We can’t protect you against AI-generated fraud, says Bank of Uganda

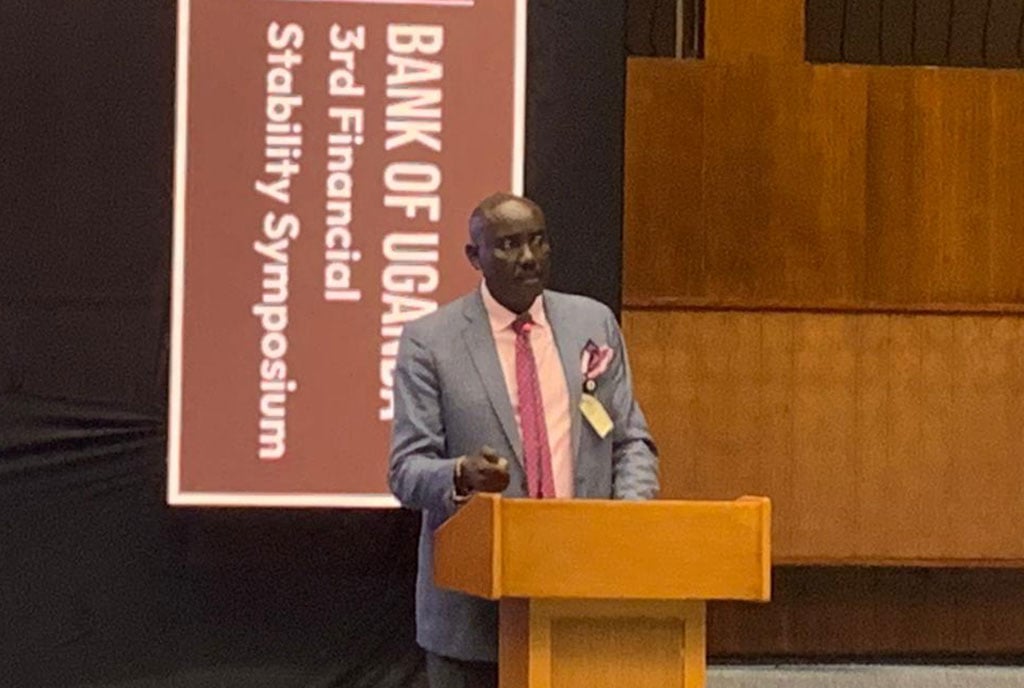

Bank of Uganda executive director for supervision Dr Tumubweinee Twinemanzi speaks during a symposium in Kampala on February 13, 2024. PHOTO/KEVIN GITHUKU

What you need to know:

- He called on mass and individual vigilance against fraud in the era of fast rising AI fraud and continued digitization.

The Bank of Uganda (BOU) has warned against Artificial-Intelligence generated fraud, with the central bank saying it can’t protect Ugandans from the crime.

The fraud which is especially in the line of financial technology spaces (Fintech) has been on the rise in the last decade with major global banking and other financial institutions hit hardest.

“We can’t protect you against Artificial Intelligence (AI) generated fraud, but we can arm you with information on how to protect yourself on the technology you use,” Bank of Uganda executive director for supervision Dr Tumubweinee Twinemanzi said.

He called on mass and individual vigilance against fraud in the era of fast rising AI and continued digitization.

“No one can protect you against technology. You protect yourself by making yourself aware of the technology you are using,” Dr Tumubweinee remarked at the third Bank of Uganda Financial Stability Symposium in Kampala on February 13.

Dr Tumubweinee, who largely blamed fraud on digitization, further emphasized that one of the major roles of the Bank of Uganda is to ensure financial stability but pledged that the central bank is actively cracking the whip on all forms of fraud by all means.

“The Role of Bank of Uganda is that we get involved because fraud erodes trust. We shall be issuing the industry with Cyber Security guidelines in terms of how they manage fraud risk and cyber threats,” he guided.

He added that: “When financial institutions submit their internal capital adequacy assessment, I will require them to look at the various risk categories as part of operations. The question then is asked, for that risk category, (fraud risk), what litigants do you have in place, and for any residual risk, what kind of capital are you holding in the event some of this fraud risk materialises,” Dr Twinemanzi said.