Prime

Chewing jean jackets is better than taking mortgages in Uganda

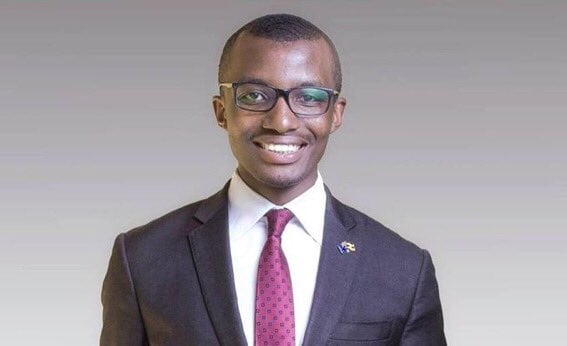

Raymond Mujuni

I don’t know if some of you have seen the newly upgraded Constitutional Square gardens but if you haven’t and you eventually see them, right in the middle of them, where the grass greens to a concrete aisle, there, that’s where I’d chew a jean jacket before taking any mortgage from a Ugandan bank.

Don’t get me wrong, jean jackets aren’t a fantastic delicacy, but on a menu with Ugandan mortgages, they aren’t just appealing, they are the better option.

Ugandan mortgages share two common aspects; they are 20 – 25 years long across many banks and are mostly priced with an interest rate of 18-25% depending on which bank you choose. On the rare off chance that the sun rises early, Housing finance, a Ugandan government part owned bank offers the 16% interest rate.

There are many ways to look at the mortgage problem in the country but none will be as important as the cost of money. The cost of raising money for mortgages and giving that money out and having it back with a profit determines, in large part, how the banks arrive at their atrocious and execrable interest rates.

It is estimated, currently, that there are about 10,000 active mortgages in the country. If each mortgage is valued at 200 million shillings on average, this is 2 trillion shillings’ worth of other people’s savings floating about. Banks are only able to lend based off of the savings in their draws. So, that must be Shs2 trillion’ worth of savings.

Mortgages get better only in countries with high saving cultures; and currently the best mortgages at least by estimation are issued in Japan, Finland, Denmark etc….

The cost of money in those countries is cheap because of the high saving cultures of those countries. It is thus, not strange when data from the world bank of savings to GDP ratio is plotted, those countries again come up top.

But, the second, and also important point is countries are only able to improve their savings cultures by improving the economic conditions of their people and increasing on their lifespan. It is important to stay on earth long enough. Not only do you see many things, you also do many things and earn a lot more money.

In Uganda, with a lifespan of 63 years, it can be hard convincing a bank when you are 40 years [The average age at which people take on mortgages] that you will return their money in 25 years. When all the data on the books shows your incomes will decline, a hospital bill will render your incomes absent and your death will tear the family apart in squabbles over your wealth.

Those things that we ignore in this country determine a lot how risk profiles are drawn up, they determine how people put their money in the bank for long term stay and also determine how that final interest rate on the mortgage is drawn up.

This is why, some people, your columnist included, argued against the midterm access and also continue to argue for early retirement of civil servants and private sector employees.

The recent effort by the URBRA to get 50% of pension as security for mortgages looks like a sound argument but it is on the whole bad economics and it will do very little to de-risk mortgages.

All data and science show, better welfare in education and health, produces better life conditions and guarantees longevity of life, that longevity guarantees longer saving periods which then serve to reduce the risk on money lent out. The government doesn’t have to believe me on this, they just have to pick out the data gathered by the Bank of Uganda on lending practices.

But also, if you live long enough, jean jackets fall out of fashion and you don’t have to chew them at Constitutional Square.