Government proposes Shs100 daily tax on social media users

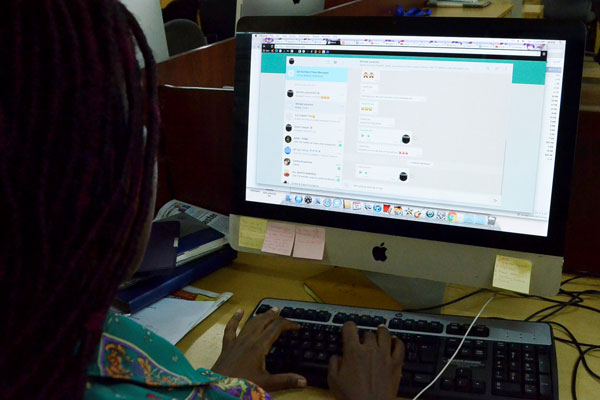

State Minister for Planning, David Bahati said the Shs100 will be charged daily on each SIM card that uses internet for social media. FILE PHOTO

What you need to know:

- The government has also introduced Shs100 tax on each litre of fuel for road maintenance, and income tax on 30 per cent of every Savings and Credit Cooperative Organization (Sacco’s) net profit.

- Mr Moses Ogwalpus, the acting commissioner tax policy at Ministry of Finance said each and every Sacco will pay 30 per cent of the net profit like any other company doing business.

The government has proposed a daily taxation of Shs100 on all social media users.

While addressing journalists at Uganda Media Centre today, the State Minister for Planning, David Bahati said the Shs100 will be charged daily on each SIM card that uses internet for social media.

President Museveni recently revealed he was planning to introduce taxes on social media platforms such as WhatsApp, Facebook, Twitter, Skype and Viber claiming that people use these platforms mainly for lugambo (gossip).

He however received backlash from social media users, including human rights defenders and opposition leaders, claiming the new tax proposals are “diversionary, deceptive, injurious to individual freedoms and burdensome”.

READ:

According to Mr Bahati, these tax measures are aimed at growing domestic budget financing.

The government has also introduced a 1 per cent tax to be charged on each and every mobile money transaction made, that is, withdrawals and deposits.

Mr Bahati said the economy grew at 6 per cent this financial year as opposed to 5.5 per cent as earlier projected.

He attributed this to significant growth in agriculture, services and industry sectors.

The government has also introduced Shs100 tax on each litre of fuel for road maintenance, and income tax on 30 per cent of every Savings and Credit Cooperative Organization (Sacco’s) net profit.

ALSO READ:

Mr Moses Ogwalpus, the acting commissioner tax policy at Ministry of Finance said each and every Sacco will pay 30 per cent of the net profit like any other company doing business.

“If Saccos charge interest or members or people they lend to, and out of that they make profit, then they pay 30 per cent income tax on the net profit," Mr Ogwalpus said.

Minister Bahati said the tax proposals will begin effectively July 1 once debated and approved by Parliament.