Shilling depreciated by 17.5% in 2015 - BoU

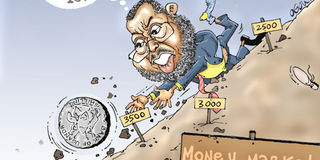

The Shilling, along with other major currencies, depreciated against a strong dollar in 2015. Cartoon by Chrisogon Atukwasize

What you need to know:

Low. The local currency is selling between 3,300 and 3,400

Kampala.

The global strengthening of the US dollar and a wide current account deficit saw the Ugandan Shilling depreciate by 17.5 per cent from January to December 30, 2015.

In 2014, the local currency depreciated by 10.8 per cent due to global strengthening of the US dollar and weak commodity exports.

Globally, the US dollar strengthened against major currencies in the world during 2015 following a rebound in US economic growth.

This is in addition to a change in the Federal Reserve Monetary Policy which saw it raising the interest for the first time on December 16, 2015 by 0.25 per cent after keeping the interest rate near zero for almost a decade since 2006.

In an interview with Daily Monitor last week the executive director research Bank of Uganda (BoU), Dr Adam Mugume, said Uganda and many other currencies in the world experienced depreciation against the US dollar.

“Similarly, regional currencies weakened against the US dollar. Uganda, Kenya and Tanzania shillings depreciated by 17.5 per cent, 11.9 per cent and 23.5 per cent, respectively, against the dollar between January and December 2015, while the South African Rand depreciated by 28.6 per cent during the same period,” he said.

Looking at other major currencies, Dr Mugume said the US dollar strengthened by 7 per cent against the Euro and 1 per cent against the Pound Sterling between January and December 30, 2015.

Causes for weakness

Explaining factors that led to weak performance of the Ugandan Shilling during the year, Dr Mugume said the depreciation reflects the widening fiscal and current account imbalances, negative sentiments originating from the elections cycle.

This is in addition to fluctuations in global sentiment and commodity prices, which have occurred alongside increased uncertainty about the outlook for China and, divergent monetary policies in the developed economies.

Like any other central bank, BoU intervenes in the foreign exchange market if there is need to bring about stability in the foreign market which can be from either the sell or buy side.

On whether the Central Bank made any loss in foreign exchange reserve in trying to stabilise the market, Dr Mugume said: “On a net basis BoU bought about $103 million in 2015. We never lost reserve in stabilising the exchange rate.”

After sharp depreciation in September last year, there was a reverse in trend beginning October 2015, Dr Mugume said: “The Ugandan Shilling strengthened against the US dollar by 8.3 per cent between September and December 2015. This is reflective of the tight monetary policy and the correction of the overshooting on the depreciation side.”

On the advantages and disadvantages of the Shilling depreciation to Uganda’s economy in 2015, Dr Mugume said so long as the trend of the shilling reflects economic fundamentals rather than noise in the market that is beneficial to the economy.

“The exchange rate is an automatic adjustment mechanism; depreciation curtails demand for imports while stimulating exports and vice versa. In the process, the economic performance should not largely be influenced by the trend of the exchange rate if indeed this is reflective of the economic fundamentals. It is only when noise and negative sentiments overplays the trend of the exchange rate as determined by economic fundamentals that it becomes distortional warranting policy intervention,” he explained.

Asked if Uganda shilling will gain strength in 2016, Dr Mugume said the strengthening of the Shilling in 2016 will depend on the recovery in exports and Foreign Direct Investment (FDI) inflows. “These will largely be influenced by the global economic factors,” he said.

Mr Uthman Mayanja, a partner with Price Water House Coopers, told Daily Monitor yesterday in an interview that much as the shilling had depreciated against US dollar in last year; lately the shilling has showed a sign of stability which is good for the economy.

“The Shilling is now trading in the range of 3,320 to 3,400 per US dollar compared the level of 3, 600 to 3,700 per US dollar in September 2015,” he said.

The numbers

23.5 per cent

The rate at which the Tanzanian shilling depreciated against the dollar in 2015.

17.5 per cent

The rate at which the Ugandan Shilling depreciated against the dollar in 2015.

11.9 per cent

The rate at which the Kenyan shilling depreciated against the dollar in 2015.