Proposal on NSSF tax an error - AG Kiryowa

NSSF headquarters in Kampala. PHOTO/COURTESY

What you need to know:

- NSSF blames the First Parliamentary Counsel responsible for drafting Bills of using an old template and recycling information.

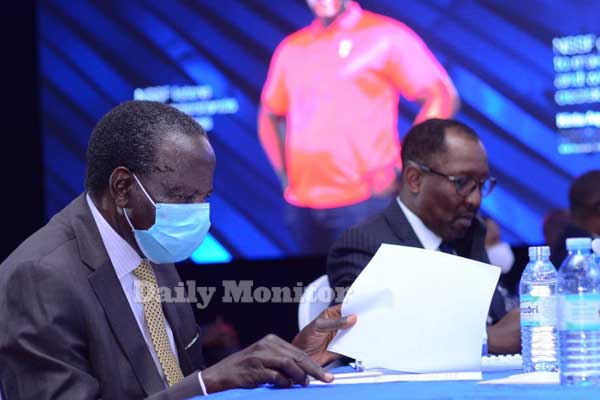

Senior government officials yesterday spoke at cross purposes about a provision in the newly tabled National Social Security Fund (Amendment) Bill, 2021 to tax NSSF benefits.

Whereas Attorney General, Mr Kiwanuka Kiryowa, owned up and said reference in the Bill’s notes to tax final benefits was an “error”, Finance Minister Matia Kasaija, who last Friday signed off the Bill’s Certificate of Financial Implication, spelling out the tax as an objective of the proposed legislation, cited a possible mischief.

Earlier in the day, the new Finance Ministry Permanent Secretary Ramathan Ggoobi tweeted the cover of Daily Monitor newspaper, which broke the story of the planned tax head, declaring the lead “fake” yet the September 24 Certificate of Financial Implication issued by the ministry in which he is the top technocrat reads : “Policy, principles and objectives of the [re-introduced NSSF Bill, 2021] are to address the following key aspects …(iv) to provide for access to voluntary contributions, annual levy by the fund, deference of taxes on contributions and scheme income to the time of payment of benefits.”

It is unclear why the PS sought to dismiss the story.

Asked last night to explain how the plan to impose tax of final NSSF members’ benefits ended up in the Certificate of Financial Implication that he signed just last week, Minister Kasaija said: “I do not know. Do not ask me, ask [the] people of [Ministry of] Labour (the Bill sponosor). To tax people’s benefits? That is not my idea. I have never debated that matter with my people [in Finance Ministry]; so, somebody must be smuggling it in...I have never sanctioned it.”

In the notes in the original Bill that lay out the principles, spirit and object of the proposed legislations as agreed by Cabinet, Gender minister Betty Amongi wrote that the government seeks to amend the National Social Security Fund Act, Cap 222, “to provide for the deference of taxes on contributions and scheme income to the time of payment of benefits.”

She was reported to be locked upon long meetings with visiting investors from Estonia and she did not respond to repeated inquiries about the new NSSF Bill and impugned tax provisions.

In an interview last night, Mr Kiwanuka said inclusion of the paragraph about both documents was an “editorial error” and he apologised for the confusion it generated.

While promising actions against officials who failed to spot what he called a mistake until this newspaper splashed it yesterday, Mr Kiryowa said his staff were overwhelmed because they had to expressly process, print and gazette seven Bills in one day.

“In updating the NSSF Bill 2019 for re-publication and re-introduction in Parliament, we omitted to delete para (f) of the explanatory memorandum to the original 2019 Bill. However, the 2021 Bill [should not] contain any such provision on deference of taxes. Indeed, unlike the 2019 Bill, the new Bill does not propose an amendment to Section 38 [of NSSF Act] at all which, therefore, remains in force reading,” he said, referring to provisions in the Act to exempt taxing the benefits.

He added: “The time constraints within which we processed these Bills unfortunately resulted in this regrettable error… We sincerely apologise for all the confusion. We shall endeavour to do better in future.”

In a separate telephone interview earlier yesterday, NSSF managing director Richard Byarugaba, who went on a media blitz to dispute out reporting, blamed the First Parliamentary Counsel responsible for drafting Bills of using an old template and recycling information already discarded in a previous version of the Bill.

