Prime

Tips on how to carry out a smooth home transaction

Not many of us can buy our home outright with cash, make sure you understand your budget. PHOTO/www.gettyimages.com

What you need to know:

Buying a home is one of the most significant purchases you will ever make so treat it with utmost care and seriousness. You need to be prepared; you should make sure that your financing is in place and ready before you begin looking at properties.

We dream of living rent-free in the haven of a home we can call our own. Are you looking to live the dream but wondering where to start? Based on my many years of experience in the property market, here are tips to successful and worry-free home buying.

Financing

Start with the finances and make sure you understand your budget. First, identify what you will need as a deposit and how to go about getting a mortgage that is right for you. Not many of us can buy our home outright with cash.

Most people need to consider a mortgage, a loan provided by a mortgage lender or a bank that enables an individual to buy a home with an initial down-payment and raise the remaining funds through their mortgage.

Jackson Emanzi from Housing Finance Bank explains: “Typically we advise someone to consider the home they can afford in terms of a multiple of their salary (or combined salary for a couple).

To raise the money for this purchase they will typically need a deposit of between 10 per cent and 25 per cent of the total cost and then by using a mortgage, paid off over a period of 10 to 20 years on a monthly basis, the rest of the funds are raised through a loan.

The typical monthly mortgage payment for a house may be slightly more than the equivalent rent. But unlike renting, you own the home and the value increases considerably over time. So, you own something worth a lot more than you paid for it.”

Another option growing in popularity in Uganda is a rent-to-own agreement. This involves paying a deposit to a developer and an agreed monthly rent, and at the end of a set period, you own the property.

The monthly rent is usually a relatively small increase on your current monthly rent, but it allows you to own a property rather than continuing to fund your landlord’s investment portfolio. This has been a popular approach in the US and Europe.

In Uganda, there are property developers such as Jakana Heights, who have this arrangement.

Location

Be clear about the location and amenities you need. A well-situated home is not only an intelligent choice but also a profitable real estate investment. One should consider a smart investment area that will appreciate more quickly than an already established premium location.

These smart investment areas are in up-and-coming locations that offer unspoiled surroundings, yet recent investment in roads creates ease in accessibility. These two things combined attract businesses to set up, increasing the availability of desirable amenities. As a result, the location quickly becomes a destination choice.

A good example is Konge Hill, an up-and-coming area in Buziga. This location is already tipped as one of Kampala’s top smart investment locations. When purchasing a home, it is wise to take a good look not just at the property but the surrounding area too. Take time to visit and walk around the local amenities before making your final decision.

Look beyond the surface

Have a checklist when you are viewing a property. Create a list of features and items that your new home must have. Be sure to review the list with all decision makers (spouse, parents, children etc.) When you have your completed list, take some time to rank the importance of each item. List the features you cannot live without and what can you. What are the essentials you need, and what are the issues to look out for? Viewing your property is an integral part of the home buying process as it gives you the chance to ‘sniff out’ any issues.

Take pictures if granted permission, so you can look back at the details and compare properties. Pay attention to specifics that might warn you of underlying problems; damp smells, signs of poor drainage, evidence of leaks, poor maintenance or upkeep of the communal areas and gardens. And remember the hidden essentials such as a backup generator.

Go for quality

“Affordable luxury is my top tip in today’s market. More developers in Uganda are making this part of their offer. Developers are employing architects to make this central to their construction vision,” Emanzi says.

Look out for developments that come with designer touches included in the price, for example, stylish kitchen fittings and a deluxe bathroom as part of the developers’ all-inclusive package.

Cover the legalities

Make sure you have dotted the Is and crossed the Ts with advice from an expert real estate attorney. Noah Wasige, a partner at Kirunda and Wasige Advocates, advises, “There are several things to check when buying a home, but most important is ensuring you have proper title to the land and undisputed site ownership.”

These can be complicated and expensive, so buying from a trusted developer who has already completed all the due diligence and has proper legal entitlement can reduce uncertainty, costs, and time.

Buying a home is one of the most significant purchases you will ever make so treat it with utmost care and seriousness. You need to be prepared; you should make sure that your financing is in place and ready before you begin looking at properties.

Stick to the budget

To avoid disappointment you should only tour homes that are in your price range. It is important that your agent conducts their analysis and review all properties before scheduling appointments to view property.

Your lender will require an appraisal of the property to confirm the value and make certain that you avoid over paying for a property. Knowing this allows you to present the seller your best offer and if it is not accepted, at least you know you tried and can move on with a clear conscious.

If your offer is accepted and you feel that you may have over paid, the appraiser will confirm the final value before closing. Just remember, you make your money in real estate when you sell, not when you buy.

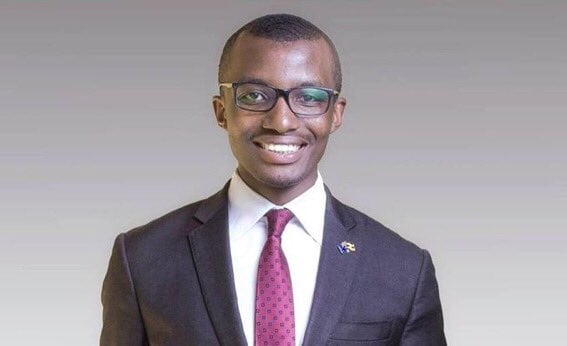

The writer David Tumwesigye is the managing director of Victoria Nile Estates.