Workers demand to get their NSSF savings at 45

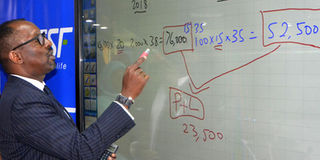

Demonstration. NSSF managing director Richard Byarugaba makes a presentation during a press conference on September 17, 2019. He said the midterm access to the money by contributing members at 45 was not included in the NSSF Bill because it would deplete the Fund’s resources. PHOTO BY STEPHEN OTAGE

What you need to know:

- The workers also rejected Gender minister Janat Mukwaya’s proposal to exempt members from taxation at contributory and investment levels but introduce taxation when the members seek to withdraw their benefits before they make the mandatory retirement age of 60.

Workers through their trade unions yesterday told Parliament that they want their members to access their savings when they turn 45 years of age as long as they have been saving with the National Social Security Fund (NSSF) for at least 10 years.

Mr Sam Lyomoki, the workers representative, told the joint Parliamentary Committees of Gender and Finance that the reforms being introduced in the NSSF Bill should expand the scope of benefits to allow individuals with various challenges such as unemployment, sickness and school fees to help them solve their issues that affect their social being without waiting for retirement.

“We want to have midterm access to NSSF money. People can be able to access their money when they have worked and are 45 years old instead of waiting for 55 years,” Mr Lyomoki said.

He was flanked by members of the Central Organisation of Free Trade Unions (COFTU) and the National Organisation of Trade Unions (Notu) together with affiliated labour unions of drivers, cooperatives, commercial, professional employees, educational, government, micro finance, civil, domestic and agricultural workers.

Notu chairperson, Mr Wilson Owere, said workers who have saved with NSSF for at least 10 years and are aged 45 and above should be allowed to get 20 per cent of their savings to enable them invest in their projects.

Rejection

The workers also rejected Gender minister Janat Mukwaya’s proposal to exempt members from taxation at contributory and investment levels but introduce taxation when the members seek to withdraw their benefits before they make the mandatory retirement age of 60.

The workers’ other contention is allowing government by law to directly borrow from NSSF. They questioned the motive since the government has been getting the money through treasury Bills.

“We want this NSSF Bill to benefit the workers, not the government, not NSSF, its employees or Uganda Retirement Benefits Regulatory Authority (URBRA). We want to increase benefits such as midterm access which we are saying when you are 45 years old and have worked for 10 years, you can get, 20 per cent of your money and start something. What we want is to safeguard the money so that NSSF is able to run profitably without any interference,” Mr Owere said.

He added: “We have removed the issue of taxation at withdrawal. You cannot tax Owere who is working in Civil Aviation, you tax my Shs140m and then when I want my money in NSSF, you tax it again. The tax is deleted. We retain our old tax regime. It shouldn’t be us to allow government to borrow our money in the law.

“We don’t want to give them the palm leaves to go and play around with our money. They should be able to do this as they have been borrowing. Up to now, they (government) have about 40 per cent of our money in treasury Bills. That should not appear in our law.”

Pian County MP Remigio Achia, who also chairs the parliamentary Pension Scheme board of trustees, supported the workers’ proposal to access money at 45.

Broader perspective

He noted that the issues being fronted should be looked at broadly as the pension sector not just as NSSF.

“It is okay for members to get part of their money when they want to help them sort out issues especially in case of sickness and unemployment just like we do it in the Parliamentary Scheme. But the laws should not only help workers who are contributing to NSSF but other pension firms in the country. The things they want to introduce should apply to all of us. NSSF should not make laws which give them privileges alone. The levy which is in the URBRA Act affects all other schemes,” Mr Achia said.

Ms Agnes Kunihira, the committee member and Workers representative in Parliament, observed that the proposed taxation in the NSSF Bill is “unfair” especially that it is being introduced at a time of exit.

“The only thing that has been proposed is to shift the taxation at exit which is unfair because they are not guaranteeing the interest that will be paid to this person but the tax will be guaranteed. At the worst performance, NSSF can pay 2.5 per cent interest. What if they come and say in the last 10 years, the performance has not been good and pay 2.5 per cent, but for you when you are exiting, you are taxed 30 per cent?” Ms Kunihira reasoned.

NSSF respond

Reacting to workers’ midterm access to money, NSSF managing director, Mr Richard Byarugaba, said the proposed 45 years is in the Pension Liberalisation Bill 2011, which was rejected sometime back.

He is opposed to the proposal for midterm access to savings at 45. He said the midterm access to the money by contributing members at 45 was not included in the NSSF Bill because it would deplete the Fund’s resources.

“The Bill doesn’t have midterm access to money for mandatory contributors. That is the position we advocate for because there is not enough money to access even at 15 per cent,” Mr Byarugaba said.

The workers’ representatives and MPs agreed to return at a later stage to submit a supplementary proposal on the Bill encompassing all the workers concerns.

Workers’ proposals

•There should be provision to enable a member to access a portion of his or her benefits for purposes of acquiring a residential house whether by buying a house or constructing, due to medical, education or unemployment needs.

•Midterm access should be to all members who have contributed to the Fund for a minimum of 10 years and have attained 45 years. They said they can access their benefits which should not exceed 20 per cent of their benefits for purposes of medication, housing, unemployment and education. Voluntary benefits should be subjected to any conditions for midterm access.

•Retain clause on current taxation policy which taxes savings at contribution level and NSSF investment level. There was concern that future tax rates could rise higher than the current rate, disadvantaging members.

•A member of the fund who qualifies for the benefits may opt to receive a lump sum, or annuity pension instalments payment or periodic drawdown as determined by the board.

•Streamlining of the appointment of board of directors. Remove NSSF managing director as a member but be retained as ex-official.

Areas workers agree with NSSF Bill

•The Bill seeks to compel every employer whether with five workers or less to contribute to NSSF.

•Allow workers to contribute voluntarily over and above the mandatory five per cent.

•Workers in the informal sector and diaspora be given opportunity to save with NSSF.

•Establishing a stakeholder board of directors.

•Raising fines against defaulting employers from Shs10,000 to Shs10m.

•Allow NSSF to use in-house fund managers to invest members’ funds.

Other clauses in NSSF Bill

•Notwithstanding the provisions of any other law, all member contributions not exceeding 30 per cent of income of the member shall be exempt from tax.

•All employer contributions to the fund shall be exempt from tax.

•The investment income of the fund shall be exempt from income tax.

•Member benefits shall be taxed at the point of payment to the member, except in case of death, invalidity, and taxation shall be at the prevailing rate at the time of payment of the benefit.

•Shall not apply to benefits arising out of contributions made to the fund before the coming into force of this Act.