Building tech startups: Lessons from successful techprenuers

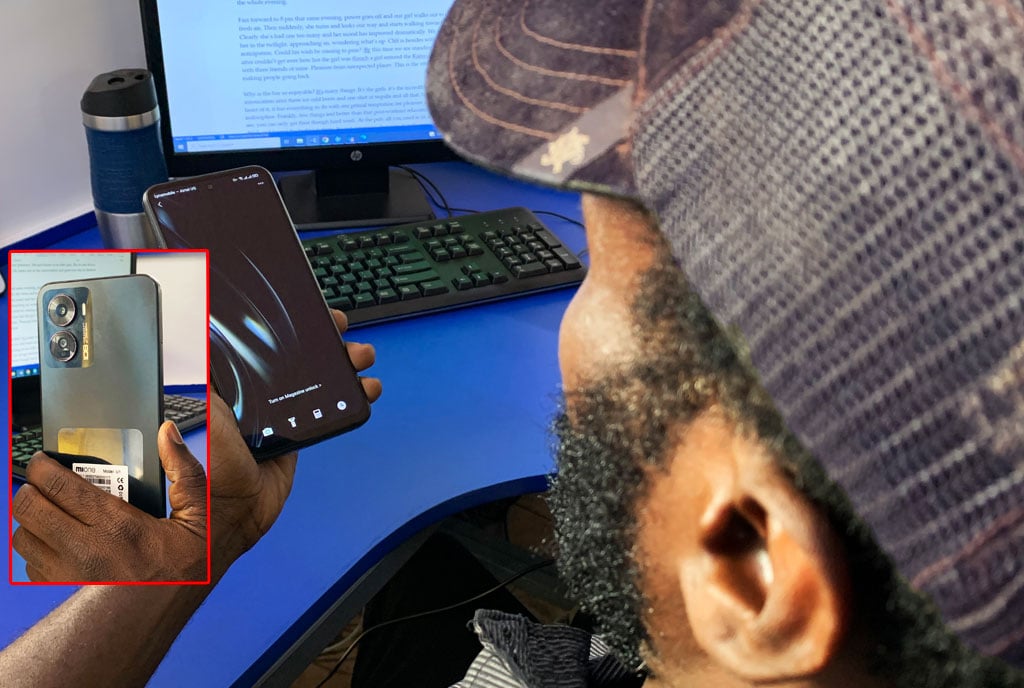

Tech developers at Design Hub. Kenya remains a hot bed for foreign angel investors following its vibrant start up ecosystem. PHOTO/RACHEL MABALA

What you need to know:

Creating a ‘side hustle’ could go a long way to fund your startup without necessarily relying on your normal income. This is simply because a startup is a growing business that needs the liquidity to move on to the next stage of development.

Uganda’s startup ecosystem has grown exponentially over the years with some young entrepreneurs investing in technology. One can agree, technology is slowly replacing the brick and mortar way of doing business.

However, some Ugandan tech startups don’t take long enough to celebrate their first or second birthday because of hindering challenges such as lack of access to information, capital, or a stringent legal environment which suffocates their operations.

So, what does it take to build a successful tech company that can offer solutions to the society’s problems?

Growing successful tech startups was key on the agenda during the recent Next Legal Virtual Global Summit that brought together tech startup founders from across the globe, among them East Africans. The summit was organised by Bytelex Advocates, a law firm in Uganda specialising in offering tech solutions in the legal sector.

Therefore, cast a glance at some of the key points that lead to building a successful startup tech company from East African techprenuers.

Start with bootstrapping

Bootstrapping, a common term used in business is a process of using only existing resources such as personal savings, personal computing equipment, and garage space, to start and grow a company.

This term has been largely associated with world tech gurus such as Microsoft founder Bill Gates who started his tech company under the roof of a garage.

Abraham Mbuchia, one of the panelists and the chief executive officer of UZAPOINT, an e- commerce platform in Kenya, recalls his fundraising process which involved bootstrapping.

He says: “I started my startup journey at university where I offered general IT services. At that time, we were using money from other projects to fund our startups.”

