China-Africa summit: Was it really a win-win co-operation?

What you need to know:

Frightening scenario. The most frightening scenario though would be when many African countries default on debt repayment to China and how the latter would respond.

On September 1- 2, African leaders held a two-day summit in Beijing with their Chinese host President Xi Jinping, which was very well attended. Very few African ‘Big Men’ missed the opportunity to pay a visit to the new financial ‘Mecca’, which, to many African countries, has replaced Paris, London and Washington. China has become the “lender- in-chief” to Africa and Africa is now an important market for Chinese products.

China exports more than $170b worth of manufactured goods to Africa and imports only $75 from Africa, nearly all of it raw material and crude oil. The pattern of trade is no different from what Africa experienced in the past with the European colonialists - cheap raw material exports in exchange for expensive finished products. It was and still is an exploitative relationship where one party in most cases determines the price of both.

African indebtedness to China is growing exponentially as the majority of the African leaders have found it easier (though not cheaper) to borrow from China, which asks no questions about human rights, good governance, etc. Uganda’s indebtedness to China currently stands at $ 1.6b and is set to rise as Uganda seeks funding for construction of the Malaba to Kampala Standard Gauge Railway.

At the summit, President Jinping unveiled a package of new funding to Africa of $60b, detailed distribution of which remains to be clarified, but most of it is likely to go to infrastructural development with the usual pattern of Chinese companies doing the construction, using Chinese goods and labour. President Jinping talked vaguely about some of it going to the environment. The new funding of $60b is not really a lot of money for a whole continent and may signal some hesitancy or caution on the part of China.

The theme of this year’s summit was ‘China-Africa. Towards an even stronger community with a shared future through win-win co-operation’. I am intrigued by the “win-win co-operation’’ part, especially when others believe it is “Debt Colonialism”. Rex Tillerson, a former US Secretary of State, warned Africa about losing its ‘sovereignty’ to China if it continued on the path of uncontrolled borrowing.

Institutions like the World Bank and the IMF and indeed many traditional donors have also warned that commercial loans for infrastructural development are not a good idea given the slow rate of returns on investment in such projects. Concessional loans are preferable since they carry very low interest rates.

China’s exponential growth in the last three decades, unprecedented in the history of the world, has given it the ability and indeed appetite to invest abroad. Africa on the other hand has only known minimal real growth over the same period and in some areas, it has retrogressed. Being rich in natural resources, it has, however, been particularly targeted by China.

China has a huge population of 1.4 billion people in a relatively small geographical space and no natural resources of any significance, while Africa has vast underutilised chunks of land, awaiting ‘exploitation’.

A win-win situation will be when Chinese money generates both growth and development in Africa ie providing employment, improving standards of living on the continent and building a capacity for Africans to maintain and run Chinese built projects.

For African Countries to be able to repay these loans, they must also export finished products, not just raw materials, to China and other countries and transform their economies through industrialisation. The most frightening scenario though would be when many African countries default on debt repayment to China and how the latter would respond. Will China write off the bad loans or will it take over key assets like electricity dams, airports and sea ports and run them to recover its money?

It has happened in one Asian country whose port was taken over by China for 99 years in order to recover money owed by that Asian country. There are unconfirmed stories that some African countries have already used key national assets as collateral for loans from China. Debt colonialism could be a reality.

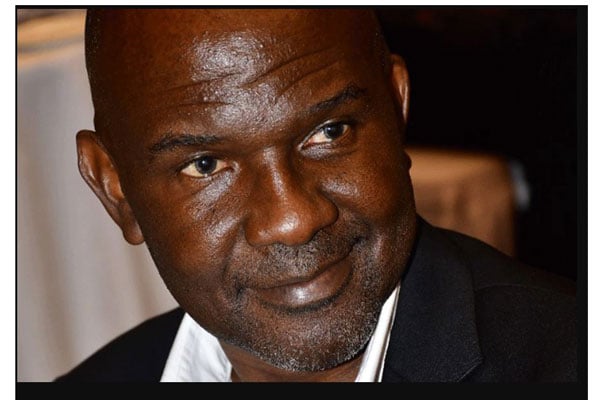

Mr Naggaga is an economist, administrator and retired ambassador. [email protected]