Prime

Mobile money loans reach monthly lending of Shs31b

Mobile money loans have created an alternative window for quick credit access among private sector players. Photo / File

What you need to know:

- In August loans dispensed through mobile money stood at Shs31.44b, according to Ministry of Finance

Mobile Money subscribers borrowed Shs31.44b in August, according to data from Ministry of Finance.

The money is accessed through short-term micro loans, which carry a monthly interest of between 8 percent and 12 percent and a recovery of at least 30 days without the option of rolling over.

It is the first time the Ministry of Finance is capturing mobile money loans under private sector credit, which signals the increasing importance of digital micro loans to the credit eco-system.

Efforts to get previous contributions of mobile money loans to private sector credit were futile by press time.

However, the Performance of the Economy report for September noted that mobile money credit has created an alternative for micro borrowers, many of whom are non-collateralised.

“This reflects the benefits of digitising the economy and underscores the potential for growth in this area,” the report reads in part, noting that majority of loan applications were approved.

During August, the report indicates, mobile money loans stood at Shs31.44b, with an approval rate of above 95 percent, which was a 2.9 percent contribution on the total amount of loans extended to the private sector.

The report further indicates that the value of private sector credit stood at Shs1.08 trillion in August, but was 2.7 percent lower than Shs1.12 trillion in July. The Shs1.08 trillion was disbursed against Shs1.6 trillion worth of applications, resulting in an approval rate of 65.7 percent, which was better than the 61 percent registered in July.

During the period, loans approved for personal and household use, under which mobile money falls, increased from Shs298.83b in July to Shs345.86b, while disbursements to agriculture rose from Shs133.9b to Shs160.5b.

The contribution of mobile money loans remains low, but government indicates it has potential to grow due to increased digitisation of the economy.

Loans through mobile money have been growing in the last five years, creating an alternative window through which micro borrowers access credit, even as the Ministry of Finance report does not show how many Ugandans on average borrow through the platform.

Mobile money loans have also become a revenue stream for electronic money operators with telecoms being the biggest beneficiaries.

For instance, in the last two years loans approved through MTN mobile money grew to an average of Shs355.5b, amid Covid-19 related disruptions and economic volatilities, which slowed growth of private sector credit .

During the year ended December 2022, MTN mobile money credit increased by Shs91b, growing to Shs401b from Shs310b in 2021 with the number of applications growing to 15.3 million.

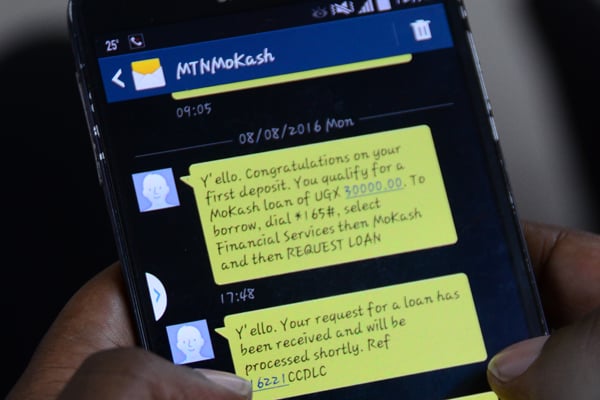

Telecoms continue to roll out credit facilities, among which include MTN’s MoKash and MoSente, operated through NCBA and Jumo, respectively, while Airtel operates Wewole, which is also operated by Jumo, among others.

MTN recently indicated that whereas credit applications had slowed in 2021 due to poor repayment, they have since 2022 recovered and are projected to grow further.