Strengthening Uganda’s economic muscle

Amena Arif is International Finance Corporation (IFC), country manager for Uganda

What you need to know:

- A new report by IFC and the World Bank suggests ways this might be done. The Uganda Country Private Sector Diagnostic (CPSD), is a detailed study of the workings of Uganda’s private sector—its strengths, weaknesses, and many opportunities.

Uganda’s economy was soaring in the 1990s, with growth averaging about seven percent annually. The country’s progress was built on strong exports and foreign capital inflows, a testament to the competitiveness of its business environment and labour market.

More recently, however, Uganda’s growth and productivity have slowed. Then came Covid-19, a health and economic shock that resounded globally. The pandemic induced Uganda’s first economic contraction in decades, with over two million Ugandans estimated to have slipped back into poverty.

It’s a critical time for Uganda to refocus and rethink parts of its economy, not only to speed up recovery from Covid-19 and other global shocks, but also to build a stronger foundation for long-term, sustainable growth and job creation.

A new report by IFC and the World Bank suggests ways this might be done. The Uganda Country Private Sector Diagnostic (CPSD), is a detailed study of the workings of Uganda’s private sector—its strengths, weaknesses, and many opportunities.

The CPSD identifies three sectors in particular with stronger potential to jumpstart broad economic growth and recovery in Uganda. These are agribusiness, energy, and housing.

Agribusiness is key for Uganda. Eight of the top 10 export industries are in agribusiness, including sugar, coffee, tea, fish, dairy, and cereals. Foreign direct investments into the country’s agro-processing sector more than tripled between 2010 and 2019, hitting $230 million. Still, bigger development dividends could be realised by boosting the quality and value of processed products.

The CPSD suggests Uganda enact the National Accreditation System Bill, which aims at boosting international recognition of Ugandan quality assurance systems, international certification, and service providers. Enacting the Bill will help expand Uganda’s access to export markets.

Agriculture generates a quarter of Uganda’s GDP and employs 70 percent of the labour force. However, the sector remains dominated by smallholder subsistence farmers, and suffers low productivity levels, high post-harvest losses, and poor market access.

Here, the CPSD found that inefficiencies and market fragmentation could be addressed by connecting small-scale farmers to private agribusinesses.

Regarding energy, this is a foundational sector that powers all others. Between 2002 and 2020, Uganda’s installed generation capacity quadrupled, with renewables such as hydropower and solar representing the largest share of the energy mix. Over the same period, Uganda’s transmission network more than doubled in size, while system losses fell significantly.

Despite these laudable improvements, only about a quarter of Ugandans are connected to the national grid, among the lowest rates in Africa - the end user grid electricity tariffs in Uganda, contrary to most countries in sub-Saharan Africa, has been largely cost reflective.

The CPSD outlines how increased investment in transmission and distribution networks, including through public-private partnerships (PPPs), can ensure that more Ugandans are connected, thus sharing the cost of service delivery and enabling more affordable electricity prices.

The level of investment needed to ensure universal electricity access in Uganda needs funding from government’ donors and private sector. Public-private partnerships could also help Uganda plug its yawning housing deficit estimated at 2.1 million units and growing by about 200,000 more a year, according to the country’s bureau of statistics.

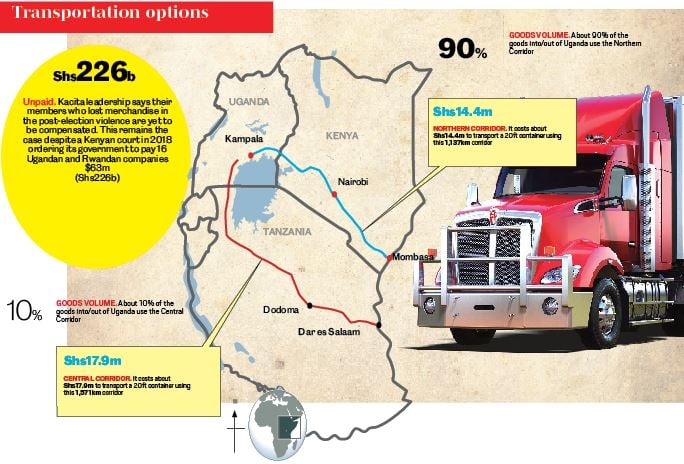

To support increased home ownership, the CPSD recommends Uganda’s financial sector introduce more flexible home finance solutions to help buyers more easily purchase and mortgage homes. The report outlines how the country can tap into its potential role as a major regional trading hub, serving neighbouring markets and beyond.

Enhancing connectivity through infrastructure and the use of cutting-edge logistics and will also speed up this process. Here too public-private partnerships could be leveraged to construct roads, railways, among others and enable access to more users through smart tools.

Amena Arif is IFC country manager for Uganda and Mukami Kariuki is the World Bank Country Manager for Uganda