Money and Marriage

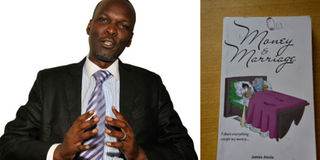

James Abola in his book says a joint account is good for couples as it comes in handy for utility bills, the children’s school fees and other family expenses. PHOTO BY MICHAEL KAKUMIRIZI

What you need to know:

Talking finances. Money is no doubt one of the biggest issues in a relationship. Issues such as declaring earnings, sharing costs and striking balances are bound to occur in a marriage if not addressed early enough. Esther Oluka spoke to James Abola and Joy Mirembe Abola, a married couple and authors of the book, Money and Marriage, a book that guides couples on how to deal with their finances.

Whose idea was it to write the book?

It was my idea and I found it enriching writing alongside my wife because the book has both feminine and masculine perspectives.

Why did you write the book?

We counsel couples intending to get married on money matters at All Saints Cathedral, Nakasero. The questions and comments that normally come from the sessions gave us the idea that we needed to put together a book.

For how long have you been counseling couples on financial matters?

For about five years now.

What outstanding financial issues have you noted among couples?

Not talking about money during courtship or marriage, not declaring assets, external money pressures that come from friends, relatives and peers, as well as debts.

Should couples declare their salaries and assets?

Couples ought to do so. If you cannot declare how much money you earn or assets you have to your partner, then, whom will you declare it to? If you can share your heart and body with your partner, then why can’t you share this piece of information as well?

Why do you think some couples hide details about their assets and money?

Reasons differ from one individual to another. Some women, for instance, do it because they perceive it as, “my assets or my money which my husband should not know about.”

What is your take on couples having joint accounts?

It is good for expenses such as home bills, rent and school fees. Couples on the other hand need to have some money on the side for their own personal errands. And it is still important that one tells their partner of the existence of this money as well. It builds trust among couples.

How about in circumstances like a separation, how should couples handle their money and asset issues?

In such a case, one needs to attain the services of an attorney to take them through the legal procedures as well as an accountant to take them through the financial concerns as well. But my advice to couples is to always work on being together. Challenges exist in marriages.

Can a relationship get affected when the woman earns more money than the man or when she owns more assets than him?

Yes it can since the way our society is structured is in such a way that the man is the provider of a home.

How about instances where a woman is the breadwinner in a home?

If the wife is bringing in the income, the man can still make a positive contribution so that the value of that income is boosted. But if you are the kind of man who is only good at complaining about not bringing in much money and not doing anything about it, you devalue yourself and this tends to bring problems in a home.

What advice do you have for such a woman who perhaps is already frustrated?

Be in position to encourage your husband to find a job, that is, in case he does not have one. The other thing you can do is sit down with him and listen to his ideas and plans.

And the advice you have for a man at home who is not working….

You have to get up on your feet and man up by finding your ability. If you have land somewhere, try out new ventures such as agriculture or livestock farming. Also, use the networks you accumulated during your working career as a platform for either establishing a new business or getting another job. You may mourn your circumstance, but you cannot spend all your days doing that.

About the book >

After reading the book, Money and Marriage, last week, I started questioning my spending habits. One of the things I am accustomed to is carrying emergency money. If my budget for the day is, for instance, Shs20,000, I always ensure to carry an extra Shs10,000 for emergency purposes.

Well, Page 66 of the book advises against carrying such money because most times the emergencies never happen and we get to spend the “just in case” money anyway, hence infringing on budgets. I found this interesting information.

Otherwise, the authors give very helpful advice on finances not only to married couples but also to singles and those in courtship. I love how they use examples of other couples’ experiences when explaining particular topics. It makes the book more interesting and relatable.

The 112-page book is divided into various themes, including family plan money, managing and controlling family cash, marriage and assets, marriage and debt, money-smart children, among others. You can get a copy at only Shs20,000 at any Aristoc bookshop outlet or at Akamai Global in Ntinda.

Why did you co-author the book?

We wanted to be able to capture a lot of stories that we picked along the way and put them in writing so that other people could benefit from them.

Should couples discuss money matters during courtship?

Yes, it is important, and it should not just be about money but other things as well. It is important to build a chemistry that is beyond just attraction.

Do you think women should declare their money and assets to their partners?

I think there should be some elements of values that a couple should keep bouncing on; that everything is for their own good at the end of the day. When couples are clear on those fundamentals, then, it is okay. But you see there are families where you will, for instance, find the man spending the money on drinking. You cannot tell such a man to declare his money.

