Prime

BoU warns against high cost on digital payments

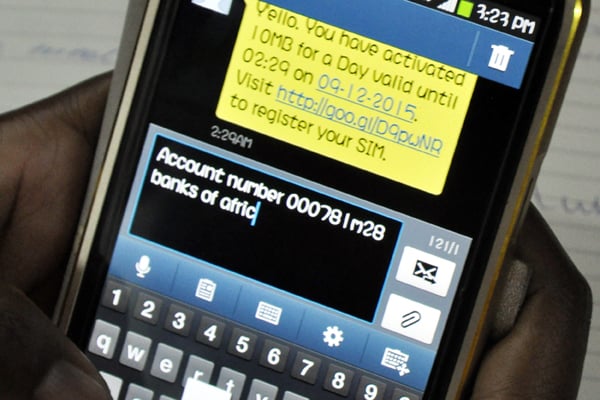

High charges on bills and utilities payments are regressive, according to Bank of Uganda. Photo / File

What you need to know:

- Bank of Uganda says high transactional costs on mobile money and utilities payment are a threat to efforts that seeks to deepen financial inclusion

Bank of Uganda has said the high transaction cost on digital payment remains one of the several barriers to financial inclusion.

Speaking during at a symposium about the Central Bank’s role in financial sector development and promoting financial inclusion in Kampala yesterday, Dr Michael Atingi-Ego, the Bank of Uganda deputy governor, said whereas financial inclusion has progressed significantly, several barriers remain, key among which include high transaction costs.

For instance, he said, on-net transactions for mobile money cost between Shs30 and Shs1,250 for values between Shs330 and Shs20,000, while payment for utilities costs between Shs160 and Shs6,300.

Such charges, Dr Atingi-Ego said, are regressive, with the vulnerable poor, who constitute the majority of users, bearing their heaviest burden.

“Statistics indicate that approximately 90 percent of mobile money transactions are in the low-value category of Shs0 - Shs50,000. We still have a lot of work to bring affordable services closer to the people,” he said.

However, in a speech read for him, Mr Ramanthan Ggoobi, the secretary to Treasury, said government was implementing a number of programmes that will be vital in realigning the tax system to meet the needs of a vibrant financial sector as well as help to build a thriving economy, adding that there has been significant progress in financial sector development, even as significant challenges still exit.

For instance, he said, although the percentage of adults that were formally included rose from 28 percent in 2009 to 58 percent in 2018, the figure is still low, adding that Uganda also continues to lag behind regional peers in mobilising long-term savings.

“For example, in 2019 bank deposits in Uganda were 16.3 percent of gross domestic product, compared to 36.6 percent in Kenya while insurance penetration stood at 0.72 percent in Uganda compared to 3 percent in Kenya,” Mr Ggoobi said, stressing that the first intervention is to increase access to and use of financial system with government targeting to have 80 percent of Ugandans financially included.

Therefore, he said, there was need to boost product innovation, expanding delivery channels, improving financial education and continuing to strengthen the development and supervision of tier four institutions and money lenders.

Agent Banking

Dr Atingi-Ego agent banking has also eased formal financial inclusion with transaction volume rising by 50 percent from 5.6 million in the 12 months ending June 2021 to 8.6 million in June 2022. Similarly, he says, transaction values have significantly increased, rising by 27.6 percent from Shs7.6 trillion in June 2021 to Shs9.7 trillion.

High interest rates starving vital sectors of funds

Meanwhie, Dr Atingi-Ego has said the persistently high lending interest rates crowd out sectors whose rate of return may be lower, yet they are critical for economic growth and employment.

Such sectors, he said, include agriculture, adding that high interest rates also have a negative impact on the cost of doing business.

Speaking during a symposium about the Central Bank’s role in financial sector development and promoting financial inclusion in Kampala yesterday, Dr Atingi-Ego said from a financial inclusion perspective, expensive loans impede individual resilience to adverse shocks, noting that recent findings from the Financial Capability Survey in 2020 revealed that 16 percent of Ugandans could not sustain their lifestyle using savings for more than a week in the event of loss of income.

Therefore, he said affordable credit would enable consumers to smoothen their expenditures during good and hard times while helping entrepreneurs to build and expand their businesses.

Lending rates have declined gradually from an average of 38 percent in 1992 to an average of 18.5 percent in 2021.

However, despite the decline, Uganda’s lending rates are still high compared to EAC partner states.

For instance, in Kenya, Tanzania, and Rwanda, lending rates stood at an average of 12 percent, 16.6 percent, and 16.2 percent, respectively, in 2021.

Dr Atingi-Ego further noted that stubborn structural challenges such as the high cost of capital, costly operations, and information asymmetry, among others, persist and need tackling, if interest rates are to be brought within manageable limits.