Interest on govt domestic debt hits Shs1.5 trillion

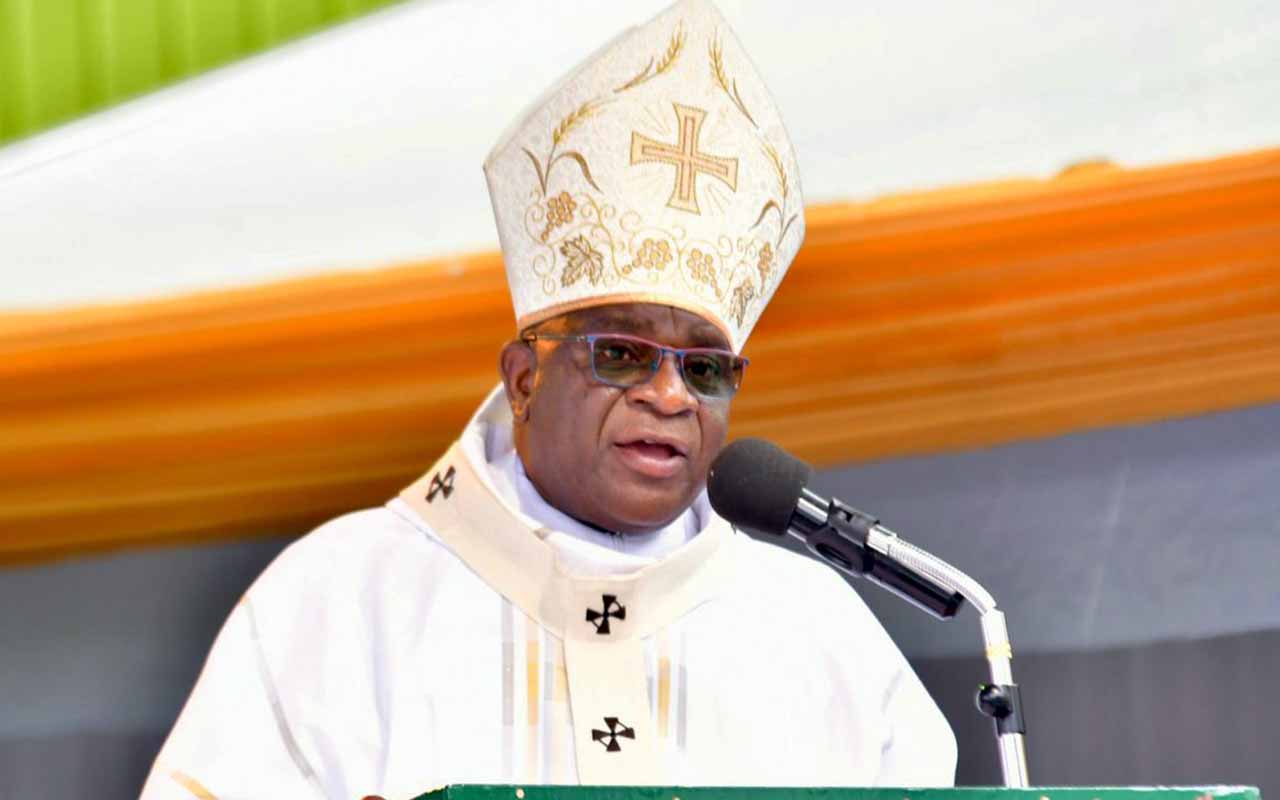

Finance minister Matia Kasaija. PHOTO/ALEX ESAGALA

What you need to know:

- The increase in domestic interest payment exerts a lot of pressure on government to meet its obligations of paying back the loans.

The government has in a space of one year spent more than Shs1.5 trillion on domestic debt servicing as the country grapples with constrained resource envelop amid growing spending appetite.

In December last year, the total stock of outstanding government domestic debt increased by 27.3 per cent [Shs 22.127 trillion] from Shs17.376 trillion in December 2019.

The money, according to government, was borrowed with authority of Parliament to bridge the resource gap between tax revenues and the planned government expenditures for the Financial Year 2020/2021.

Increments

Finance Minister Matia Kasaija has in the new Public Debt, Guarantees, Other Financial Liabilities and Grants report to Parliament revealed that domestic debt interest payment increased by Shs167.2b as at December 2020 compared to December 2019 which was Shs1.3 trillion.

