Mobile loans data to be shared with credit reference bureaus

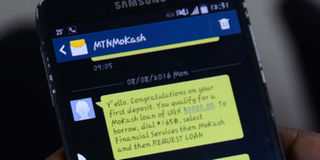

Micro loans have been growing at a very first pace in the last five years. PHOTO | FILE

The Financial Intelligence Authority (FIA) is reviewing regulations to come up with a way in which mobile loan data can be sufficiently shared with credit reference bureaus (CRB) to minimise default.

The regulations, under FIA, as amendment in 2016, would allow accredited credit providers such as mobile money network operators and utility companies to use national identity cards to provide information to credit reference systems.

The review, according to Dr Adam Mugume, the Bank of Uganda executive director for research, seeks to find an efficient process that will ensure that mobile loan information is sent to credit reference bureaus with national identity cards as enablers.

“We are working on a submission criterion for information on the mobile loans to the credit reference system using national IDs [national identity cards],” Dr Mugume told Daily Monitor in an emailed response to a number of questions.

Currently, only supervised financial institutions are required to submit borrowers’ loan data to Metropol Credit Reference Bureau and Compuscan, the only two CRBs operating in Uganda.

Micro loans, which are extended by mobile money service providers such as MTN and Airtel, the central bank said, fall below the Shs500,000 threshold set for reporting to the CRB using the financial card System.

However, in a June 2020 circular to all supervised financial institutions, the central bank noted that use of financial card system was hindering access to credit by the wider segment of the country’s population.

The circular informed supervised financial institutions and the market of the central bank’s progress on establishing the National Identification Number (NIN) as a unique identifier for borrowers, in addition to putting in place a near real-time mechanism for the authentication of NINs.

In a bid to ease access to credit, the central bank in the same circular waived the mandatory requirement for borrowers to acquire financial cards, if the loan is Shs500,000 or less.

However, the shift to national IDs could pose a risk to the financial sector if the process is not streamlined because there has been multiple reports of inconsistencies.

Benefits of sharing mobile loan data

Sharing mobile loan information based on National IDs would reduce default rates in micro loans, which are facilitated through possession of a Simcard by ensuring that even when the Simcard is discarded, the service provider is able to recover the loan.

The financial sector, especially banking, has been forced to pay attention to micro loans, which are growing at a fast pace.

Currently there are over 23 million mobile subscribers and the average number of micro-loans taken on a monthly basis, during 2020, according to Bank of Uganda stood at 421,300.

Increase in adoption of micro loans has been found to affect the banking sector.