Umeme investors targeted NSSF money since 2004, says MP

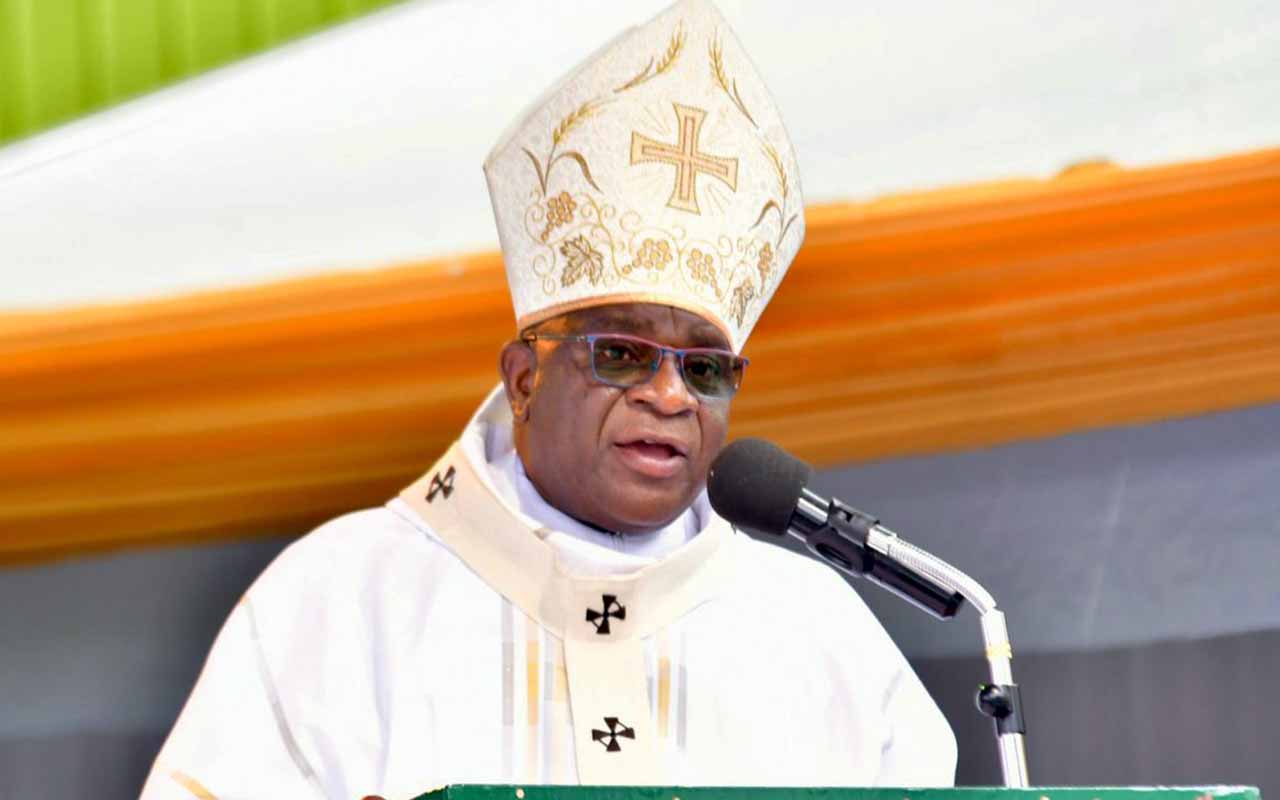

Deputy Secretary to the Treasury and board member of National Social Security Fund (NSSF) Patrick Ocailap with the Ag. managing director NSSF, Ms Geraldine Ssali, before Parliament’s Select Committee yesterday. PHOTO by Geoffrey Sseruyange

What you need to know:

Cash bonaza. MP claims it was a well calculated move to use NSSF cash to capitalise Umeme.

Parliament.

The ongoing inquiry into corruption allegations at the National Social Security Fund yesterday heard that the owners of Umeme tapped the Fund as a source of cash back in 2004, a charge the power company has refuted.

Members on the House Select committee investigating the allegations also dug into details of why Finance minister Maria Kiwanuka objected to the nearly Shs70 billion transaction in which NSSF bought Umeme shares.

A copy of what MPs said were Umeme’s Articles of Association, and Memorandum of Association, scrutinised in the committee yesterday revealed that Umeme investors had envisioned selling ordinary shares to NSSF or its employees.

“From the evidence we have so far, it was a well calculated move to use NSSF cash to capitalise Umeme and it’s not surprising that the whole deal is shrouded in controversies,” Mr Alex Ruhunda (Fort Portal Municipality, NRM) said.

Mr Ruhunda had read from one of the documents, quoting section G(vi) on Transfer of Shares, which was signed by the Registrar of Companies on May 4, 2004, noting that “…the government will not unreasonably withhold the approval of the transfer/sale of ordinary shares to NSSF or its employees where the company desires to sell 10 per cent of its share capital.”

