Prime

New BoU demand to bind loans to national IDs illegal

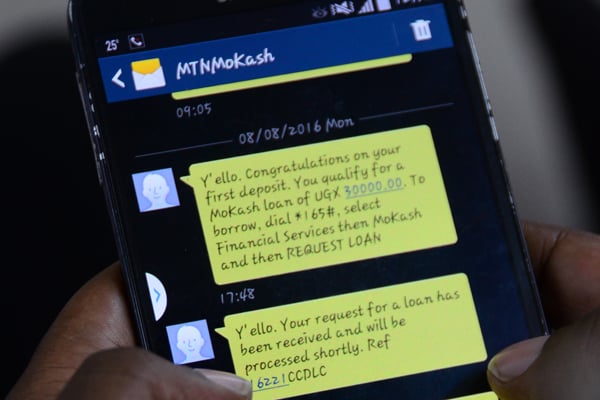

Effective January 1, 2023, all individual borrower accounts must have a NIN for Ugandans and an alien identifier number for non-Ugandans. PHOTO | EDGAR R BATTE

What you need to know:

- According to a October 26 Daily Monitor news story (All borrowers must now have national IDs, BoU directs), BoU executive director [in-charge of] supervision said “effective January 1, 2023, all individual credit borrower account records shall be supplied with a NIN or other unique identifier duly issued by the relevant registration authority in accordance with the laws of Uganda.”

For close observers and watchers of monetary and non-monetary policy statements and guidelines issued by the Bank of Uganda, a recent circular and directive issued by the Central Bank to all supervised financial institutions requiring new and existing individual borrowers to resort to the use of a National Identification Number (NIN) for Ugandans or a unique identification number for non-Ugandans, must have come as a bit of a shock on many fronts.

According to a October 26 Daily Monitor news story (All borrowers must now have national IDs, BoU directs), BoU executive director [in-charge of] supervision said “effective January 1, 2023, all individual credit borrower account records shall be supplied with a NIN or other unique identifier duly issued by the relevant registration authority in accordance with the laws of Uganda.”

Apparently, BoU in making that directive, was responding to Section 66 of the Registration of Persons’ Act 2015, which demands that a person must have a NIN or alien identification number, to among others, open a bank account, consume credit or access financial services.

At first impression, I took it to be a prank, having first read an earlier version of the news story from an online publisher with less visibility and less traction compared to what is considered mainstream media and, therefore, more credible sources of news.

Issue

Two things stood out for me: first, that BoU has taken to rule-making, absent a clear and supporting legislation of Parliament to confer rulemaking power by delegation on BoU as an agency of the Executive branch of government; secondly, but more worrying, the Central Bank is ceding part of its power as a sole banking regulator to a non-bank agency.

In issuing its guidance that may easily bring BoU to legal exposure given its core mandate to implement and enforce a specifically-tailored banking legislation relating to the regulation and control of financial institutions, BoU may not have thoroughly consulted the Financial Institutions Act (FIA), as the primary statute in guiding members of the public and deposit-taking financial institutions on the terms of its circular.

The act of accessing consumer bank credit, opening bank accounts and transacting with any bank as a customer are primarily and exclusively the function of banking as a regulated activity. To employ the language of the statute, these activities constitute the “banking business” as a defined term by statute.

Accordingly, Section 1(b) of the FIA spells out what activities are covered as principal business of banking which includes (ii) employing such deposits wholly or partly by lending or any other means for the account and at the risk of the person accepting such deposits. Bank lending is not only an inherently and traditional part of the business of banking, it is a covered activity engaged in and performed by financial institutions supervised and regulated by BoU under our nation’s existing legal framework.

Maybe BoU, by informing itself of the appropriateness and correctness of its policy statement, have considered and felt bound by the Registration of Persons’ Act of 2015 as being a later statute compared to the FIA over permissible forms of identification to be used by individual borrowers in applying for bank loans/credit extension, bank account opening and generally accessing banking services.

BoU may have valid and good intentions, chief among which relates to tracking data about borrower loan repayment history and profiling borrower credit worthiness by credit reporting bureaus and agencies that it licences.

However, it comes as a huge surprise that a provision of the statute that has been on the books and gathering dust since 2015 when it was first published, adherence with a Section 66 requirement of the Act has only become necessary and mandatory in 2022/2023, seven or eight years later.

That on its face, should be problematic for the general public and Uganda Bankers Association to ask, why now? The answer is quite simple and basic. That law does not preempt or trump FIA as it relates to banking and banking activities.

But more concerning is that while indirectly ceding its authority to a non-bank agency established by the Registration of Persons’ Act to implement that statute, consciously aware that accessing financial services from regulated bank lenders as well as opening bank accounts are covered activities within the jurisdiction of FIA and by extension BoU, the executives at BoU may never have been guided by Section 53 of the FIA which is to the effect that for purposes of banking, the Act prevails over any other legislation relating to financial institutions or, as I suspect, deliberately chose to discard the law so far as it is relevant, for other purposes.

An important takeaway for me is that the act of BoU in handing down its directive as an agency of the Executive branch, committed a constitutional violation in bypassing Parliament and usurping parliamentary authority as the Legislative branch constitutionally empowered to make law, because BoU in the exercise of its regulatory and supervisory function, has no rulemaking power delegated upon it by Parliament.

It is safe to conclude that there is a legitimate governmental interest related to compiling individual borrower data by a central repository bureau for a number of reasons related to promoting safe and sound banking practices, as is the act of extending consumer loans to a credit worthy borrower.

However, in the current environment, BoU may not act in a vacuum by encroaching upon the Legislative branch in enforcing compliance with a legal provision of a non-bank statute.

We all agree that such is a violation of the separation of powers as a constitutional principle that we all must adhere to as law-abiding persons, including BoU.

In other jurisdictions where agencies of government exercise rulemaking powers by virtue of delegated authority, the practice that precedes rulemaking is to invite the public by a notice that calls for public comments before a rule becomes final. Such a process is intended, among others, to avoid rule by tyranny as most of us have become accustomed to over the years.

It is anyone’s guess, considering the date of first publication of the non-bank statute that BoU is helping itself to in enforcing compliance in what are traditionally banking activities outside of FIA, if a pronouncement and directive of the kind as recently made by the Central Bank, albeit ultra vires, would have seen the light of day under the previous leadership of now deceased former BoU Governor, Tumusiime Mutebile. No disrespect to the current team of able and highly qualified professionals employed at BoU, some of whom are my great friends.

It is not too much to assume that as financial regulators and supervisors, Central Bank executives entrusted with a public duty to properly discharge the functions of their offices are held to a higher standard of responsibility which the October 21, circular does not exactly, nor remotely, reflect.

It is my firm hope and belief, that BoU shall in the coming days consider retracting and or withdrawing its irregular and facially invalid circular, by seeking to pursue its legitimate ends and objectives in a fashion that comports with the law as established by Parliament.

The author is an Advocate of the High Court of Uganda. Author makes an express disclaimer that nothing herein contained should be construed as rendering legal advice.