Prime

URA expresses concern about gambling activities

Uganda Revenue Authority (URA) is playing catch-up as betting companies walk with smiles to banks. PHOTO/file

What you need to know:

- Internet gambling begins with the bettor opening a betting account with the operator of choice, where they deposit funds using either mobile money or other options, writes Deogratius Wamala.

The exponential growth of Uganda’s gambling industry has left the taxman playing catch-up, an in-house study by Uganda Revenue Authority (URA) has disclosed.

The growth of the gambling industry is fueled by the fact that today’s customers find these practices appealing because they are accustomed to using phones and other wireless devices for entertainment and recreational purposes. This is on top of the ease and accessibility of online gambling, which offers better value for money, bonuses and pay-outs rates, speed, a wider selection of betting products, and the comfort of being able to wager from home.

But “while Internet gambling is becoming a normalised activity in Uganda, (its) expansion … is out-pacing the tax body’s understanding of the phenomenon, as well as out-pacing the existing tax laws meant to enable (URA) collect revenue for sustainable national development,” URA’s tax investigations department worries.

“Consequently, we (at URA) find ourselves in a situation where we have insufficient knowledge on Internet gambling, the software and licenses used by the gaming houses in running the business, limited technology for real-time monitoring of the number of transactions and money involved, inappropriate regulation and legislation ultimately leading to the loss of the much-needed revenue for national development,” it adds.

Concerns

New data from Uganda’s tax authorities shows that withholding tax from gaming and betting—which was eliminated last July—is increasing. In fact, in the seven months preceding January 2024, it rose by more than 100 percent, or from Shs15b to Shs29.5b. This is a weekly levy that the licensed betting house was obliged to pay from the winnings, before making any pay-outs. This is regarded as a final tax to the winners. But in the same period, the gaming tax—a 30 percent levy on operator income—saw a Shs5b shortfall to Shs46.4b.

“This tells you that people are increasingly betting, but betting companies are not paying gaming tax either because they are not profitable or just not being compliant,” Mr Nicholas Musoke, an economist and Supervisor Research and Revenue Modelling at URA, told Business Outlook.

Ms Jane Pacutho, the deputy chairperson of the House Finance Committee, during the presentation of a report on the Lotteries and Gaming (Amendment) Bill, 2023, stated last May that punter sessions for games such as roulette, poker, and slots have multiple start and stop points that make it difficult to enforce the tax point for winnings.

The national treasury had observed that casinos were using end-of-day reconciliations in order to account for withholding tax. This method is, however, only used on days when the casinos have experienced a loss, which is extremely unlikely for a casino to occur because betting and gaming companies consistently turn a profit.

“To plug this revenue leakage, the measure proposes to remove the 15 percent withholding tax on payments for winnings of gaming and instead increase the gaming tax to a rate of 30 percent across the gaming sector,” Ms Pacutho said.

Shifting sands

There are many different forms of online gambling, with new sites and types of gambling emerging every year—from virtually mediated casino games, slot machines, bingo, lotteries, sports betting, horse race betting, and skill games. Additionally, there is an increasing number of auxiliary or ancillary websites, such as portals for gambling websites, information pages with odds and payout information, and pages dedicated to sports handicappers.

This is a result of both technological advancements and a change in global business trends brought about by the Covid-19 pandemic. As a result, most land-based licensed operators have shifted to online gambling in order to cut costs and stay in business. Consequently, more gaming and gambling businesses from overseas nations with intricate technological, legal, and operational frameworks have joined the country.

Reanalysis

In response, the taxman decided to analyse tax returns for 89 entities registered for taxes under the subsector of gambling and betting activities and its legacy systems for the fiscal years 2018/19 through 2021/2022. Here, it was discovered that the total withholding tax (WHT) on winnings declared for the period had decreased to six percent. Gaming companies attributed this to the early Covid-19 pandemic shocks.

WHT eventually increased by eight percent in the 2020/2021 fiscal year and by an exponential 89 percent in the 2021/2022 fiscal year as more businesses began their operations online.

Conversely, gaming tax saw decimal growth in the 2019/2020 and 2020/2021 fiscal years, posting negative growth of -28 and -30 percent, respectively, when compared to WHT. URA records show that in the 2021/2022 financial year, the tax body however saw a monstrous 296 percent improvement in performance from Shs13.3b to Shs52.6b. But the total gross revenue declared by the registered entities for income tax purposes posted a sharp negative performance of -32 percent and -50 percent in the 2019/2020 and 2020/2021 financial years, respectively.

“To leverage from this trajectory of growth [in gaming and gambling], URA MUST resolve to invest in systems and equip staff with skills and knowledge to match the player’s levels of aggression all aimed at mitigating tax evasion and illicit financial flows,” the taxman emphasises in a report.