There is an element of being wise and smart but also knowing and understanding your partner and seeing what works for and against them. In a scenario where a man takes away money from the woman and takes it for drinking, she needs to be smart in terms of how she can progress and move forward. I cannot stand and be counted for telling women never to declare because we are all different.

How can a woman earning more than her man make a fair contribution in a home?

A woman in such a situation just needs to let the man take care and provide for the family. A man finds a lot of satisfaction and fulfillment in being the main provider in a home. When that status quo is changed, it brings other issues.

Can a relationship get affected because the woman takes more money home?

It should not, but it can because it affects the man’s ego. It takes a very solid affirmed man not to be threatened by a strong woman.

And if it is a problem in a relationship, how can couples resolve it?

In such a case, the woman has to be more mature and not flaunt the wealth and money. Some men have previously told me that a man in such a scenario should aim to change that status quo, in other words, they should aim to work harder.

What is your take on the issue of women being breadwinners in a home?

If a woman shoulders the financial burden in a home, it is just a matter of time before she becomes overwhelmed because from what I have seen and read, it is not her primary role to provide. She is taking on a burden which is not hers and this can bring resentment. The woman will not be looking forward to the relationship. It becomes hard to respect a man whom you are providing for and it takes a lot of grace for a woman to humble herself before such a man.

What is your advice to such a woman?

Sometimes a woman has to let the man feel the pinch a bit. At some point, you need to stop doing everything just to make a point. I think it is necessary. It makes a man feel inadequate, too comfortable and rested when you are shouldering most of the burden. Sometimes relationships require this kind of firmness.

Do you think couples should have joint accounts?

I do not think it is paramount. But on the other hand, they can be useful. It helps couples mobilise money. My view is that a couple should have a sense of responsibility at the end of the day. This means owning up to whatever decisions you make, you are responsible and accountable for them. That aside, I think it is essential that everybody is allowed some amount of money on the side without having to be accountable for it.

How can one deal with an extravagant spouse?

Both parties need to look at each other’s strengths and weaknesses and figure out how you are going to solve the problem. One of the weaknesses that stand out for most people is that some people are big spenders than others.

And if that is the issue, figure out how you are going to deal with it. I used to be such an impulsive buyer and I think it is a disease that many women suffer from. I dealt with it by not carrying money with me all the time. So that even if I looked at something and wanted to buy it, I would not have the means.

What is the biggest mistake most people make when it comes to money?

Not knowing their financial realities. Most people know how much they earn at the end of the month but do not know how much they spend. A question I tend to ask people is that do they know where all their earnings go?

Someone may, for instance, earn Shs1,500,000 and yet they spend Shs2,300,000. Such a person lives on a deficit budget by either borrowing or getting things on credit and the funny thing is that they do not know what they are doing.

How can this be resolved?

Do a personal diagnosis of your financial realities and do not just assume that everything is in check.

CAN MONEY MATTERS BREAK A COUPLE?

“Finances can make a couple split, especially where one party does not want to declare how much they earn. It makes the other person suspicious and have many questions. To avoid all that, couples ought to declare their salaries to each other,”

Clara Kokunda, monitoring and evaluation ass.

“What I know is that when most couples face financial woes, they sit together and draft a plan on resolving the problem. They do not separate just like that,”

Sylvia Namutebi, gardener

“Love is not all about money. If you really love someone and they face any sort of financial difficulty during the relationship, you will stick by them. On the other hand, couples who desert their spouses when they face financial woes are in the relationship just for the money and not love,”

Florence Namusisi, hair stylist

“Nowadays, a relationship can end because of finance issues. When you keep on telling a woman that you do not have money, there is a likelihood that she will leave you,”

Joseph Nsubuga, former athlete

“Money becomes an issue when the woman is earning more than the man and she keeps rubbing it in his face. Majority of men cannot stomach that. They would rather opt out,”

James Muzinga, communications officer

“Money is the controller of everything in a relationship. Minus it, the relationship is bound to fail,”

Godfrey Munyumya, director at GOPRM Limited

“Money is not a key factor that can make a couple split up. There are other serious issues, including lack of trust among partners,”

Ivan Olupot, businessman

“I do not think so. Money is just a minor issue which can be resolved. Otherwise, the two major reasons many couples break up today is mistrust and infidelity,”

Margaret Apolot, student

Compiled by Esther Oluka