Digital is the future of retail

A woman looks at some cosmetic items online. PHOTO/Kelvin

Atuhaire

What you need to know:

Go digital. With 83 per cent of retail businesses existing in rural areas, maximisation of the digital space is a step in the right direction for business continuity.

The new customer is online! This was a recorded quote from one of the experts that featured in a documentary on the future of the retail industry. This, in essence, means revolutionary entrepreneurs are required to transform the economy through start-ups.

Over the recent decade, the drivers that have influenced the rise of retail in Africa include mobile technology, booming population and rapid urbanisation which will translate into bigger opportunities for the sector.

With 83 per cent of retail businesses existing in rural areas, maximisation of the digital space is a step in the right direction for business continuity.

From a drop in sales, less walk-ins, transport restrictions, restructured systems of payments, economic strain and destruction due to no imports, there is a paradigm shift of brands to locate the customers directly using the gateway of online space.

Also in the aftermath of Covid-19, retailers noted a rise in their costs of operation due to the increase in supply costs due to higher transport fares, disruption of supply chains, extra Standard Operating Procedure costs and enforcement of social distancing.

At the launch of ‘The Future of Retail’ thought leadership report 2020 last month, a number of key stakeholders in the technology industry were optimistic that the new wave of digital transformation is an enroute to economic recovery. The report documents the impact of the lockdown measures on businesses during the Covid-19 pandemic, with a focus on the trends redefining the sector and opportunity spaces for the retail ecosystem to ensure longer term sustainable economic development and business resilience.

The motivation behind the report is to get the necessary data to help businesses position themselves to be competitive in a post Covid era.

From the comprehensive study conducted by The Innovation Village, micro small medium enterprises are predominantly owned by youth, who do not have the necessary skills to build businesses and the need for closing supply gaps. According to the Uganda Investment Authority, micro enterprises are businesses that employ at most four persons while small businesses employ between five and 49 persons.

Ms Olga Kiconco, the head of strategy and consulting at The Innovation Village, noted that the report presents an opportunity for retail innovation in the way our retailers provide tangible value to consumers.

“The use of alternative technologies and business processes cannot be ignored but rather embraced and incorporated in operations to offer consumers convenience and value for money and in turn growth and competitive advantage for our retailers,” she said.

“Rethinking and redefining our retail stores will take collaborative initiatives such as training retailers on how to adopt new technologies and selling trends including creating and innovating solutions to suit our environments,” Kiconco reveals.

The Covid-19 Pandemic triggered a shift in retailer behaviour, with 15.8 per cent of the survey respondents noting that they explored new digital platforms to sell their products during nationwide lockdowns. Consumer behaviour also shifted towards the use of e-commerce platforms in search for convenient alternatives to in-person purchase.

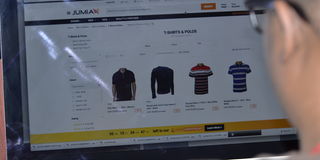

A woman browses an online website. Online retailers, reported an increase in sales as consumers turned online to buy items. PHOTO/kelvin atuhaire

The advent of the pandemic led to a sharp decline in the revenues of most retailers in 2020 compared to 2019. Overall, up to 78.1 per cent of the businesses that participated in the survey projected that their revenues will decrease this year compared to last. Of those, 56.5 per cent indicated that their revenues would decrease by more than 25 per cent while 21.9 per cent project their revenues will decrease by less than 25 per cent. Only 5.5 per cent of respondents projected revenues to increase year on year from 2019 to 2020.

Of the 900 businesses surveyed, up to 45.4 per cent of retail businesses expect their costs to increase. Most of the businesses surveyed had experienced lower revenues and increased costs of operations.

The pandemic

To control the spread of the novel virus, the President Museveni enforced a lockdown on March 30, 2020 including suspension of public transport, closure of ‘non-essential’ businesses and nationwide curfew.

However, the report highlights that the impact of these measures has greatly impacted Micro, Small, and Medium Enterprises (MSMEs) that account for about 90 per cent of the entire private sector, generating over 80 per cent of manufactured output with the retail industry averaging about 18 per cent in gross domestic product (GDP). It was reported that about 4,200 companies in the country shut down because of low cash inflows brought about by various lockdown measures. As a result, there was a decline in Uganda’s imports from $491.49 million in March to $435.6 million in May. This decline was matched by a fall in the country’s exports from $315.52 million to $290.93 million in two months from March to May.

Supply chain disruptions

In reference to the report, about 20 per cent of trade globally relies on China, rising from 4 per cent reported two decades ago. However, at the onset of the Covid-19 pandemic, China was forced to shut down its factories. This move greatly disrupted the global supply chains as the demand for the Chinese products plummeted.

