Prime

Bullish government rules out salary delays

Health workers under their umbrella Allied Health Professionals Associations’ Alliance hold a press conference about their strike over salary enhancements early this year. PHOTO/ FILE

What you need to know:

- Government has released Shs1.78 trillion to ensure comprehensive provision for salaries, including enhancements for scientists, health professionals, science teachers/tutors and scientists in public universities.

The government has given assurances that payday delays that civil servants were beset with in the first quarter of the 2022/2023 Financial Year will be no more.

The assurances came in the shape of a second quarter allotment of Shs1.78 trillion to ensure comprehensive provision for salaries. This, the Finance ministry confirmed yesterday, includes enhancements for scientists, health professionals, science teachers/tutors and scientists in public universities.

Mr Ramathan Ggoobi, the Permanent Secretary/Secretary to the Treasury (PSST), revealed that Shs7.307 trillion has been released for the second quarter. From this, Shs265.9b has been earmarked for pension and gratuity, and will also cover the increment in pension due to salary enhancement for scientists and military officers under the Uganda People’s Defense Forces (UPDF).

Salaries of scientists nearly tripled this financial year. For example, graduate science and grade five teachers’ pay was pushed to Shs4m and Shs3m, up from Shs1.1m and Shs796,000 respectively.

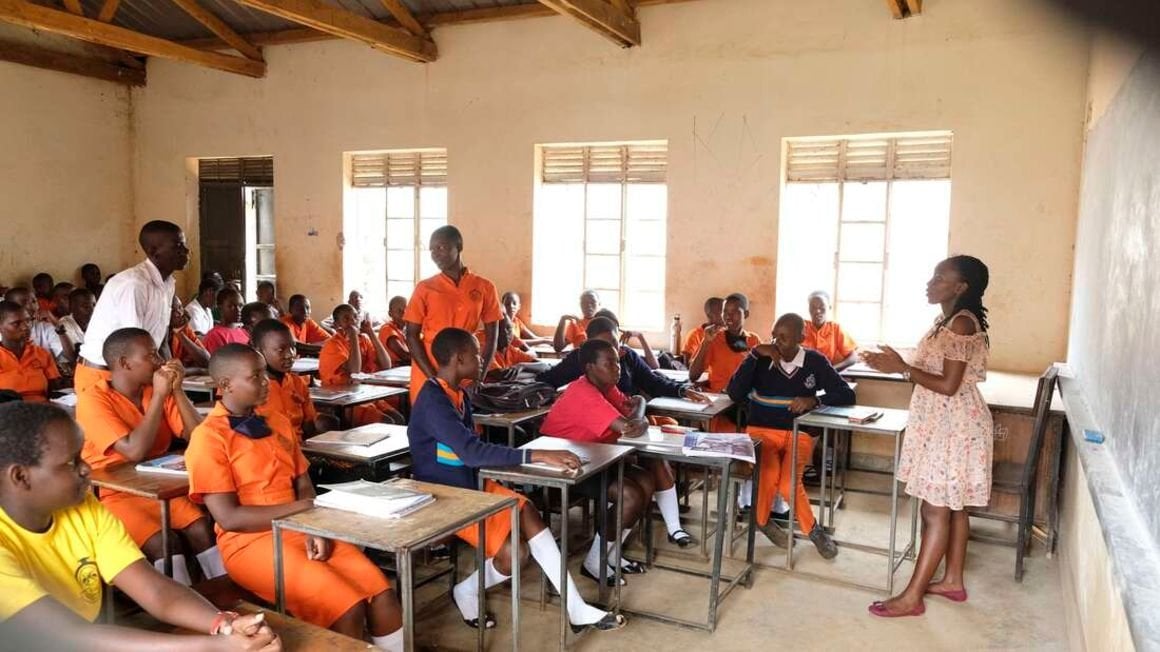

The allotment for wages (Shs796.73b) has also been increased to cater for various salary enhancements. Science teachers were supposed to receive their first enhanced pay at the end of July, but the Public Service ministry delayed sending out new pay structures to their counterparts in Finance.

“The issue of delayed salaries for civil salaries was as a result of the government policies, which are beyond our control,” the PSST revealed, blaming the delay on a review the ministry “had to do … to establish the information about those who qualified.”

With that blip now in the rearview mirror, Mr Ggoobi “assured all civil servants that starting this month (October), all wages will be paid by the 28th of every month.” This will be a relief for workers on the government’s payroll, some of whom were formally told to brace themselves for delayed salaries last month due to a constricted resource envelope.

Last month, the Cabinet approved an enhanced pay plan for all civil servants to take effect in the next financial year.

