Prime

Money laundering tops illicit financial flow methods used in Uganda – Report

In a 2015 report, the High-Level Panel on Illicit Financial Flows from Africa projected that the continent loses more than $50b (about Shs183 trillion) a year in criminal financial flows. Photo / File

Trade-Based Money Laundering (TBML) is increasingly becoming one of the leading forms of Illicit Financial Flows (IFF) being frequently used in the country, reveals a new report.

According to the expert analysis published as a policy memo - a tool meant to inform and influence decision-makers, TBML has since emerged as one of the most sophisticated methods, and also hardest to detect by financial institutions and customs authorities because often times it resembles legitimate trade.

This policy memo - a joint publication by Advocates Coalition for Development and Environment (ACODE) and Global Financial Integrity (GFI), titled: Trade-Based Money Laundering in Uganda, notes that TBML largely involves giving false information on imports and exports through over/ under-billing, multiple billing, over/under shipping, and quality misrepresentation.

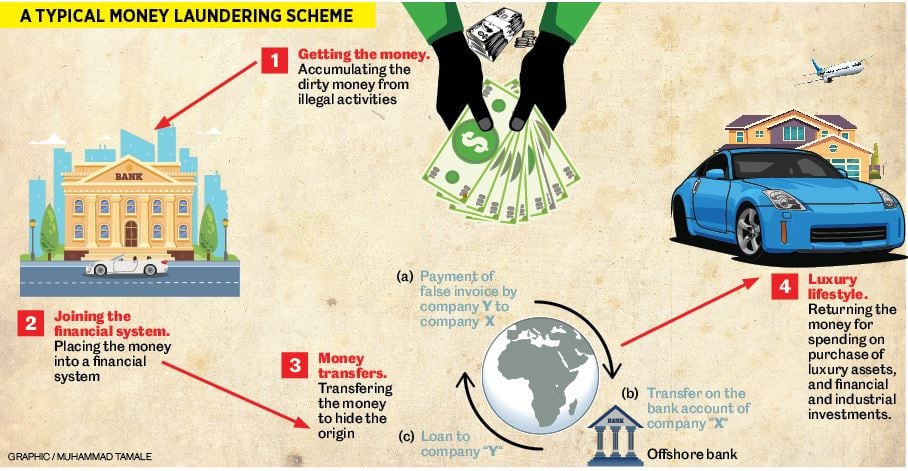

The Financial Action Task Force (FATF), defines TBML as “as a process of concealing the proceeds of crime and moving value through the use of trade transactions to legitimise their illicit origins”. This explains why policy makers struggle to understand TBML, often confusing it with trade-related offences such as fraud and smuggling yet it is distinct in a sense that it doesn’t involve movement of goods, but rather the movement of value that the trade transactions facilitate.

According to the 20-page policy memo authored by Mr Onesmus Mugyenyi, Ms Phoebe Atukunda, Mr Eugene Gerald Ssemakula, Mr Robert Ssuuna and Mr John Okiira – all of whom are grounded on research, policy matters, taxation and related tax abuses manifested through IFFs, TBML has been recognised as one of the three main methods which criminal organisations and terrorist financiers move money while disguising its origins and integrating it back into the formal economy.

This method of money laundering is based on the fraudulent trade transactions and their financing, thanks to the scale, complexity, and speed of global trade making it easy to thrive. Worth noting is that digitalisation of global commerce even with all its gains, has not helped matters, but has rather “acted as an enabler for electronic fraud including falsification of documents and lowering transportation costs for commodities”.

Additionally, the authors of the Policy Memo, found out that TBML often times converges with other types of crime, such as corruption, illicit trade, drug trafficking, human trafficking, terrorism financing, and other illegal activities.

Deprived revenue

The aforementioned authors are of the view that TBML and IFFs deprives the government of much-needed tax income, which in turn limits the amount of money it can spend on service deliveries like security, administration of justice, and social programs and development. This compels the government to finance its budget through both domestic and foreign borrowing. Currently, Uganda’s debt burden stands at 51.9 per cent of GDP – akin to playing with fire.

The report also disclosed that trade mis-invoicing (TM), a form of TBML in Uganda, is considered a major cause of revenue loss to the country with GFI estimating the total value gap as $6.6 billion (24trillion) in trade from Uganda between years 2006 and 2015.

Vulnerable sectors

Gold and petroleum products are listed as being particularly vulnerable to TBML, either as exports or imports. With regard to gold, the trade in gold has grown to become Uganda’s biggest export accounting for $ 1.2billion (about Shs4.3 trillion) in 2019, $1.8 billion (about Shs6.4 trillion) in 2020 and $ 1.03 billion (about Shs3.7 trillion) in 2021.

However, reported production of gold in the country is low with only 40 Kgs of gold produced between 2015 and 2020. There is also no clear data on the mines from which this gold is sourced within and outside Uganda.

Petroleum products are one of country’s top exports and imports which are particularly vulnerable to all types of mis-invoicing techniques. The risks in the oil and gas industry are mainly explained by the nature of the oil companies involved. The major international oil companies currently involved in Uganda's oil sector are registered in tax havens, and some have hidden ownership structures that pose a high risk of Illicit Financial Flows and TBML.

Susceptible commodities

The vulnerable export commodities to trade mis-invoicing, a form of trade-based money laundering, according to GFI, includes: coffee, tea, spices, fish, crustaceans; tobacco; edible oils, waxes; salt, stones, cement; iron and steel; cocoa; grains, seeds, fruit; soaps and waxes; raw hides, leather; cereals; sugar; iron and steel articles; machinery, and plastic.

Regarding imports, the GFI report identified mineral fuels, vehicles, electrical machinery, machinery, pharmaceuticals, iron and steel, as the top imports vulnerable to trade mis-invoicing. Also part of the list are; plastics, cereals, paper and paperboard, sugars, edible oils, waxes; worn clothing; iron and steel articles; salt, stone, cement; chemical products.

Countering TBML

Already key institutions including Financial Intelligence Authority (FIA), Criminal Investigations Department (CID), and Uganda Revenue Authority (URA) exist to help counter TBML.

In terms of policy and legal frameworks, Uganda developed a National Strategy for Combating Money Laundering and the Financing of Terrorism and Proliferation for FY 2020/21 – FY 2024/25 to ensure that Uganda’s AML regime is aligned with international standards.

To make trade mis-invoicing illegal, Section 65(6) of the VAT Cap 349, Section 15A (6) of the Excise Duty Act 2014 and Section 50 of the Tax Procedures Code Act (TPCA) 2014 impose penal taxes for making false and misleading statements.

Furthermore, the penalty for making false or misleading statements has been increased from Shs4 million ($ 1,060) to Shs110 million ($29,154) as a deterrent measure to improve voluntary compliance.

The Parliament of Uganda on August 30, 2022 passed key legislation to address existing gaps in the law on beneficial ownership information. It also passed the Anti-Money Laundering (Amendment) Bill, 2022 to empower the FIA and other supervisory authorities to levy administrative penalties for breach of the provisions of the Act and related matters.