Bankers choose fourth industrialization to provide good financial services

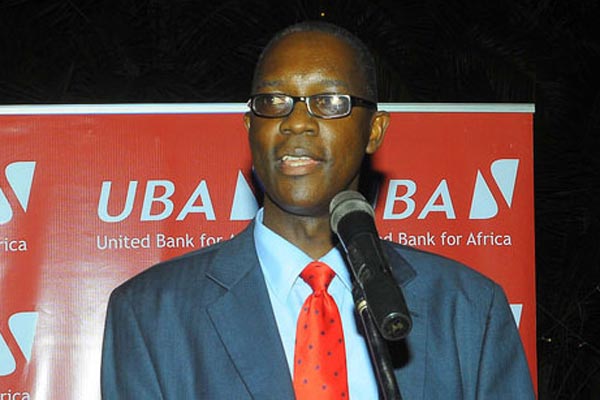

UBA executive director, Mr Wilbrod Humphrey Owor

Bankers under their umbrella body, the Uganda Bankers Association (UBA) have chosen the fourth industrial revolution as the main topic of discussion during their forth coming annual conference because the fourth industrial revolution has already unfurled its wings over all industries to impact them positively.

The term “Industry 4.0” (Fourth Industrialization) refers to the concept that technology has permeated all areas of society: production, finance, services, transportation, and communications. Such developments are driven by digital integration (with devices and processes capable of transmitting and processing huge masses of data) and automation (the availability of machines capable of carrying out tasks of medium–high complexity.

The financial services sector is also one of the sectors that have leveraged the power of the fourth industrialization.

Speaking at virtual news conference ahead of the 4th Annual Bankers Conference be held July 26 and 27th 2021, Mr Mathias Katamba, UBA Chairman, who is also the managing director of Dfcu bank said: “This year’s event will be delivered virtually and aim to facilitate a focused discussion among key players and Industry stakeholders regarding the 4th Industrial revolution.”

The theme for the annual banker’s conference is, Bend but don’t break: How the financial sector can thrive in the era of the 4th Industrial revolution.

Mr Katamba said the bankers, policy makers, regulators and other players in the banking industry will highlight among others emerging trends /developments and future outlook in the payments space.

Mr Katamba said this year’s event will be delivered virtually and aim to facilitate a focused discussion among key players and Industry stakeholders regarding the 4th Industrial revolution and highlight among others emerging trends /developments and future outlook in the payments space.

“Confronting fraud and cyber security risks, redefining financial inclusion and deepening access to financial services, and harnessing opportunities from the unprecedented processing power and storage capacity in 4IR” (4th Industrial Revolution),” he said.

Mr Wilbrod Owor, the UBA Executive Director said this year’s Annual banker’s conference aims at analyzing the key issues affecting the banking sector and offer recommendations to shape how the sector runs and the interventions required.

“Government has provided a number of policy frameworks that enable embracing technology. The financial sector has embarked on partnerships with Fintechs, telecoms to serve their customers better through digital/technology led platforms. We have continued to dialogue with the government to change policies and taxes that hinder the adoption of digital changes,” he said.

The digitization of finance has been spurred by the innovations encompassed in the term fintech. Put simply, fintech is the collection of technologies whose applications may affect financial services. This includes artificial intelligence, big data, biometrics and distributed ledger technologies such as blockchains.

Owor explained that the banking sector has witnessed new innovations and technologies such as online banking, mobile banking, and contactless ATM cards among others, which have been embraced by the public; adding that the Covid-19 crisis more than ever has brought to the fore the necessity and possibilities of the digital economy.

[email protected]