The increase in domestic interest payment exerts a lot of pressure on government to meet its obligations of paying back the loans it has borrowed from the domestic market and on the loan it sourced externally.

Mr Kasaija explained: “Interest repayment increased due to increases in both outstanding stock and interest rates. The increase in stock was driven by increases in the levels of borrowing. The rise in interest rates were due to disruptions of the Covid-19 pandemic and the election cycle.”

As at December 2020, out of the total debt stock, 65 per cent amounting to $11.7 billion (Shs42.6 trillion) was attributed to external debt while 35 per cent equivalent to $6.3 billion (Shs22.9 trillion) was on account of domestic debt.

Every financial year, the Minister of Finance is mandated to prepare the Public Debt, Guarantees, other Financial Liabilities and Grants report to Parliament. The March 2021 report was one of the key documents Ministry of Finance officials tabled before Parliament last week.

Mr Kasaija attributed increased interest payment to the need by government to fund activities to combat the Covid-19 pandemic. The ratio of Treasury Bills to Treasury Bonds stood at 26:74.

The Public Debt Management Framework document stipulates a ratio of 30:70 for Treasury Bills to Treasury Bonds ,which indicates the preference for issuance of long-term instruments relative to short term instruments in a bid to minimise costs risks.

Mr Kaisaija explained that the outstanding principal repayments to be made by government in the medium term are projected to decrease, this is on account of a deliberate government’s strategy to maintain net domestic borrowing at 1 per cent of GDP.

Daily Monitor understands that the total debt issued between July 2020 and end December 2020 was Shs7.475 trillion whereby, the redemptions accounted for 43 per cent (Shs3.212 trillion) and Net Domestic Financing (NDF) requirements accounted for 57 per cent (Shs4.264 trillion).

The planned total issuance, according the report, was Shs5.976 trillion vis-à-vis the actual issuance was Shs7.476 trillion as at December 31, 2020.

“The Net Domestic Financing (NDF) target for FY 2020/2021 was revised upwards from Shs3.054 trillion to Shs6.312 trillion. This was to cater for government’s urgent funding requirements. Therefore, issuance was frontloaded into the first half of the FY 2020/2021 to meet the resource needs,” the report reads.

External debt

As at December 31, 2020, Mr Kasaija states in the report that the total external debt service with arrears for FY 2020/2021 amounted to $193.72 million (about Shs704.5b) of which $108.06m (about Shs393.1b) was for principal payments, $78.07m (about Shs284.018b) for interest payments and $7.59 million (about Shs27.6 billion) for payments towards commissions.

“The $99.16 million (about Shs360.744 b) representing 51 per cent of the total debt service with arrears was paid out to the Bilateral creditors, followed by $72.3 million (about 262.027 billion (37 percent) to Multilateral creditors and $22.26 million (about Shs80.981 billion (12 per cent) to commercial banks,” the report reads.

Exim Bank of China and IDA took the largest share of the total debt service during the first half of the FY 2020/2021 with 40 per cent and 19 per cent respectively whereas the share of the rest of the development partners averaged at 2 percent of the total debt service.

Currency composition

The Ministry of Finance stresses that the total external debt stock as at December 31, 2020 is mainly denominated in Special Drawing Rights (SDR) with 43 per cent followed by United States Dollars with 31 per cent.

“This is because the current debt stock is largely from multilateral partners. The share of the EUR currency has increased by 6 per cent as compared to the status as at December 31,2019 mainly attributed to increase in disbursements from UKEF,” said the Ministry of Finance.

The external debt stock is dominated by the Multilateral Creditors with 64 per cent of the total debt stock followed by bilateral creditors with 35 per cent and Commercial banks with 1 per cent. This has relatively remained the same over the past two years.

Multilateral Creditors

The debt stock of multilateral creditors is dominated by the International Development Association (IDA) of the World Bank with 58 percent followed by African Development Fund (AfDF) with 20 per cent.

These have been dominant over the past two years which is in line with government’s efforts to borrow on concessional terms. However, there has been a 2 per cent and 3 per cent reduction in the share of IDA and AfDF respectively from December 2019.

This is mainly as a result of new financing from the International Monetary Fund that has taken up 7 per cent share of the multilateral creditor’s debt stock.

Issue

Finance minister Matia Kasaija attributed increased interest payment to the need by government to fund activities to combat the Covid-19 pandemic. The ratio of Treasury Bills to Treasury Bonds stood at 26:74.