During the hearing, members put Deputy Secretary to the Treasury Patrick Ocailap, who also chairs the investment committee of the NSSF board, under the spotlight as they reviewed evidence indicating that on March 31, the investment committee finalised its due diligence on Umeme. The transaction took place on May 8.

The evidence showed that the NSSF board chairman, Mr Ivan Kyayonka, rang Ms Kiwanuka who was on her way to State House on May 8, requesting her approval for NSSF to buy more shares (15 per cent) in Umeme.

However, the minister in her reply to Mr Kyayonka chairman, dated May 13, protested that she had received the documents on the deal less than 24 hours before Mr Kyayonka’s telephone call.

“I reiterate that it’s impossible to grant immediate approval to the proposed transaction given the short notice given,” Ms Kiwanuka wrote.

The minister said in her letter that the proposed cap price seemed to be higher than the market price of Shs340 as of May 8.

“The USE market dealings would provide a more objective platform for valuing a listed company such as Umeme. It is also noted that Umeme had a very generous dividend payout policy in the period prior to this share offer. This policy may have also critically inflated Umeme share value.”

The minister questioned NSSF’s decision to acquire an additional 15 per cent shares in Umeme without knowing who the other shareholders controlling the remaining 38 per cent of the company were.

Ms Kiwanuka warned that Umeme was enjoying a monopoly protected by a contract which was under public debate. The minister’s advice referred to a resolution of Parliament that Umeme’s contract be cancelled in public interest.

illegal purchase of shares

On the alleged illegal purchase of Umeme shares in spite of the House resolution, Mr Kyayonka has since said, Section 30 of the NSSF Act (1985) allows the Fund to make investments of all monies under its control.

This, he said, included monies in the reserve account which are not, for the time being, required to be applied for the purpose of the Fund in such investments as may be determined by the board in consultation with the minister.

The board chairman said the decision to invest in Umeme was approved by the board of NSSF in consultation with the Minister of Finance, as provided for under Section 30 of the NSSF Act.

However, shortly after the Umeme shares controversy broke some board members said they were not in agreement over the transaction.

While Mr Ocailap told the committee that his team did a thorough due diligence using the prospectus issued by Umeme, Ms Kiwanuka wrote: “Umeme debt position also needs further scrutiny. Total liabilities, equity ratio is about 70:30.

Further, current liabilities are over 60 per cent of the total liabilities. The trend is also visible in the financial projections.”

The committee criticised Mr Ocailap’s committee and some members of the NSSF board for ignoring the advice of the minister.

Ms Kiwanuka had advised that an independent and proven expert reviews the whole investment proposal.

Justified

“We evaluated the risks involved and found that it made business sense to invest in Umeme,” Mr Ocailap said. “In writing to the minister, we were just consulting her and this is the law. The decision to buy or not to buy the shares was on May 8,” Mr Ocailap said. “The board takes the investment decisions and takes full responsibility. Maybe the minister didn’t have time to go through all the documents.”

Yesterday, Finance ministry spokesman Jim Mugunga said: “My understanding of the minister’s response to the NSSF letter was to call for extra care and prudence in determining the way forward for investments in Umeme.

Her overall comments were focused a lot more on the political aspects of the investment and it is clear she left the commercials aspects to the NSSF management to carefully consider. The deputy secretary to the treasury is not at variance, his comments within context refer to the total sum of the due diligence report which explained in detail the concerns raised by the minister. Just like the decision of Parliament’s own pension managers; their decision to invest was based a lot more on the commercial viability of the offer and as has been proved; it was a good investment which has produced plausible dividends for the MPs as it did for NSSF and the workers.”

Umeme spokesperson Henry Rugamba last evening denied that the power company targeted NSSF cash at incorporation in 2004.

“The NSSF decision to buy shares in our company had nothing to do with us. In any case, there are procedures to follow; I don’t know how members of Parliament are getting such assumptions that we targeted NSSF. It seems they are trying to throw mud at us. This is conspiracy and there is no merit to their comments without substantiating them.”

Mr Ocailap was yesterday compelled to explain the allegations of irregularities at the Fund after saying Mr Kyayonka was indisposed and therefore unable to appear with other board members.

Mr Ocailap who had appeared with the acting Managing Director Geraldine Ssali and other NSSF officials said some board members were out of the country and appealed for postponement of the meeting.

However, the Select Committee chair, Mr Vincent Ssempija, also observed that the board is so divided that some members have requested that they appear individually. The committee decides today on whether to meet the board members individually or as a group.

Background

A five-member Select Committee named by Speaker Rebecca Kadaga on July 17 was instructed to probe allegations of nepotism and unfair recruitment at NSSF; illegal purchase of Umeme shares; irregular disposal of NSSF assets and any other matter related to suspected mismanagement at the Fund.