Prime

New Budget: A policy of deliberate ambiguity

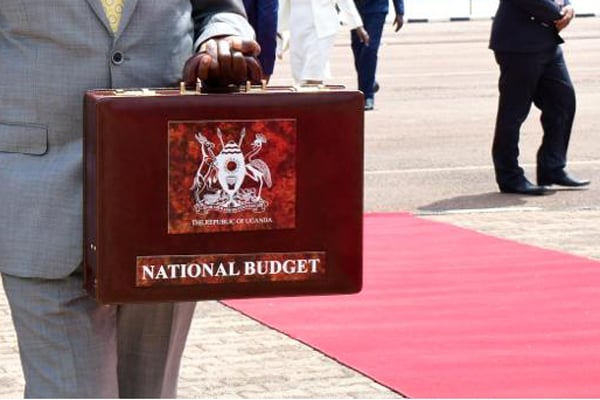

Finance Minister Matia Kasaija arrives at Kololo ceremonial grounds in Kampala for national budget reading on June 14, 2022. PHOTO/ DAVID LUBOWA

What you need to know:

- The issue: 2022/2023 Budget

- Our view: We believe a lot more should have been done to indicate a readiness to if not draw a line under the current geopolitical factors then build the economy post-pandemic.

Finance minister Matia Kasaija said yesterday that his budget will deliver a stronger economy for the Ugandan people, with the buoyancy informed by expected growth in a vast array of sectors.

Mr Kasaija confirmed that the services (3.8 percent), industry (5.4 percent), and agriculture (4.3 percent) sectors are all expected to post growth. He also pledged to open up the spending taps on big public service items like the Parish Development Model (PDM), economic recovery programmes, and enhancement of salaries of scientists to mention but three.

The budget is billed as a good litmus test of a government’s choices about its priorities, spending levels, borrowing and taxation policies. Mr Kasaija felt the need to wrap up the reading of the budget by dedicating it “to delivering the Ugandan households still in the subsistence to the money economy.”

This, he had earlier stated, will be the handiwork of the PDM, which he reckons will “usher in a mass socio-economic transformation movement in our society with better sustained outcomes.”

But with inflationary pressures affecting the Ugandan economy and public debt soaring, Ugandans can be excused for not being particularly sanguine about future prospects. Promises to address the rise of the debt stock through a plethora of ways—including reducing “domestic borrowing over the medium term to an average of 2.2 percent of [Gross Domestic Product or GDP] per year” and “implement[ing] the Public Investment Financing Strategy”—sound hollow.

The reason for this unremittingly gloomy forecast gains fresh resonance when one tries to make sense of the ubiquitousness of supplementary budgets. Fiscal discipline appears to be in scant supply, and—sadly—it will continue to be if the latest supplementary budget is anything to go by (refer to today’s cover story). This is quite unfortunate because the balancing of books is supposed to take on renewed significance since the threat of inflation cannot be wished away.

Mr Kasaija’s trumpeting of better than expected economic growth (a GDP per capita increment equivalent to Shs3.7m per person per year) also appears to have a hollowness about it. The rosy outlook certainly does not translate into much-needed money to help hard-pressed key workers put food on the table for their families.

In fact, in its reckless optimism, the budget dedicated itself to a torrent of ecstatic predictions based on poor evidence rather than alleviating hardship among those who need the most support—struggling households.

Mr Kasaija for instance waxed lyrical about the decline in commercial bank lending rates when a recent increase in the Central Bank Rate is primed to precipitate a spike. We believe a lot more should have been done to indicate a readiness to if not draw a line under the current geopolitical factors then build the economy post-pandemic.

A clear message around fiscal rules that frequently change to pave the way for borrowing would have been much appreciated for one. Instead, we ended up with the usual policy of deliberate ambiguity.