Trucks loaded with goods at Malaba border. The jump in Uganda’s share in Kenya’s export earnings to 11 percent was largely due to the increased sale of agricultural produce and fuel products to the landlocked country. PHOTO / MICHAEL KAKUMIRIZI

Prosper

Prime

EAC: Uganda no longer the ‘small boy’

What you need to know:

Uganda has been the biggest victim of EAC regional-imposed non tariff barriers. These have been slapped on Uganda’s exports over time, with Kenya being the major culprit.

Despite struggling with the high cost of doing business which President Museveni in his end of 2023 address says is a challenge that his government is trying to address, the country’s manufacturing and export sector somewhat managed to stamp its foot prints beyond the national borders.

In his speech, President Museveni referenced high energy costs and exorbitant cost of financing as some of the reasons driving the cost of doing business in the country.

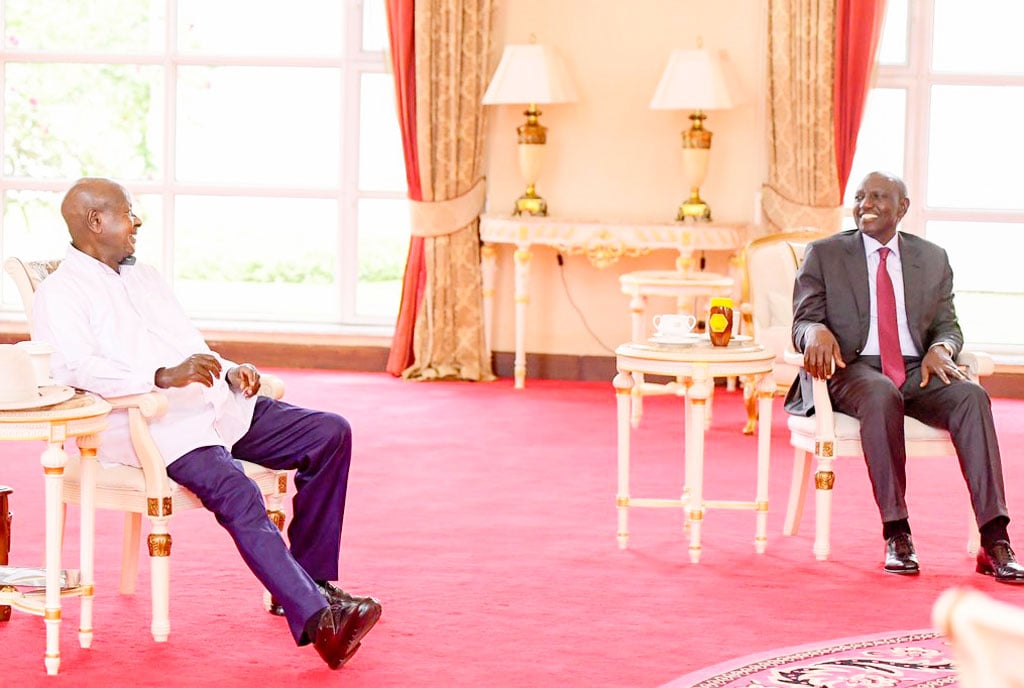

President Museveni said regional integration is an important route for Uganda’s prosperity. PHOTO/FILE

Prosper Magazine has also established that non-existence of Ugandan financial institution across the region, logistical challenges including poor storage infrastructures, uncoordinated transportation system – particularly the missing link between roads, railways, water ways and air system among other factors further worsens the already difficulty situation.

The country’s manufacturing and export sector is dominated by cottage industries, agro-processing, food and beverages, households’ products, construction materials and fast-moving consumer goods.

According to Uganda National Bureau of Statistics and Uganda Investment Authority (UIA) data, the EAC demand for Uganda’s manufactured export goods is growing annually at 16 percent.

However, access to the region’s estimated 285 million citizens, of which over 30 per cent is urban population, in many ways continues to be a nightmare to Ugandan exporters.

Amidst the difficulties, some of which are arbitrarily introduced to suffocate Ugandan exporters, the Trade Ministry and Finance Ministry data indicates that East African Community (EAC) remained the top destination for Uganda’s exports in 2023, accounting for 43.5 per cent of total exports followed by the Middle East at slightly more than 18 per cent and Asia with 17.6 per cent.

Under Article 5(2)(a) of the EAC Common Market Protocol, partner states commit to eliminate Non-Tariff Barriers (NTBs) and technical barriers to trade to the importation into their respective territories of goods originating in the other Partner States and, thereafter, not to impose any new NTBs.

In his analysis of regional NTBs, Mr Africa Kiiza, a trade economist with experience in trade policy, trade development and treaty negotiations, describes NTBs as restrictive regulations and procedures, other than tariffs, that add to the difficulty and cost of importing or exporting products.

