Make your money work by investing in stocks

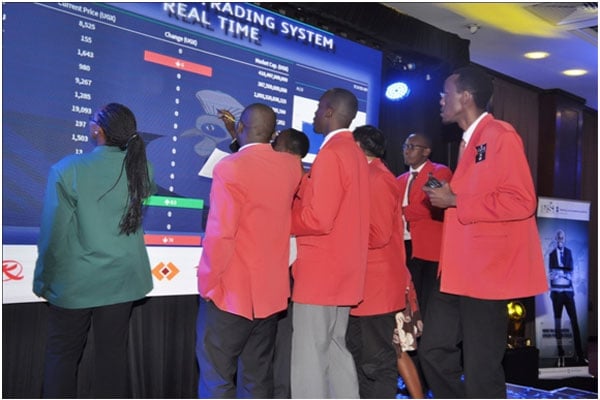

An efficiently functioning stock market is very critical to economic development as it gives companies the ability to quickly access capital from the public. PHOTO/FILE

What you need to know:

- Shares listed on the stock exchange can be bought and sold more quickly and easily than other investments, such as land, making them a more liquid asset compared to real estate. investing in shares is one of the ways an individual can shield their wealth from high rates of taxation.

If the thought of buying shares or investing in the stock market scares you, you are not alone. Individuals with very limited experience in investing in shares can be easily confused and even intimated by all the technical jargon, terminology, commentary by financial experts, analysts, stockbrokers, and horror stories by other investors.

Regardless of what you know or do not know about investing in shares, and what you have heard from other people who have invested in shares in the past or what you have read on social media, investing in shares is a personal choice.

That depends on your financial situation, risk appetite, personal financial goals, and investment style.

Much of the world’s business activity as we know it today would be impossible without investment and trading in shares and bonds. Shares and bonds are financial instruments that are sold to raise money for starting a new company or for expanding an existing company. Shares and bonds are also called securities, and people who buy them are called investors.

A person who buys shares in a company becomes a shareholder in that company and one of the company’s owners. As an owner, the shareholder is eligible to share in the company’s profits by receiving a dividend. The amount of this dividend may change from year to year depending on the company’s performance. Well established companies try to pay shareholders as high a dividend as possible.

Owning shares in a company implies that you as the shareholder owns a slice of the company. That ownership is equal to the number of shares you hold as a proportion of the company’s total issued share capital. For instance, an individual or entity that owns 1,000 shares of a company with issued share capital of 10,000 shares would have a 10 per cent shareholding of that company.

Owning shares in a company also gives you as a shareholder voting rights as well as a residual claim on the assets of the company. In general, you can make money with shares in two ways, through value appreciation of the company’s shares in form of capital gains and by sharing in the company’s profits in form of dividends.

Securities exchanges or stock markets are where individual and institutional investors come together to buy and sell shares in a public venue. In Uganda, this is done on the Securities Exchange (USE). Nowadays, these exchanges exist as electronic marketplaces. Share prices are set by supply and demand in the market as buyers and sellers place orders. Order flow and bid-ask spreads are often maintained by specialists or market makers also known as stockbrokers to ensure an orderly, efficient, and fair market. An efficiently functioning stock market is very critical to economic development as it gives companies the ability to quickly access capital from the public.

Securities exchanges such as the USE are secondary markets where existing owners of shares can transact with potential buyers. After a company has been listed on the stock exchange through the Initial Public Offering (IPO), it does not buy or sell its shares on the USE, or issue new shares. Likewise, when you sell your shares, in a company listed on the USE, you do not sell them back to the company, but rather you sell them to some other investors.

The day-to-day operations of buying and selling shares on the USE is between the existing shareholders and other existing as well as potential new investors and shareholders.

If you own property, it is likely that your home could be the most valuable asset in your portfolio making up the biggest share of your net worth. But at a global level, the wealthiest people have most of their wealth invested in shares.

For example, in the USA, the richest country in the world, more than half of American families’ wealth is invested in the stock market. According to the USA’s Federal Reserve’s Survey of Consumer Finances conducted in 2019, 53% of all American families had most of their wealth held in form of shares publicly traded on various stock exchanges. The average value of shares held by each household in the USA was $40,000.

Investing in the stock market carries risks just like all other business and investment ventures. However, when approached in a disciplined manner, it is one of the most efficient ways to build wealth. Today’s global corporate giants such as Google, Amazon, Facebook, Alibaba and so on all had their starts as a small private entity launched by a visionary founder and entrepreneur a few decades ago. Think of Jack Ma incubating Alibaba Group from his apartment in Hangzhou, China, in 1999, or Mark Zuckerberg founding the earliest version of Facebook, Inc. from his Harvard University dorm room in 2004.

Technology giants like these have become among the biggest companies in the world within a couple of decades, making their founders one of the wealthiest people in the world.

The price of shares may go up or down over time. When it goes up, shareholders can choose to sell their shares at a profit thereby earning a capital gain. Profits in the form of a capital gain earned by individuals on selling shares listed on a stock exchange are not subject to capital gains tax in Uganda.

Shareholders are entitled to a share of the company’s profits in form of dividends. Many companies listed on the stock exchange have a generous dividend policy to ensure that their shareholders get a regular and decent return on their investment in the company. Dividends earned by individuals from a company listed on the stock exchange are taxed at the lower rate of withholding tax of 10 per cent as opposed to the higher rate of 15 per cent that apply to dividends earned from private companies.

Shares listed on the stock exchange can be bought and sold more quickly and easily than other investments, such as land. This makes them a more liquid asset compared to real estate. This means investors can buy or sell their investments in shares for cash with relative ease. Income earned from shares listed on the stock exchange is taxed at a lower rate of tax compared to employment income and interest income from bonds and other fixed income securities. This means that investing in shares is one of the ways an individual can shield their wealth from high rates of taxation.

If you are considering investing in the stock market, start by “cutting out the noise” on social media and speak to the real experts - the stockbrokers - licensed by the Capital Markets Authority. Investing in shares is a personal choice.

*Written by Francis Kamulegeya

Author: Francis Kamulegeya, Certified Public Accountant and Chartered Tax Adviser.