As a business or an individual, timely repayment of loans gives you a good credit history, which in turn offers you easier access to credit. Photo / File

|Prosper

Prime

It is important to clean up your credit history

What you need to know:

- Without a well-defined score, it has always been difficult for financial institutions to measure the creditworthiness of many intending borrowers

In the past, a sizable number of formal and informal small businesses in Uganda have or had unmet financing needs but with no way out.

Why? Because many or the majority have little or no credit history, which makes it difficult for credit institutions to assess their ability to access or repay loans.

Creditworthiness is an important aspect of business development and without it, it is always difficult for lenders to offer credit to a business.

However, today, credit rating services are in plenty, and experts in different disciplines, including new spaces such as financial technology, believe leveraging data and building robust credit information sharing infrastructure, will quickly turn around small businesses’ access to credit.

Credit rating is believed to promote creditworthiness among businesses and inclusive growth.

If a commercial or development bank is to lend to a company or business, its measure of risk must be accurate to avoid losses.

Vicky Nakidde, the head of personal banking at Standard Chartered Bank, says borrowers without a proper measure of creditworthiness are assumed to be risky and are therefore, sometimes subjected to higher interest rates, which means that they pay more for a loan.

Worse still, lenders, she says, are usually reluctant to lend to borrowers whose ability to repay is not known.

Therefore, they are exposed to money lenders, who load them with high-interest rates that most times make loan repayment challenging.

However, Nakidde notes that because technology has broken up boundaries, lenders, irrespective of their capacity, are now able to know loan defaults, because most lenders now require one to have a unique identifier, which is the national ID.

“When you borrow, even from unlicensed lenders, know that you are being tracked. If you default, your indebtedness is reported on credit reference, which might impact your future borrowing,” she says.

In Uganda, many customers borrow to solve short-term financial needs yet many have the creditworthiness to access growth and development capital.

However, as the need to extend credit increases, several players such as ICRA, which recently launched a partnership with Private Sector Foundation Uganda, have come up to help rate small and medium enterprises.

The move seeks to enable SMEs to access financing, promote corporate governance and business growth.

Stephen Asiimwe is the PSFU chief executive officer. He believes the partnership will result into business confidence and an increase in lending to small businesses as well as helping to create credit rating standards for small businesses that clearly define the principle of having a balance between investment and business growth.

Asiimwe believes that credit rating can unlock financing opportunities and foster inclusive growth.

“Competitiveness is the ability of a country to beat other players with quality, efficiency, and trust. Trust is not announced; you must be certified,” he says and notes that it is important for Uganda to build competitiveness in credit access, where the country still performs poorly.

Beyond access to loans, credit rating helps banks and insurers to fix small businesses challenges, which often expose them to high-interest rates given that lenders usually want to insulate themselves against default.

Across the globe, credit rating is measured using similar parameters that include compliance with payment and regulatory obligations, business sustainability, and environmental protection.

Zeeshan Khan, the ICRA global general manager, says credit rating adds value to financial markets and builds business confidence.

“It gives [investors] an idea of the level of risk they might be taking care of. Uganda is making policies to increase domestic production, and compete in the world in international trade. Building a solid credit system at all levels is now important,” he says.

Technology-based rating

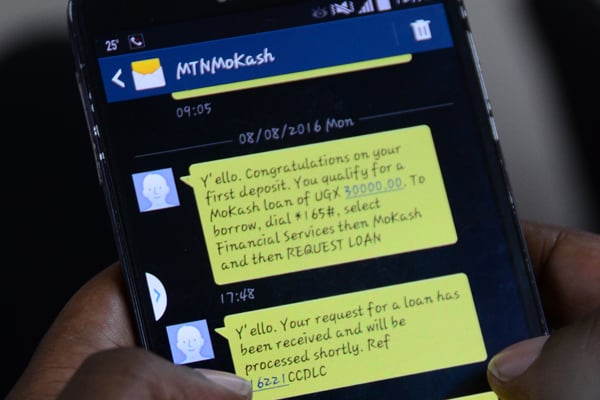

Credit rating has shifted from issuance of financial cards to borrowers to real-time technology-based rating.

During the third Bank of Uganda Financial Stability Symposium early this month, the Central Bank said it had instructed credit reference bureau to use national identity cards to identify borrowers, and, by extension, rate them and issue them with a credit score.

Thus, this meant that credit reference bureaus have a wide array of parameters, apart from banking history to determine the creditworthiness of a borrower.

During the meeting, Twinemanzi Tumubweinee, the Bank of Uganda executive director of supervision, said that based on a borrower’s NIN, financial institutions can determine whether to approve or decline a loan request.

“We are moving away from credit reports to credit per se, to credit score. This means that how much a person uses credit whether to a utility company, car dealer, or ware store; whichever entity you signed up to, all this information which is currently not available to [credit reference bureaus] is used to compute your score. Based on your score, a financial institution can provide you credit [which] in other words is referred to as reputation collateral,” he said.

Reputation collateral covers a range of obligations, among them utility bills, rent and banking history.