IMF to Uganda: Make realistic national budget

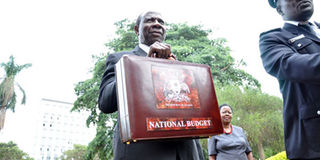

Budget. Finance Minister Matia Kasaija arrives at the Kampala Serena Hotel for the reading of the National Budget in 2015. FILE PHOTO

What you need to know:

- In the 10-year period to 2017, the total value of public expenditure increased from 15 per cent of GDP to more than 20 per cent.

The International Monetary Fund (IMF) has asked the Uganda government to ensure it makes a realistic budget to avoid contracting more debt during a particular fiscal year.

In another technical policy support, the IMF has also advised government to prioritise the implementation of the new Domestic Revenue Mobilisation strategy, targeting an increase in the tax-to-GDP ratio by 0.5 per cent per year.

The IMF advice comes at a time when government is struggling to raise the domestic revenue to finance the 2019/20 budget, which has already seen government suffering a shortfall in revenue collection of more than Shs600 billion because of delays in the implementation of domestic tax measures.

An IMF team led by Ms Clara Mira, the institution’s resident representative in Uganda, visited Kampala from January 20 to 24 to discuss Uganda’s economic outlook, the budget for FY2020/21, and the direction of monetary policy.

In the statement issued yesterday morning, Ms Clara said the execution of the current budget continues to be challenging among revenue and financing shortfalls and large expenditure pressures, which have resulted in a supplementary budget and increased borrowing needs.

Ms Clara said: “Overall, the team encouraged the authorities to ensure that the budget is realistic, remains consistent with debt sustainability while avoiding exacerbating debt vulnerabilities, and is consistent with available domestic financing. It is also essential that the capital position of the central bank is strengthened to ensure that the Bank of Uganda can continue pursuing its operations efficiently.”

Background

Fiscal policy. Uganda’s fiscal policy has remained mainly expenditure-driven, with domestic revenue continuing to lag. This has resulted in a widening financing gap.

In the 10-year period to 2017, the total value of public expenditure increased from 15 per cent of GDP to more than 20 per cent.

During this time, the tax-to-GDP ratio grew by an average annual rate of 0.2 percentage points, with the value of collected revenues increasing from 10 to 13.8 per cent of GDP over the same period.