports are the most expensive in the region because the government does not subsidise the farmers who produce the crops while other countries have found a way of making agriculture attractive.”

He continued: “Our exports are 75 per cent more expensive than the ones from India and 35 per cent more expensive than Kenyan exports and about 45 per cent more expensive than Rwandan exports. So, we need to do more to be competitive in this business.”

That affects the quantity and quality of exports, according to Mr Kanyije.

The Speaker of Uganda Quality Coffee Traders and Processors Association, Mr Fredrick William Nteza, told Prosper that global dynamics also affect exports and import trade much more these days than previously thought.

“Stability of the dollar is important in determining whether exports like coffee will do well or not. Instability in Ukraine and bad harvests in Brazil are also important reasons,” Mr Nteza said.

He continued: “Dry spells and high costs of borrowing are the other problems we are grappling with.”

UEPB trade promotion officer, Mr Moses Mabala, in an interview last week, said as industry promoters they are engaged in enhancing exporters and farmers’ skills with the view to have them make the most of international trade.

According to Mr Mabala, UEPB does not only provide financial and technical assistance (training) but it also links them to the regional market. This is done through match-making, exhibitions and finding direct potential buyers,” Mr Mabala said.

Challenges

Despite such efforts, Mr Mabala reckons that challenges such as high transport cost (between Mombasa and Kampala a container cost between $3,000 to $4,000), lack of tailor made trade financing like the Chinese do it for their exporters and the fact that most of the local industry players are still inexperienced in this kind of demanding trade, implies that more time, effort and resources will be required before the proceeds of the investment are harvested.

Need for import-export bank

Industry players such as Mr Nteza and Mr Kanyije and industry analyst Mr Ogwal suggest that an import and export bank be established to facilitate trade that is transacted across the border, a proposal Mr Mabala agrees with, saying it will be good for the commercial farmers and exporters.

Meanwhile, Trade minister, Amelia Kyambadde, last week warned a group of local exporters against taking orders when they lack capacity to deliver, saying that renders the export industry uncompetitive.

According to Ms Kyambadde, government is considering reprimanding exporters who fail to honour their side of the bargain, especially after entering a contract with a promise to supply then half- way fail to deliver.

The director policy advocacy, Private Sector Foundation Uganda (PSFU), Mr Moses Ogwal Goli, told Prosper in an interview last week that local exporters should expand their horizons and make the most of the lucrative European markets.

Address quality gaps

He, however, warned that that can only be realised if issues of quantity and quality are addressed, given that the demands of such lucrative markets are stiffer than what many exporters are used to.

The Kampala City Traders Association Spokesperson, Mr Isa Ssekitto, said for Uganda to maximise its potential, it must concentrate on exports where it has comparative advantage. According to Mr Sekitto, the country’s comparative advantage lies in agriculture and agro-processing.

Ms Maggie Kigozi, the former executive director of Uganda Investment Authority, said focus should be put on exporting only value added products. That, she said, will be the only way to make the most out of the export industry.

top exports

TO EAC Region

Commodity

1.Tea

2.Tobacco

3. Cement

4. Cooking oil

5. Palm oil

6. Electrical energy

7. Maize (corn)

8. Soap and detergent

9. Flat-rolled iron

10. Plastic packaging goods