Mr Kiiza, who is a researcher and currently a PhD fellow, Faculty of Business, Economics and Social Sciences; Universität Hamburg, notes that NTBs can be categorised to include import licensing, pre-shipment inspections, rules of origin, custom delays, and other mechanisms that prevent or restrict trade.

According to the expert analysis, without eliminating NTBs, boosting intra-EAC trade, including with Africa as continent, trade as envisioned in the EAC treaty will be untenable.

The United Nations Conference on Trade and Development (UNCTAD), an intergovernmental organisation that promotes the interests of developing countries in world estimates that NTBs are at least three times more restrictive than regular customs duties, and if tackled at the continental level, African countries could gain $20 billion in Gross Domestic Product (GDP) growth.

Cost of NTBs

At the regional level, a recent EAC regional meeting committee report (2023) estimated the direct costs of NTBs at $16,703,970 (nearly Shs65 billion) and total trade impact at $94,918,000, (about Shs363 billion)decreasing trade by an average of nearly 60 per cent.

Due to the persistence of NTBs, researcher Kiiza notes that intra-EAC trade and supply chains are disrupted by protectionist policies and inward-looking measures affecting businesses and industries at the expense of consumers, raising costs and reducing productivity.

A report of the 43rd Sectoral Council of Ministers on Trade, Industry, Finance and Investment (SCTIFI), held from 5th-7th December in Arusha revealed that currently, the EAC Time Bound Programme for the elimination of NTBs had 11 outstanding NTBs, with Uganda and Tanzania having imposed the highest number of NTBs (4) for each for the two countries while Kenya and South Sudan had one each, with Rwanda and Burundi having not imposed any NTB on goods from other partner states.

Some of the NTBs imposed by Uganda on other EAC partner states include: charging 18 per cent VAT on exercise books from Kenya; rejection of tissue paper manufactured in Kenya; not recognising the Calibration Certificate issued by the Weight and Measures Agent (WMA) for the oil tanks from Tanzania.

Fuel trucks approach Malaba border. On June 13, 2022, Kenya introduced an import levy of Ksh72 (Shs2,500) per tray of eggs from Uganda. PHOTO / MICHAEL KAKUMIRIZI

Even as the most recent EAC Regional Meeting Committee report indicates Uganda as one of the main players in the NTB arena, is bearing the most significant brunt, making her the biggest victim of EAC region imposed NTBs.

“Whereas Uganda is no saint when it comes to the introduction of NTBs, she is a country more sinned against, than sinned,” researcher Kiiza observed in his expert analysis.

He continued: “For example, the continued ban on Uganda’s milk by Kenya through non-issuance of dairy import permits to Ugandan dairy exporters has affected the prices of milk from over 4.2 million households involved in the sector, causing more than 40,000 direct job losses. Furthermore, the blockage of trucks carrying over 1,700 tonnes of Ugandan maize by South Sudan in 2023 led to losses by Ugandan traders, valued at Shs7.5 billion.”

According to the expert analysis, Uganda has always been the biggest victim as evidenced by other NTBs, though resolved have been slapped on Uganda’s exports over time, with Kenya being the major culprit.

For example, on June 13, 2022, Kenya introduced an import levy of Ksh72 (Shs2,500) per tray of eggs from Uganda. Furthermore, in 2011 reduced the importation of Ugandan sugar by 79 per cent from the initially agreed 90,000 tons to 18,923 tons of sugar and stopped the import of sugarcane.

A statement by PSFU, the private sector apex body in the country, in 2023 notes that this decision led to a loss to sugar manufacturers who had stored sugar worth $50 million (Slightly over Shs190 billion), while an estimated 40,000 households and 640,000 labourers were affected.

Earlier, Kenya restricted the import of Ugandan maize, a decision which, according to UBOS, affected Uganda’s maize exports earning from $ 92.11 million (Shs352 billion) in 2020 to $ 52.07 million (nearly Shs200 billion) in 2021, and also affected over 4.26 million households engaged in maize production.

The problem according to manufactures stems from Kenya questioning the origin of Uganda’s products, even those with valid certificates of origin.

According to UMA, the umbrella association that brings together Ugandan industrialists and manufacturers, Kenya has tendencies of arbitrarily barring the country’s exports from accessing Nairobi and other key markets in the neighbouring country.

The association leadership describes claims that their products are counterfeit as baseless, stressing that they are of required quality bearing the “Q” mark certification issued by the Uganda National Bureau of Standards (UNBS).

The unilateral restrictions against Ugandan-originating goods, according to the private sector players is structured, tantamount to institutionalised harassment targeting Ugandan-originating goods, including poultry, milk and sugar among other exports.

