Prime

The path to wealth for Uganda’s young is bleak

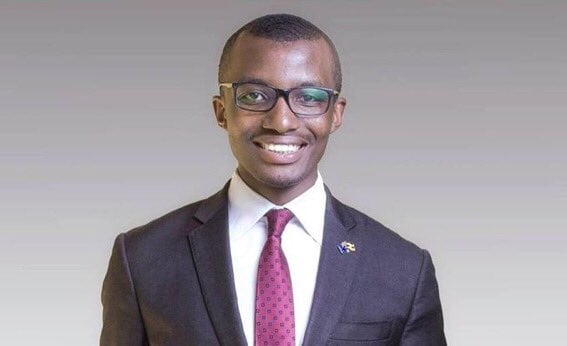

Raymond Mujuni

What you need to know:

- The government has firmly insisted that investment in agriculture and manufacturing is the path to wealth but many of Uganda’s young aren’t land owners with capacity to exploit agriculture [which already has low returns] neither are they in position to exploit the wealth of manufacturing which is concentrated at the top or in the hands of the owners of capital

A lot of people think that the biggest demographic problem facing Uganda is that it’s young people are producing more young people they are incapable of looking after – and that’s true. Others think that the crisis facing Uganda’s young people is unemployment, which too, is a fact.

There exists another problem, which if solved, would answer both problems; young wealth.

There doesn’t seem to be – or at least we haven’t been shown – a clear path to wealth for majority of Uganda’s young population. The government has firmly insisted that investment in agriculture and manufacturing is the path to wealth but many of Uganda’s young aren’t land owners with capacity to exploit agriculture [which already has low returns] neither are they in position to exploit the wealth of manufacturing which is concentrated at the top or in the hands of the owners of capital.

Many of the young people are either unemployed, underemployed or earning just enough to see five business days pass them by. They’ve created an enviable SME economy which feeds a hand to mouth lifestyle.

In the absence of a clear plan with defined markers, Uganda’s young people need to start thinking creatively about wealth, how to make, retain and grow it – and this will require some pot breaking.

Let’s start right; Uganda is at an iconic place in its statehood project. It has the highest life expectancy ever recorded, the highest educated population of its lifetime, the most employed population ever recorded –and yet, that still isn’t enough.

The number of Ugandans earning above a million shillings is still a paltry 1% of the working population. From a pool of 14 million bank accounts, 93% have less than a million shillings on them. On the wealth side, things are even bleaker; only 39% of Ugandans individually own land – of the 60% of households that own land, 80% of them own it on customary tenure which makes it inadmissible in the capital markets.

Don’t get me started on the saving culture; it is first that, in an economy where majority of workers earn less than Shs150,000, asking for savings is a steep demand. Less than a million Ugandans have a pension to their name. The millennials today are also facing the sharpest inflation. In the last two decades, the compounded inflation has wiped out the value wages and yet those wages remain constant. So, I suggest, that we start an actual important conversation on wealth.

The conversation needs a structure. A political, economic and social one. We must talk about wages – and the labour market in an honest manner. Every political actor must show us their economic plan for how to concentrate wealth in the hands of majority Ugandans – and how to grow that wealth. We must be told how long, after education, a labourer must take to earn back the money invested in their education. We should talk about our property prices – and the cost of inflation that has put them out of reach of millennials.

Short of that, there will be hard days on the streets my friends. Let’s approach the wealth conversation like we are deserving of it, trained to have it and capable of earning it in our lifetime.