Money laundering

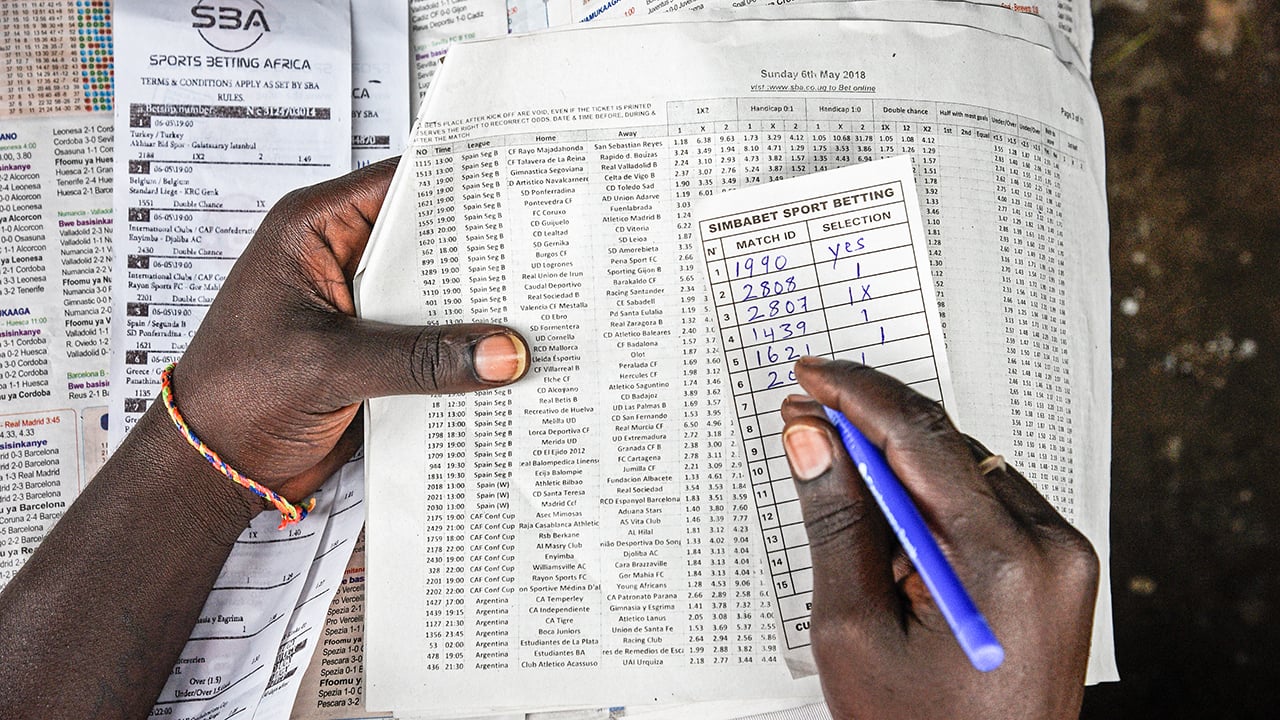

Internet gambling begins with the bettor opening a betting account with the operator of choice, where they deposit funds using either mobile money or a bank transfer (Visa). They then select their preferred games to wager on. The operator’s deposit holding account, which is kept up to date with the mobile network operators (MNOs) like, receives the amount wagered on the designated games until the games are settled.

After the placed odds are settled and the applicable payouts are paid, the remaining funds are moved from the holding account to the MNO’s escrow account at a financial institution. The operator can then request and receive a transfer of this money to their bank account. Data shows that the most used mobile payment platforms in Uganda are MTN Mobile Money and Airtel Money. “Well-financed and technologically savvy criminals can move large amounts of funds easily and quickly from one country to another using electronic means. Internet gambling is an ideal web-based ‘service’ to provide a cover for a money laundering scheme,” URA worries.

Adding: “There is evidence in some Financial Action Task Force [the global money laundering and terrorist financing watchdog] jurisdictions that criminals are using Internet gambling to launder criminal proceeds (including proceeds of tax evasion). This is because [gambling] enable[s] criminals to transfer funds instantaneously and enables poorly regulated offshore centres to increase their customer base.”

The taxman also discloses thus: “Despite attempts to deal with the potential problems of Internet gambling through regulation, requiring operating licenses, or banning such services outright, a number of concerns remain. For example, transactions are primarily performed through mobile money transactions, credit cards, and the offshore location of some Internet gambling sites makes locating and prosecuting relevant parties difficult, if not impossible.”

Following this, financial institutions take over and keep up MNO escrow accounts, which are used for liquidations. Additionally, banks keep gaming house bank accounts through which they receive payments from MNOs and transfer them to the operator’s account in the bank upon request or as per the agreement.

URA now advises auditors and tax collectors that escrow accounts offer information related to net earnings (stakes less pay-outs) transferred to the operator’s bank account that is essential in calculating the operator’s gross profit (revenue less direct expenses).

“This information can be used by the investigators/auditors to verify the accuracy of the operator’s revenue declaration in the income tax returns and weekly gaming tax returns and determining the correct income tax and gaming tax payable by the operator,” URA says.