Shs1b loaned through mobile phones

What you need to know:

Reach. More than 920,000 borrowers have accessed micro-loans over a two-month period and savings are said to have reached Shs2b.

Kampala.

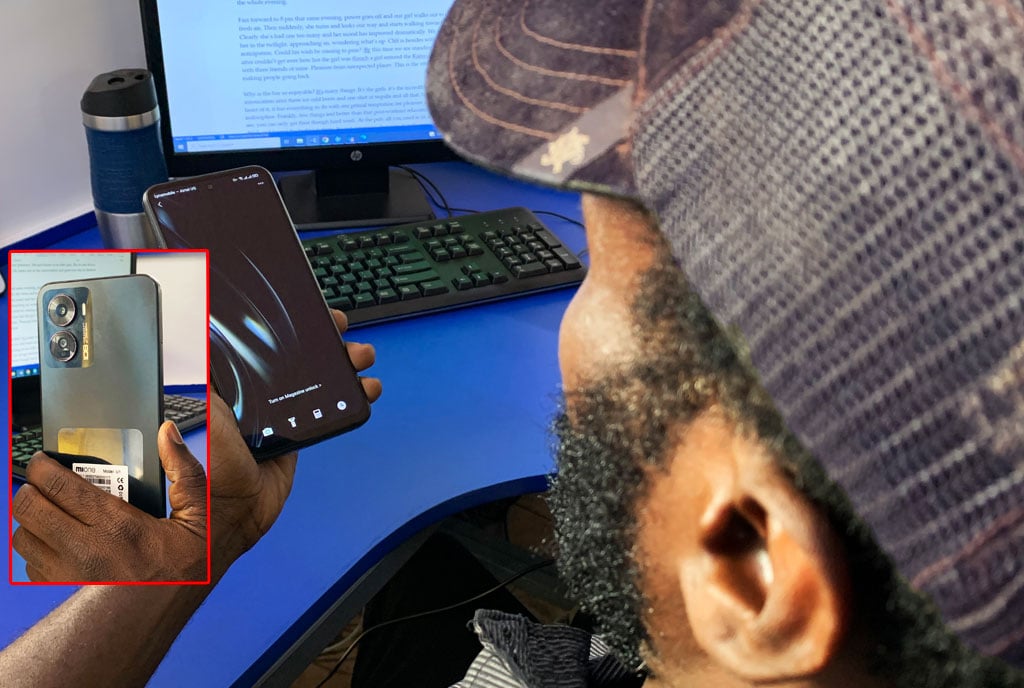

In just two months, the mobile micro-lending and saving platform, MoKash, has been adding an average of 15,000 customers per day, reaching 920,000 over the period. Launched in August and operated by MTN Uganda and the Commercial Bank of Africa (CBA), MoKash allows mobile phone owners to save and apply for micro-loans. This is the first platform operated by both a telecom company and bank that could carry out the function of a commercial bank.

“The biggest contributor is that the service is affordable, extremely simple and convenient to use with all transactions being completed in a matter of seconds.

To access the service, a customer does not go through a protracted registration and verification process or need to visit a banking hall to sign various documents,” Mr Phrase Lubega, the general manager, Mobile Financial Services, told Daily Monitor in an interview recently.

The service allows people to save money and earn annualised interest and also borrow money based on a credit rating developed by CBA and MTN Uganda.

Several people, Daily Monitor has talked to have borrowed amounts as low as Shs30,000 to take care of short-term financial needs. Interest on MoKash loans is at a monthly fixed rate of 9 per cent.

Both MTN and CBA could not reveal the exact figure of the savings they had mobilised and loans they had disbursed in the period. According to figures sent to this newspaper from CBA, the loans approved were over Shs1 billion for the two months period. Additionally, savings are also said to have reached Shs2 billion over the same period.

However, Daily Monitor understands that the savings could be hitting the Shs3 billion mark soon. According to the Bank of Uganda annual supervision report for 2015, the total commercial bank loans in the year stood at Shs10.8 trillion or Shs900b per month.

Traditional banking is known for its bureaucracy in the various processes including account opening. It can take up to a month to process a loan in a commercial bank.

Additionally, borrowing small amounts of Shs5,000 to Shs0.5m is not possible in most cases. Speaking to Business Daily recently, the CBA Group managing director Isaac Awuondo, said MoKash is currently processing an average of 2,000 loans per day; with an average loan size of Shs18,000.

“Customers so far say that the product is very convenient. They like the fact that they can earn interest on their savings and access instant loans when they need to borrow,” said Awuondo.

The service, however, hasn’t been short of glitches. In the first few weeks, it would go offline, sometimes making it hard for borrowers to access the system.

Some customers have failed to access loans despite having saved, while one customer revealed that a loan approval request reflected that money had been transferred to their mobile money accounts but upon checking, the money had not been transferred.

However, MTN reveals that such cases are isolated and being addressed.

Qualification

To qualify for a loan a customer needs to have been an MTN Mobile Money subscriber for a minimum of six months and save on MoKash, among others. Below is the share of loans per platform.

The numbers

0.5b

Money lent to borrowers via mobile phones monthly.

900b

Money lent to borrowers via traditional banking monthly.