In a response we could not independently verify, Mr Byarugaba said the 30 percent Pay As You Earn Remittance to Uganda Revenue Authority include levies on individual contribution to the Fund and NSSF’s income is also taxed, which is why savers upon attaining 55 or 60 years have walked away with their benefits untaxed.

Mr Byarugaba said their proposal to exempt individual contribution and NSSF income from tax and tax the final benefits of members if they withdraw them at 55 years, or exempt them is claimed by a saver aged 60 years or above, was defeated.

Calculations by the Fund showed that taxing the final benefit payment was cheaper than incremental monthly or annual levies, he said, but he did not share the statistics with this newspaper as promised.

Daily Monitor yesterday broke the story about government plan to tax the NSSF benefits, a proposal that had been deleted by the 10th parliament during consideration of the original amendment Bill (2019), attracting criticisms and rebuttal from sections of the public.

NSSF’s Byarugaba, who is not the sponsor of the Bill, said: “Where the clause relating to tax is, it is not there because it was removed only that these guys were lazy and used the same top page because if you go into the original amendment, all those clauses were changed. Whoever drafted the minister’s memo did not make the changes”.

As the debate on whether the tax reference in the official government document was an error or intended, but the account about it being revised by bureaucrats after this newspaper spotted the anomaly, the National Organisation of Trade Unions (Notu) told individuals involved in processing the Bill that no mischief will be accepted.

Mr Usher Wilson Owere, the NOTU chairperson general, said: “The people in [the Minsitry of] Finance just want to fail the workers, but I want to warn them because our agreement was to bring back the old Bill to amend the issue of mid-term access. The issue of tax is going to be dangerous. We rejected it the first time with all the stakeholders. They just want to punish the savers who are to get mid-term access.”

It is provided that an NSSF member aged 40 and above, and who has saved for at least a decade, is eligible to mid-term access of up to 20 percent of their benefits.

Mr Owere said they were to engage both the Finance and Gender ministers to have the proposal deleted from the draft Bill.

The re-tabling of the Bill in Parliament on Wednesday followed President Museveni’s letter to Parliament Speaker Jacob Oulanyah, accompanying his return of the NSSF (Amendment) Bill, 2019, for reconsideration by lawmakers.

In the August 26 letter, Mr Museveni, who withheld his signature on the enacted Act, asked Members of Parliament to amend Section 24 to clarify that only Fund members aged 45 and above and who have saved for at least a decade, are eligible for mid-term access, contrary to the wording in the Act that mid-term eligible savers are those aged 45 or above or those who have saved for at least 10 years.

In an interview yesterday, former workers’ MP and Confederation of Free Trade Unions (Coftu) chairperson, Dr Sam Lyomoki, said he believed the tax reference in the new NSSF Bill was an oversight by the drafters and it will be corrected and no taxes chipped away in levies.

Notes on nssf bill 2021 says at a glance

The Bill therefore seeks to amend the National Social Security Fund

Act,Cap.222-

(a) to provide for the appointment of a stakeholder board by

the Minister comprised of representatives of Government,

employers and employees;

(b) to transfer the regulation and management of the National

Social Security Fund to the Minisrer responsible for finance;

(c) to expand social security coverage by providing for mandatory contribution by all workers, regardless of the size of the enterprise or number of employees and also

allowing voluntary contributions to the fund; ....

(e) to provide for mid-term access to voluntary contributions and to members who are forty five years and above and have contributed to the fund for at least 10 years;

(f) to provide for the deference of taxes on contributions and scheme income to the time of payment of benefits

HON. AMONGI BETTY ONGOM,

Minister of Gender, labour

and social development

About NSSF

The National Social Security Fund (NSSF) is a quasi-government agency responsible for the collection, safekeeping, responsible investment, and distribution of retirement funds from employees of the private sector in Uganda who are not covered by the Government Retirement Scheme.

Who is eligible to contribute to NSSF? Any employee of or above the age of sixteen and below the age of fifty-five years except an employee employed in excepted employment; a nonresident employee; and an employee not employed in Uganda.