In turn, Uganda has been affected by this crisis as about 20 per cent of the products in Uganda’s retail sector are directly sourced from China ccording to the report. To keep in operation, retailers were compelled to opt for other sources of supplies that proved expensive for them and led to the closure of operations for some leading to job losses.

This shutdown of trade between China and Uganda especially on retail trade also greatly impacted the country’s taxation, as Uganda collects over 42 per cent of its tax from international trade of which China dominates. With the disruption of trade between these two countries, Uganda is likely to register a decline in the tax payments through the Value Added Tax (VAT) remittances, import and excise duties.

With the limitation on movement as one of the ways to slow down the spread of the virus, brick and mortar retailers reported a decrease in sales since customers could not access their areas of business operation. Online retailers, on the other hand, reported an increase in sales as consumers turned online to buy items.

Retailers are now leveraging several media platforms including newspapers, television and social media especially Facebook, Whatsapp, Instagram and Twitter to advertise and sell their products.

“Our e-commerce shop saw an increase in visitors from 150 to 800 per day. Volumes increased by up to 1,500% as demand for telemedicine shot up during lockdown,” Davis Musinguzi, managing director Rocket Health, an online telemedicine.

“The benefits of online retail have been emphasized by the pandemic. The first movers from traditional to online retail will have the opportunity to capture significant market share,” says Nick Kamanzi, head of payment, SafeBoda.

In the coming years, large retailers will connect directly to the consumers and thereby personalise their offerings. Overtime, trust will be established for the purpose of branding businesses and competition will be based on quality of service than price.

Tax regulation

To increase tax compliance among businesses in Uganda, the report states, government announced a waiver of interest upon voluntary disclosure of any tax liabilities due by 30 June 2020. It also allowed the deferment of Pay As You Earn (PAYE) liability falling due between April 1– June 30 2020 to 30th September 2020 with no penalties or interest accruing for tax compliant businesses facing hardships arising from Covid-19 pandemic.

In addition, the government expanded tax and investment incentives to include businesses dealing in logistics, warehousing and Information Communication Technology (ICT). In July 2018, the government elected an over the top tax on all social media and mobile money transactions in the country to increase the tax base. However, this tax has tied the growth of online retail businesses across the country.

Brian Yesigye, the chief executive officer, Bravo Shoes Limited, engaged in online marketing, believes OTT is a stumbling block to businesses and a failed venture.

“I think they are going to remove it if they have realised there is no much tax being charged. Most people use VPN [Virtual Private Networks]; meaning it is not working for them but they have already passed it and it is another process to remove it. We are trying to improve businesses, so it has to be a free world since you are trying to get people online. Don’t tax the system that helps them make transactions which means you are derailing the online businesses. But once you live the consumer to freely enjoy online, then tax them when they make a sale out there.”

Going forward

Kiconco says for retailers to be competitive in the digital economy, they have to look into digital transformation.

“We need to skill as many youth as possible, equip them with the necessary tools that they need to stay competitive, address issues around necessary training for business development skills. This is key on how sustainable businesses will be in future and how to build their resilience,” Kiconco says.

She adds, “There is a need to explore spaces around import substitution since we are strong believers of Build Uganda, Buy Uganda.”

Traditional retail has been physical but with the advent of cashless payments, retailers need to build trust, reliability, and value of the brand and create a strong online presence to ramp up their returns.

Musinguzi says everything that exists in the physical world must also exist in the digital world that is why they are going to need a presence online if they do not have one. A lot of new emerging businesses had positioned themselves for the new feature. Consumers are changing their mindset about how they access services. Service providers need to start establishing platforms that engage a wider audience of consumers and build more trust.

In addition to the above, Yesigye advises retailers to hold onto their permanent addresses as opposed to closing them. In the African setting, there is a lot of power in testimonies, building networks, data and trust in customers. Some people will want to physically be familiar with the location and ascertain the reality. Otherwise, it will be an enormous effort to build your brand online without a location.

“Consumer protection goes hand in hand with how people perceive your brand and how people trust your kind of business with their data. If you are not doing branding, you will keep the lowest. If you want to be a brand, state your price openly,” Yesigye says.

Regarding business development support, the report recommends a need for capacity building in areas of financial and business management, human resource and leadership, as well as risk management frameworks and contingency operating plans as businesses undergo recovery and aspire to expand in the future.

For policy intervention, the report reads an opportune window to develop enabling policies and frameworks to support businesses transition from the informal sector to digital, particularly within the payments space.

Uganda being the 102th on the global innovation index.

Doreen Lukandwa, the head of marketing and customer success Beyonic, concluded, that government needs to facilitate the availability of software, hardware and capacity building so that people launch businesses at zero business cost. This will help businesses come on board quickly.