In July, the government also increased the salaries of top UPDF officials. In the new salary structure, a four-star General earns Shs15m up from Shs1.6m, Lieutenant General Shs13m from Shs1.5m, Major General Shs12m from Shs1.4m, Brigadier Shs10m from Shs1.3m, Colonel Shs8m from Shs1.1m, Lieutenant Colonel Shs5m and Major Shs2.5m.

Mr Ggoobi says the move to decentralise salary and pension payroll management to the respective institutions has been purposely undertaken to make accounting officers accountable for any changes on the payroll and payments to public officers, as well as pensioners. He said the move has enabled timely payment of employers and pensioners.

Tough times

While the government says there has been increased revenue performance, the spiralling inflation in the country has raised concerns, with households facing a cost of living crisis.

Between July and September, a surplus of Shs177.9b was realised by the government, according to the Finance ministry.

“The matter of inflation is a very critical one more, especially on the well-being of people because it raises the cost of living since the same amount of money someone has been earning can now purchase a smaller basket of goods,” the PSST acknowledged, adding, “That is why we are considering dealing with it first because it is a cancer to our economy, but we can only do so much because the drivers of this inflation are beyond our control. This is imported inflation.”

The government says it has lowered the economic growth forecast to 5.3 percent, down from six percent, for the 2022/2023 financial year because of inflation and a slowing global economy.

Ramathan Ggoobi, Permanent Secretary/Secretary to the Treasury.

In September, year-on-year inflation jumped to 10 percent from nine percent in August, which is double the five percent targeted by the central bank.

“The domestic economy, which has weathered several shocks, is showing signs of recovery,” Mr Michael Atingi-Ego, the central bank deputy governor, said on Thursday, adding, “The Composite Index of Economic Activity grew slightly by 1.2 percent in the quarter to August from 1.1 percent in the quarter to May 2022, supported by increased industrial activity.”

Unlike in the first quarter, which had no release for capital development, the Finance ministry has earmarked more than Shs1 trillion as a development expenditure to selected ministries to enable them undertake development programmes they have budgeted.

Capital expenditure is usually tethered to acquisition of land, intangible assets, government stocks, as well as nonmilitary and non-financial assets. It also applies for capital grants.

Budgetary allocations

The PSST revealed thus: “Shs142b for certificates and contractual obligations under the Ministry of Works and Transport, and Shs45 billion for the requirements of the National Airlines; Shs111b for certificates under the Ministry of Water and Environment.”

For the case of the Local Government releases, Mr Ggoobi said Shs1.429 trillion has been released to Local Governments.

Mr Ggoobi said under the education sub programme, the balance on the capitation grants for schools has been fully released to cater for the third term of the academic calendar, which started in September.

“In addition, the release caters for 33 percent of the Local Government development grants to enable them implement projects timely, the balance will be released in the subsequent quarters. The budget balance for USMID has been released to cater for payment certificates already issued on contracts to avoid accumulation of arrears,” he said.

Key objectives

The Ministry of Finance, Planning and Economic undertook specific consideration in the Quarter Two budget with four key objectives including the need to support continued economic recovery and growth, and therefore focuses on key growth areas; the need to pay certificates already issued on contracts to avoid accumulation of arrears and impairing private sector performance.

In this regard, Mr Ggoobi said: “This has been prioritised given that we did not make release for the development expenditure in the first quarter for all most all MDAs (ministries, departments and agencies); government’s commitment to maintain an optimum balance between economic growth and macroeconomic objectives; and enabling operational funds under non-wage recurrent without undermining the objective to control inflation that has risen to 10 percent in September.”

Non-wage recurrent expenditure of Shs397.275b has been provided for the Parish Development Model (PDM).

“This, therefore, means we released 50 percent of the budget for the PDM (Shs529.7b); all parishes should now be able to access Shs50m each, by half year,” Mr Ggoobi said.

The second quarter two release saw Shs337.3b being released to Uganda National Oil Company (UNOC), a 100 percent budget release for this financial year (Shs672.3billion). The PSST said this has been done to meet the governments equity participating interest in the EACOP (East Africa Crude Oil Pipeline) Company.

Statistics show that Shs305.1b has been released for operations of security institutions, with the Ministry of Defence receiving Shs180.36b, the police (Shs64.5b), Prisons (Shs36.9b), ISO and ESO (Shs23.28b).

The Second Quarter budget release has also seen Shs137.9b extended to National Road Fund for road maintenance, especially to cater for roads affected by the seasonal rains.

Elsewhere, Mr Ggoobi said Shs122.41b has been provided to agricultural institutions to cater for the planting season.

The much-maligned national carrier, Uganda Airlines, also walks away with a Shs45b shot in the arm having previously run into turbulence.