Why tax on bank withdrawals should stand

What you need to know:

- Under the proposal, the Finance ministry was considering a 0.5 per cent levy on all bank withdrawals done over the counter, from ATMs or bank agents.

Last week, a leaked proposal by the Finance ministry to tax bank withdrawals caused an uproar in sections of the urban elite.

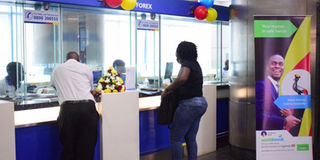

Under the proposal, the Finance ministry was considering a 0.5 per cent levy on all bank withdrawals done over the counter, from ATMs or bank agents.

The main critics of the proposal complained that this amounted to double taxation, as a lot of money held in the bank belongs to salary earners, who have already paid Pay As You earn (PAYE) on their income.

They also warned that people will withdraw all their money from banks, thereby defeating another government objective of widening access to financial services.

However, these are all red herrings. Thankfully, in our immediate past, we have seen government levy a similar charge on Mobile Money transactions and the sky did not fall on our heads.

In 2018, government introduced a 0.5 per cent levy on Mobile Money, and after initial opposition to the fees , the value of Mobile Money transactions dropped to Shs66.9 trillion in 2018 compared to Shs73 trillion in 2017. This reluctance has been overcome as Shs80 trillion in transaction in 2019 indicates.

What seems to have changed is the average value of individual transactions. There were 1.3 billion transactions in 2017 versus 2.5 billion transactions in 2018 and 3.1 billion in 2019.

The high value transactions, this seems to suggest, moved to other platforms – maybe the banks, with the small transactions more than bridging the initial deficit. This, in turn, suggests that other than discourage small users, who are in dire need of access financial services, there has been an increase in activity.

Going by this example alone, the banks need not fear that their depositors will take flight.

When withdrawal levy was being imposed on Mobile Money, the banking industry was conspicuous by its silence.

It is no secret that Mobile Money channels have not only reached prior to this untapped markets – the bottom of the pyramid, but the speed at which they have done it has forced a rethink of the banks’ business models, including them opening themselves to collaboration with the mobile money players.

In classic divide and rule tactics, the government first levied the fees on the less influential telecom companies and have now three years later, rounded on the banking industry.

The banks have now recommended that the levy on withdrawals, for both mobile money and banks, be scrapped and instead an excise duty on transaction fees be levied across the board.

It is true as some people argued that two wrongs don’t make a right, but in the interest of fairness, you either persist with the injustice or eliminate it for both the mobile money and banking industries.

Abrahams Massa,

[email protected]