MTN pays NSSF Shs31.4b as dividend for its 1.98b shares

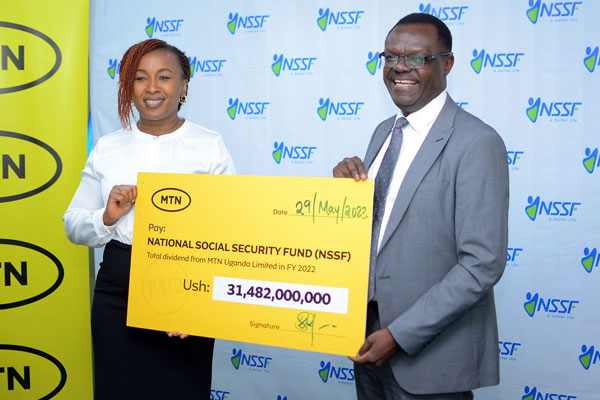

Ms Mulinge hands over a Shs31.4b dummy cheque to Mr Ayota as payment for NSSF's 1.98 billion shares. Photo / Courtesy

What you need to know:

- The payment, NSSF says, is the single largest dividend it has received out of its investments in equities

MTN has paid National Social Security Fund (NSSF) Shs31.48b in dividends for its investment in one of Uganda’s telecom.

The payment, NSSF said, is the single largest dividend it has received out of its investments in equities.

NSSF in 2021, during MTN’s Initial Public Offering bought 1.98 billion shares worth Shs360b, making the Fund the second largest shareholder in MTN.

Speaking in Kampala during a ceremony to handover the payment, Mr Patrick Ayota, the NSSF acting managing director, said the earnings affirm the Fund’s decision to invest in MTN given its performance track record and market leadership.

“MTN has high margins, which have contributed to attractive returns on invested capital,” he said, noting MTN was NSSF’s largest equity investment holding 14.6 percent to its total equity portfolio.

The investment, Mr Ayota noted, fits well with the Fund’s diversification strategy, a key component of the corporate strategy to grow the fund to Shs20 trillion by 2025.

Mr Gerald Paul Kasaato, the NSSF chief investment officer, said the Fund’s total investment in equities stands at Shs2 trillion held in at least 30 companies.

However, he added, the Fund manages assets worth more than Shs17.8 trillion, invested in fixed income, equities and real estate’s asset within East Africa.

Ms Sylivia Mulinge, the MTN chief executive officer, said NSSF remains a significant shareholder representing many Ugandans, who hold a stake in the Fund, noting that it was important to return value to Fund members.

MTN currently has 20,870 shareholders with over 200 smaller pension funds and Saccos, representing millions of Ugandans.

MTN early this month indicated that it would pay out a dividend of Shs5.5 per share totaling Shs123.1b for the period ended December 2022.

This is in addition to two interim dividends paid out last year in September of Shs5 per share and Shs5.4 per shares in December totaling Shs232.8b.

Ms Mulinge also noted that MTN is cognizant of the significant contribution of NSSF to social security, committing to ensure that investment in MTN fulfils the investment objectives and goals for the Fund.

Investment objectives

According to Ms Mulinge, MTN is cognizant of the significant contribution of NSSF to social security. Therefore, she says, MTN, is committed to ensuring that investment in MTN fulfils the investment objectives and goals for the Fund.