This situation is not helped by Tanzania’s incessant tariff changes, and some sort of repeated “standoff” with Kigali and the frequent annoying trade disruption by elements in South Sudan - all breaching the EAC common market commitments.The top three destinations for Uganda’s exports in 2023, according to government statistics were Kenya with a share of 31.5 per cent, followed by the Democratic Republic of Congo at 25 per cent and South Sudan, commanding just over 23 per cent, and traded at a surplus worth $716 million (about Shs2.7 trillion) with EAC partner states.“These numbers tell us that whereas Uganda is often bullied by partner states like Kenya through blockage of her exports, its decision not to retaliate to consolidate intra-EAC trade ensures that her leading export destination, though turbulent, is secured,” researcher Kiiza observed in his analysis. President Museveni has objected to retaliation calls. In his end of 2023 address, President Museveni said regional integration is an important route for Uganda’s prosperity, citing the wider market it provides “for our goods and services”.

He said: “A year ago, I had to kill the unholy idea of banning Tanzanian rice. The NRM will not be part of those blind policies. In the early years of our Government, Mzee Moi, at one time, closed the border, but I rejected the arguments for retaliation.

Southern and Eastern Africa Trade Information and Negotiations Institute – Uganda executive director Jane Nalunga, says Mr Museveni should ensure that a robust dispute settlement mechanism is put in place to guarantee stability for trade and attract investments into the region.

Retaliation

Meanwhile, Uganda Manufacturers Association cannot wait for a quid pro quo like arrangement - in which returning a gesture in this case retaliation should be contingent upon the action of the other party.

So far, President Museveni has objected to retaliation calls. In his end of 2023 address, President Museveni said regional integration is an important route for Uganda’s prosperity, citing the wider market it provides “for our goods and services”.

He said: “About a year ago, I had to kill the unholy idea of banning Tanzanian rice…”

He continued, “The NRM will not be part of those blind policies. Some of the Ugandan business people cite the non-tariff barriers practised by other countries. In the early years of our Government, Mzee Moi, at one time, closed the border, but I rejected the arguments for retaliation.

“Uganda’s exports to Kenya are either equal to our imports from there or, sometimes, they are higher. Rationality cannot be ignored indefinitely. We shall continue discussing with our EAC partners and, I am sure, we shall end up with a real common market, free of non-tariff barriers because those barriers hurt the wanainchi of all our countries.”

Uganda National Bureau of Standards in a statement said they are working to ensure that international standards are more accessible to enterprises, especially the small and medium-sized enterprises that account for the vast majority of jobs in Uganda.

A statement issued by the standard prefect’s spokesperson quoting the Deputy Executive director Ms Patricia Ejalu, reads: “The main thing that standards do is create access to markets. UNBS harmonises standards at the regional and international level so that what we are implementing in Uganda applies to the EAC and beyond. We want our locally manufactured products to meet the health and safety requirements of the markets they are traded. In essence, the role of standards is to facilitate export trade.

Remember, development of standards also involves adoption meaning that if you are meeting the Uganda standard you are in essence meeting the regional standard and therefore access to the EAC is available to you.

According to the director of trade information at Uganda Export Promotion Board (UEPB), Mr Lawrence Micheal Oketcho, the institution not only carries out export readiness assessments and training while linking producers to current exporters, but also closely works with Ministries, Departments and Agencies of government in the partner states and engages with the EAC secretariat to address the emerging NTBs.

Non-tariff barriers

Uganda as one of the main players in the NTB arena, is bearing the most significant brunt, making her the biggest victim of EAC region imposed NTBs.

A report of the 43rd Sectoral Council of Ministers on Trade, Industry, Finance and Investment (SCTIFI), held from 5th-7th in Arusha revealed that currently, the EAC Time Bound Programme for the elimination of NTBs had 11 outstanding NTBs, with Uganda and Tanzania having imposed the highest number of NTBs (4) for each for the two countries while Kenya and South Sudan had one each, with Rwanda and Burundi having not imposed any NTB on goods from other partner states.

Some of the NTBs imposed by Uganda on other EAC partner states include: charging 18 per cent VAT on exercise books from Kenya; rejection of tissue paper manufactured in Kenya; not recognising the Calibration Certificate issued by the Weight and Measures Agent (WMA) for the oil tanks from Tanzania.

Receipts from Uganda rose by 41 percent to a record high of kSh113.8 billion (Sh3 trillion) representing 11 percent of total export earnings last year.

The jump in Uganda’s share in Kenya’s export earnings to over 10 percent, poses a concentration risk on Kenya’s export earnings should there be a fallout or a major shift in policy that sidelines Kenya.