Prime

Revamping Kilembe Mines: What it means to mining sector

Kilembe Mines, a copper producer which began operating in 1950, had an estimated 4.5 million tonnes of copper ore when operations stopped. PHOTO/COURTESY

What you need to know:

There are some voices of reason behind the revival backed up an array of experts knowledgeable in mining

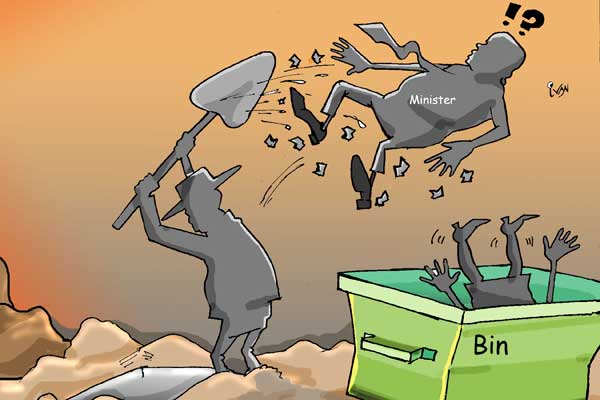

Kilembe has suffered decades of waste. Attempts to awake once one of Uganda’s foreign exchange earners have ended in talk alone with little evidence to suggest there is work being done.

However, the story line seems to have returned. Could it be different this time round? Well, time is the best answer.

There are some voices of reason behind the revival backed up an array of experts knowledgeable in mining.

Reviving Kilembe Mines has the potential to grow Uganda’s copper ore reserves as well as returning Uganda back to the copper mining fold.

The mines have proven ore reserves estimated composed of 1.77 percent pure copper and 0.17 percent cobalt, according to the Department of Geological Survey and Mines.

Nestled on the foothills of the Rwenzori Mountains, north west of Uganda, Kilembe Copper Mines is one of the oldest mining industries in Uganda with an estimated 4.5m tonnes of ore.

Between 1956 and 1960s, it was believed to be one of Uganda’s export, accounting for up to 30 per cent of Uganda’s foreign export earnings.

It was also Uganda’s third highest export earner, coming after coffee and cotton.

However, Kilembe was abandoned by Canadian firm, Falconbridge in the 1970s as the economy stalled with the mine posting losses due to lack of recapitalisation, runaway inflation and the collapse of copper prices on the international market.

The exit of Falconbridge meant that government had to enter the mine to salvage the little that had been left.

From 1975, government continued producing copper until 1982 when production stopped.

Various attempts to revive it have been made but they usually end with so little or nothing done.

However, government is mapping out new attempts kick-started by the recent visit by Vice-President Jessica Alupo to the mines on the orders of President Museveni to fast track revamping of the Kilembe Mines.

The neglect has not only impacted the mineral sector but also caused loss of lives that has now become more regular due to flooding of River Nyamwamba.

During her visit, Alupo said, the Ministry of Finance was looking for money to enable Kilmebe Mines pay arrears.

“I am here to find out how stakeholders can work with government to revive the operations of Kilembe,” she said.

However, beyond Kilembe, government is also seeking ways to resolve the crisis in which River Mubuku and River Nyamwamba have been wreaking havoc in much of Kasese.

According to Alupo, Kilembe at the time of closure had 4.5 million deposits of copper and it is highly probable that there are more deposits.

Kilembe Mines remains troubled in many different ways. Currently, staff are awaiting their salary in arrears of about Shs2b for more than two years.

Despite the directive, Ministry of Energy has not been approached on the way forward.

Energy Ministry public relations officer Solomon Muyita said last week, they have not handled anything related to Kilembe Mines.

Works and maintenance of bridges along Kilembe Mines

During her visit, Alupo had also directed the Ministry of Water and Environment to prepare a comprehensive water management solution for Rivers Nyamwamba and Mobuku.

In the same measure, she had directed the Ministry of Works to provide a road maintenance unit to help de-silt Nyamwamba as well as speed up the reconstruction of Kyanjukyi Bridge that connects to copper deposits and tourist sites such as Margherita Peak on Mount Rwenzori and conduct repairs on Kicucu bridge on River Mobuku.

Edward Kato, the Kilembe Mines chairman, said there is an estimated 5.5 million tonnes of copper at an average grade of 0.171 percent and 0. 114 percent cobalt left above ground in dams as tailings.

The tailings are expected to supplement metal recoveries and enhance cash flow when production at Kilembe resumes.

“There is need for government to accelerate the process of identifying a strategic partner to revamp the mining activities, considering the current high copper prices and the moderate demand for cobalt, and as demonstrated by the high number of companies that expressed interest in investing in Kilembe Mines to produce copper, cobalt and other metals in the ore, like nickel and gold,” he said.

Statistics

The 2021 Resource Governance Index (RGI) released on September 2, revealed that despite improvements in governance’s natural resources, its nascent oil and gas sector — as well as that of mining — are still classified as weak, with widening gaps between the laws and practice, that could impact the country’s push for transparency.

The Index shows that Uganda scored 49 points — an improvement by five points in 2017 — in the petroleum sector, while in mining it registered 55 points.

“Despite the positive trend, challenges remain, placing the governance of Uganda’s oil and gas sector in the ‘weak’ performance band,” the Index reads in part.

Uganda has a variety of mineral deposits but it is the gold sector that has expanded substantially since 2015, with a number of refineries now operating in the country.

Revamping Kilembe Mines

About $236m is required to revive Kilembe Mines, Uganda’s largest and once most important mineral deposit of copper ore.

This will be required for restoring poor infrastructure, much of which has since been washed away by floodwater and years of mismanagement. As government searches for another investor, it must address a series of issues.

These, according to Jim Nyamutale, a senior engineer at Kilembe Mines, include reworking of a 5MW plant that no longer operates at full capacity.

The plant, he said, still uses equipment that was installed in 1955.

Ms Pauline Batebe, the permanent secretary in the Ministry of Energy, says revamping Kilembe Mines must have happened 30 years ago.

“With prices going up again, we are confident that we shall attract a formidable investor should this time,” she says.