Prime

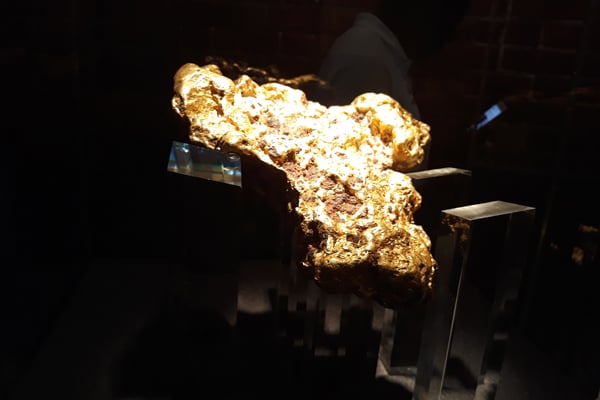

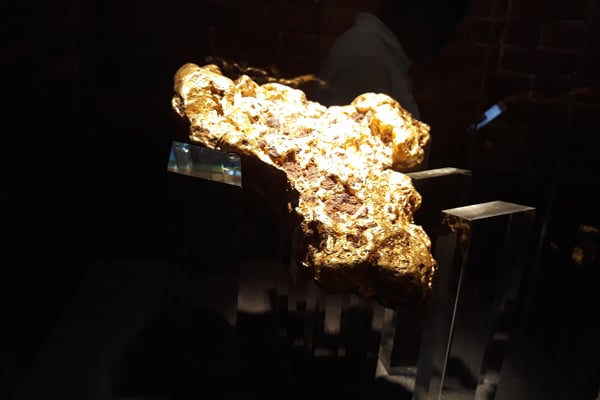

Uganda’s gold vulnerable to laundering, says report

Whereas there is little information on the source of Uganda's gold, it has since 2018 been the country's largest export. Photo / File

What you need to know:

- Gold is one of Uganda's leading imports, yet at the same time it is the country’s largest export commodity

A policy memo has indicated that Uganda’s gold is vulnerable to trade-based money laundering.

The memo, titled: Trade-Based Money Laundering: A Global Challenge, authored by Global Financial Integrity, Fedesarrollo, Transparency International Kenya and Acode, notes that because Uganda’s gold is cash-intensive with limited oversight and hard to trace origins, it is easy to smuggle.

“This makes it easy, for example, to co-mingle smuggled gold with legally mined gold,” the memo reads in part.

The policy memo, which is a paper written to provide an analysis or recommendation of an issue to a specific audience, in this case tax authority and country’s policy makers, indicates that gold remains one of the most vulnerable value commodity to Trade-Based Money Laundering schemes.

Gold, which is one of the leading imports, according to the Uganda Revenue Authority (URA) half year performance report for 2022/23, has also been the country’s leading export since 2018.

It has overtaken traditional exports such as coffee.

As of 2020, Uganda’s annual gold exports amounted to $3.47b (Shs13.8 trillion) in value, accounting for 59 percent of country’s export earnings.

Importantly, domestic production of gold has not grown comparably while at the same time, the country imported gold worth $1.97b (Shs7.2 trillion) in 2020.

There is no clear data on the mines from which gold is sourced within or outside Uganda, and Bank of Uganda estimates that only about 10 percent of gold exports are mined domestically.

Mr Onesmus Mugyenyi, the Acode deputy executive director, said the analysis comes at a time when URA is struggling to close tax leakages and loss of revenue through illicit financial flows and Trade Based Money Laundering.

The report analyses the methods being used by companies and individuals to move illicitly earned money and avoid paying required taxes.

“URA should pick interest and address the gaps identified and methods used in moving illicitly earned money. The report is helpful to Uganda as a country because it provides information and recommendations that can address loss of revenue that the country would earn to address its development needs,” Mr Mugyenyi said.