East Africa private equity funds are shifting to long-term debt

What you need to know:

Private debt allows investors to benefit from more bond-like returns although they cannot claim ownership of the companies.

Nairobi. East Africa is set to benefit from a new investment model being adopted by private equity funds, which are shifting from traditional avenues such as shareholding in private firms.

PE funds plan to issue more long-term private debt to East African firms that operate in a market whose foreign direct investment flows remained largely stagnant at $9 billion in 2018, according to the latest World Investment Report.

Private debt allows investors to benefit from more bond-like returns although they cannot claim ownership of the companies. It is argued that globally, investor interest in private debt is increasing because of the low yields available from government bonds, with the major players being pension funds and insurance companies.

Financing

The total volume of institutional assets under management allocated to private debt is estimated at $638 billion globally. In 2017, private debt funds worldwide raised some $106 billion of new capital. Of this, $67 billion was raised by funds in the US, $33 billion by those in Europe, and $6 billion by funds in Asia.

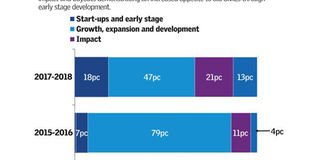

Data from the East African Private Equity and Venture Capital Association (EAVCA) show that PE funds are making inroads into the private debt market to boost their efforts in securing a presence in East Africa, a bloc with a market size of more than 170 million people.

AVCA’s executive director Eva Warigia said that although most foreign investments in the region are still largely in the form of private equity, the increased demand for financing by firms to support their growth plans is pushing them towards private debt.

“Private debt has a long-term equity structure, with a fairly reasonable interest rate, which is making it easier for companies to venture into the East African region,” she said.

In 2018, for example, Co-operative Bank of Kenya received $150 million in private debt from the International Finance Corporation, the lending arm of the World Bank, for onward lending to small and medium-sized enterprises. Early this year, regional lender Equity Bank secured a $100 million long-term loan from the IFC to strengthen the capital of its Kenyan subsidiary and lend to SMEs.

According to the African Private Equity and Venture Capital Association, Africa’s PE market will continue growing, presenting a unique asset class for the continent while allowing companies to expand, create employment and improve lives.

TAX CONTRIBUTION

Last year, Kenya was the favourite investment destination for PE funds in the region, attributed to its relative low capital gains tax that was initially set at five per cent. It has now risen to 12.5 per cent in the 2019/20 budget.