Shs27.2b held in dormant mobile money accounts

In June Bank of Uganda indicated there were at least 10.9 mobile money accounts that had not conducted any transaction in at least three months. Photo | File

What you need to know:

- In response to Daily Monitor’s inquiries, the Central Bank indicated that as of September 30, there were 5.25 million dormant electronic money accounts, holding a value of Shs27.2b.

At least Shs27.2b is held in dormant electronic money or mobile money accounts, according to Bank of Uganda.

In response to Daily Monitor’s inquiries, the Central Bank indicated that as of September 30, there were 5.25 million dormant electronic money accounts, holding a value of Shs27.2b.

“As [of] September 30, 2021, volume and value of dormant accounts for electronic money [mobile money] stood at 5.25 million and Shs27.2b, respectively,” the Central Bank said in an emailed response at the weekend.

However, Bank of Uganda, which in April took over regulation and supervision of mobile money companies, did not provide more details.

The National Payment Systems Act, which was enacted last year effectively separated mobile money from telecommunications services.

The Central Bank did not provide details of which mobile money company shares the largest volume of dormant electronic accounts.

In details contained in the Bank of Uganda Annual Supervision Report for the period ended December 2020, the Central Bank noted that the mobile money sector had recorded 30.7 million subscribers with a substantial number of these not conducting a single transaction in at least three months.

Only 19.8 million accounts, according to the report, which represents about 55 per cent of the total subscriber base, were active in the period under review.

It is not clear why the Central Bank has classified the 5.25 million accounts as dormant.

However, the National Payment Systems Act mandates Bank of Uganda to declare an electronic money account dormant if it goes for a stipulated period without activity.

In April, government gazetted the National Payment Systems Guidelines in which it authorised the Central Bank to declare an electronic money account that does not conduct a single transaction for nine months dormant.

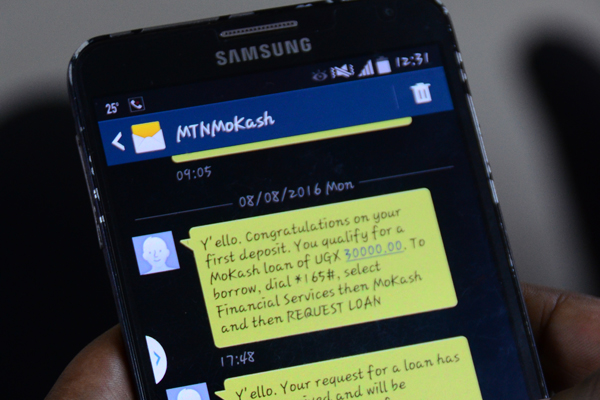

The Central Bank has since issued 11 companies with non-bank payment service providers and payment system operators and providers licences as of November 9, including MTN Mobile Money, Airtel Mobile Commerce, Mcash, Micropay, Interswitch and Pegsus Technologies.

Others are Agent Banking Company, Wave Transfer, Chipper Technologies, Yo Uganda and Future Link Technologies.

The National Payment Systems Act requires such companies to notify a subscriber, whose account has been inactive for nine months, of a pending suspension “unless there is a transaction on such an account”.

“At the expiry of the notice … the electronic money issuer [mobile money company] shall block the account [customer] and shall not permit further transactions until the account is reactivated,” the Act reads in part.

The Act, which is part of the larger plan to streamline the operations and regulation of mobile money, also seeks to fast-track attainment of a cashless economy, which the Central Bank had in 2017 said would be achieved next year.

The Act also provides that in the event that a suspended account is not reactivated within six months, the electronic money issuer will be required to close such an account, after which details of the holder, shall be transferred to the Central Bank, which will, on request within seven years after the account is transferred, refund any unclaimed balances to the account holder or to a legal representative.

Unclaimed balances

According to the National Payment Systems Act, if no claim is lodged by the owner or a legal representative to redeem the money of a closed account within seven years, the unclaimed balances is transferred to the Consolidated Fund, which then becomes a property of government. Unlike mobile money, a commercial bank account is considered inactive after six months and dormant after two years of no activity.