Prime

Banks start drive to reduce overhead costs

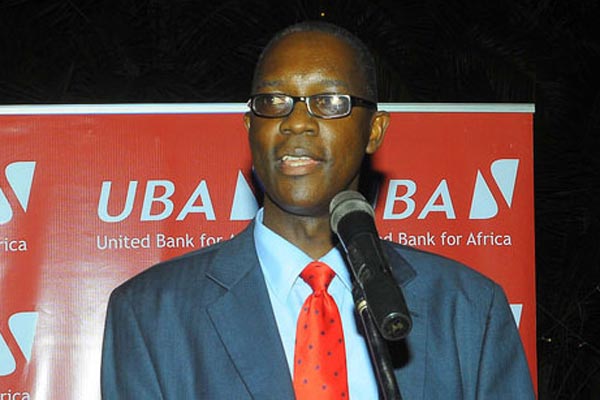

UBA executive director, Mr Wilbrod Humphrey Owor

What you need to know:

- Mr Fabian Kasi, the UBA chairman, said the approach will result in appropriate recommendations that they can adopt to overcome the challenges and ensure that there’s sustainability in the businesses we all do.

- Experts argue that the largest single contributor to interest rate spreads in Uganda is bank overhead costs, which are high because of the structural features of the economy and the banking system.

KAMPALA. Commercial banks under their umbrella organisation, Uganda Bankers Association (UBA), have started a series of consultative meetings with various stakeholders to find a lasting solution to the high cost of credit in Uganda.

During a presentation to MPs on Monday, Mr Wilbrod Humphrey Owor, the executive director UBA, said banks were undertaking collaborative projects that involve shared technology platforms to reduce the cost of delivery of services and increase their outreach.

“In order to promote financial inclusion and bring the informal sector into the financial system, the banks plan to approach agency banking via a shared inter operable platform for all banks and also between mobile network operators MNOs and capture all e-wallet transactions in the banking system through which monetary policy can be transmitted,” Mr Owor said.

Experts argue that the largest single contributor to interest rate spreads in Uganda is bank overhead costs, which are high because of the structural features of the economy and the banking system. The costs contribute to the high cost of credit.

In detail

Mr Owor said through the consultative process, the banks will find good directions towards the challenges around the financial sector and wider economy and make progress not only in addressing the issue of the cost of credit, but also tackling the real underlying causes and dynamics behind the price of money.

Ms Syda Bbumba, the chairperson of the parliamentary committee on the economy, said they need to see government assist the private sector players to reduce the cost of borrowing. “We cannot reap benefits until we are competitive in the region,” she said.

Mr Fabian Kasi, the UBA chairman, said the approach will result in appropriate recommendations that they can adopt to overcome the challenges and ensure that there’s sustainability in the businesses we all do.

The banker’s association comprises of 25 commercial banks and one development bank in Uganda. Its mandate is to promote a strong and vibrant banking sector, encourage good governance and best practices in banking as well as represent the professional and business interests of its members.