Performance of bank stocks on Uganda Securities Exchange

|Bank stocks drop on tough economic times

What you need to know:

- Data from the USE indicates that three banking stock prices are down, compared to the same period in 2021.

- Other stocks. These price drops are not unique to the banks, since most other stock prices with the exception of Uganda Clays and Umeme are at lower prices than in 2021. In fact, when the National Social Security Fund (NSSF) announced its July 2021 to June 2022 performance, it indicated that the total market value of the USE declined as much as 21 percent.

The Uganda Securities Exchange (USE) has three locally listed commercial banks, Stanbic Bank Uganda (SBU), Bank of Baroda Uganda (BOBU) and dfcu. These banks published half-year results and their price movements are closely watched by investors.

Data from the USE indicates that three banking stock prices are down, compared to the same period in 2021. Most of the market is lower than it was in 2021 as the global and local economic headwinds affect investments. The optimism that came with the listing of Uganda’s largest telecom company, MTN, in December 2021 has all but been wiped out by the state of the economy. This is the case despite the positive performance of some of the listed stocks.

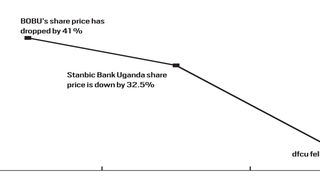

An analysis of data from the USE indicates that the share prices of SBU, BOBU and dfcu are all down from the previous year. Comparison of the price trend for the last one year indicates that BOBU’s share price has dropped by 41 percent, SBU is down by 32.5 percent and dfcu fell by 8.2 percent. These price drops are not unique to the banks, since most other stock prices with the exception of Uganda Clays and Umeme are at lower prices than in 2021. In fact, when the National Social Security Fund (NSSF) announced its July 2021 to June 2022 performance, it indicated that the total market value of the USE declined as much as 21 percent.

From its equity investments (in Uganda and other markets), the NSSF made negative 2.6 percent return due to the price declines in listed companies where it invested.

Notably, the NSSF holds shares in both SBU and dfcu, and due to the price drops, the NSSF made a loss on the value of the shares it owns. For several analysts, the USE still remains underdeveloped. Individual price drops could be as a result of the broader view of the economy and not the fundamentals of the company.

Performance

BOBU, which has largest price drops of the three banks has been a descent investment for shareholders as it has seen year-on-year profitability, asset growth and lending while keeping its loan book largely clean and at lower costs.

In their half-year results for 2022, BOBU’s profit rose by 32.4 percent to Shs59.4 billion. BOBU also grew its loan book by 20.8 percent to Shs1.02 trillion. With interest rates rising and the loan book growing, BOBU’s interest income rose by 20.2 percent to Shs75.6 billion. For shareholders, operating costs dropped by 25.68 percent to Shs16.8 billion. This has not propelled any significant price rise but that is a broader problem from the USE.

However, BOBU in the first half of the year was one of the top four most active counters on the USE. For investors, BOBU has also had a consistent dividend policy that makes its shares attractive.

On the flip side, dfcu had a first half of 2022 to forget with after-tax profit declining by 50 percent to Shs18.7 billion. Even though Dfcu had a considerable rise in income by 5.7 percent to Shs187 billion, for yet another half year, the bank continues to pay the price for some of the loans it took over from the acquisition of Crane Bank in 2017. The bank did not disclose its half-year Non-Performing Loan (NPLs) portfolio.

However, they had to make significant provisions from their income to cover for some of the NPLs. Dfcu’s provisions rose by 104 percent to Shs75 billion, which is slightly over 40 percent of the total income the bank made in the first half of the year.

The acquisition of some of the assets of Crane Bank was meant to spur dfcu to challenge Stanbic, the largest bank in Uganda. But it is still paying the price of some of the loans they took on.

Dfcu’s half-year loan-book declined by 18.75 percent to Shs1.3 trillion. The bank opted for a cautious approach to take on any additional risks.

For shareholders, the full benefits of the Crane Bank acquisition have not yet been achieved, which has made the company less attractive since their dividends have either reduced or not been there.

SBU is the most active counter on the USE, in part, due to the availability of shares and the low pricing for its shares. This, however, has not propelled the price upwards in the last one year, even though it has enabled entry and exit of investors at a much faster rate.

Considering the state of the economy, SBU’s half- year performance is considered positive with 4.7 percent rise in after tax profit to Shs162 billion. SBU still took a cautious approach to lending, growing its lending by 2.2 percent to Shs3.8 trillion.

With interest rates expected to keep rising throughout the second the half of 2022 and inflationary pressures continuing to rise, several companies including banks will be affected. With not enough money to move around due to the tough economic times, it is unlikely the three bank stocks will register significant price changes.