He further says, “At the start, I was not good in IT but I approached my fellow student in class, and told him since he knew tech and I knew business, we would team up to start a tech company because then, I didn’t have funding for the programming. We were able to put our skills together and start our tech company.”

Expose yourself to angel investors

Mbuchia then started his tech journey with a classmate by putting skills together. Their next move was to build a strategy to get funding from angel investors.

An angel investor also known as a private, seed or angel funder is a high net worth individual who provides financial backing for small startups or entrepreneurs, typically in exchange for ownership equity in the company. Often, angel investors are found among an entrepreneur’s family and friends.

Kenya remains a hot bed for foreign angel investors following its vibrant start up ecosystem. But to attract angel investors, Mbuchia says one needs to build their value, understand their competitors and gain traction. This also entails building a market to prove your worth to the investor.

“At the foundation stage,” he says, “We made several pitches for grants, and later on went into a competition by Total and got a grant. This exposed us to a couple of angel investors currently in the country,” he says.

To prove your concept so that when you go to an angel investor, Mbuchia notes make sure your company’s valuation is high so as to have some negotiating power.

“Learn more and expose yourself to accelerator programmes and putting your account books in order will go a long way to give you credit.”

Don’t break your bank account

Creating a ‘side hustle’ could go a long way to fund your startup without necessarily relying on your normal income. This is simply because a startup is a growing business that needs the liquidity to move on to the next stage of development.

Favour Chananel Ruhiu, another Kenyan techprenuer and founder of SOOFA PAY, a e-payment platform, recalls that until he got an angel investor, he does not remember touching his salary to invest in his startup, rather, he relied on ‘side hustles’.

“I had that knowledge that if I started to depend on this startup at an early stage, then I would fail.”

For Valentino Shimanyi owning SISITECH Limited, a software company in Kenya, he says to enjoy steady growth, don’t have a target on your bank account.

“Never fail to create a side hustle that gives you a stream of money to service the start up until it reaches profitable levels,” he says, adding: “Always find a number of people who you can work together to keep the dream going.”

Managing partnerships

Shareholding in a startup can be tricky business. Whereas one shareholder may want a company to grow by ploughing back profits, others may want to quickly reap from the investment.

Dickson Mushabe, a Ugandan techprenuer and the chief executive officer of Hostalite, a web design tech company, says be strategic when sourcing for partners, and be specific on a partner’s role as well as setting targets.

“Look out for partners who share the same vision with you, not some who want to join and earn the following day. Take your time when recruiting, by identifying someone who can go the extra mile,” Mushabe explains.

“Let a partner come on board knowing what they are coming to do. If you bring a partner into a start up to do marketing, let them know the number of clients they will bring in, and in how long and what is their share after a certain period?” Mushabe says.

Respect value of shares

One of the cultures especially in Uganda and other African countries is lack of respect for shares as units of value in startups. This has for long bred conflict among partners, according to Raymond Asiimwe, the managing partner at Bytelex Advocates.

But Mushabe says to solve such a challenge in a startup, partners must write down records for every transaction or any agreements such as a shareholder’s agreement that takes place to avoid conflict. Also, have partnership and exit clauses for someone to leave in peace.

“Partners who invest money in startups tend to think other people who have brought in their sweat in running the operations, don’t deserve the shares.”

According to Mushabe, this is not true because, “You may have the money but you can’t do everything alone.”

He advises that the best thing is to quantify a partner’s sweat, but also make sure you write it down in terms of shares one owns.

Managing founder’s syndrome

Startups are meant to have power struggles, but as a startup leader, Mushabe says be humble, honest and have candid talks and set targets.

“As a manager, take a step back and evaluate yourself and listen to what other partners say and listen to their ideas,” Mushabe says.

Mushabe refers to Jeff Bezos, the founder of e-commerce giant, Amazon, who confirmed that some of the best ideas come from his employees because he lets staff innovate and come up with ideas.

Bottom line

Shimani sums up by saying, the most important thing is to remain focused on your idea and find a way of charting it out.

Make sure to have an idea or plan of how long it will take to work on this project to raise a specific amount of money.

Assess your side hustle and the startup idea and create a team you will work with.