Prime

Considering investing in overseas property

What you need to know:

- Investing in overseas real estate is becoming more and more popular as technology transforms the world into one global community.

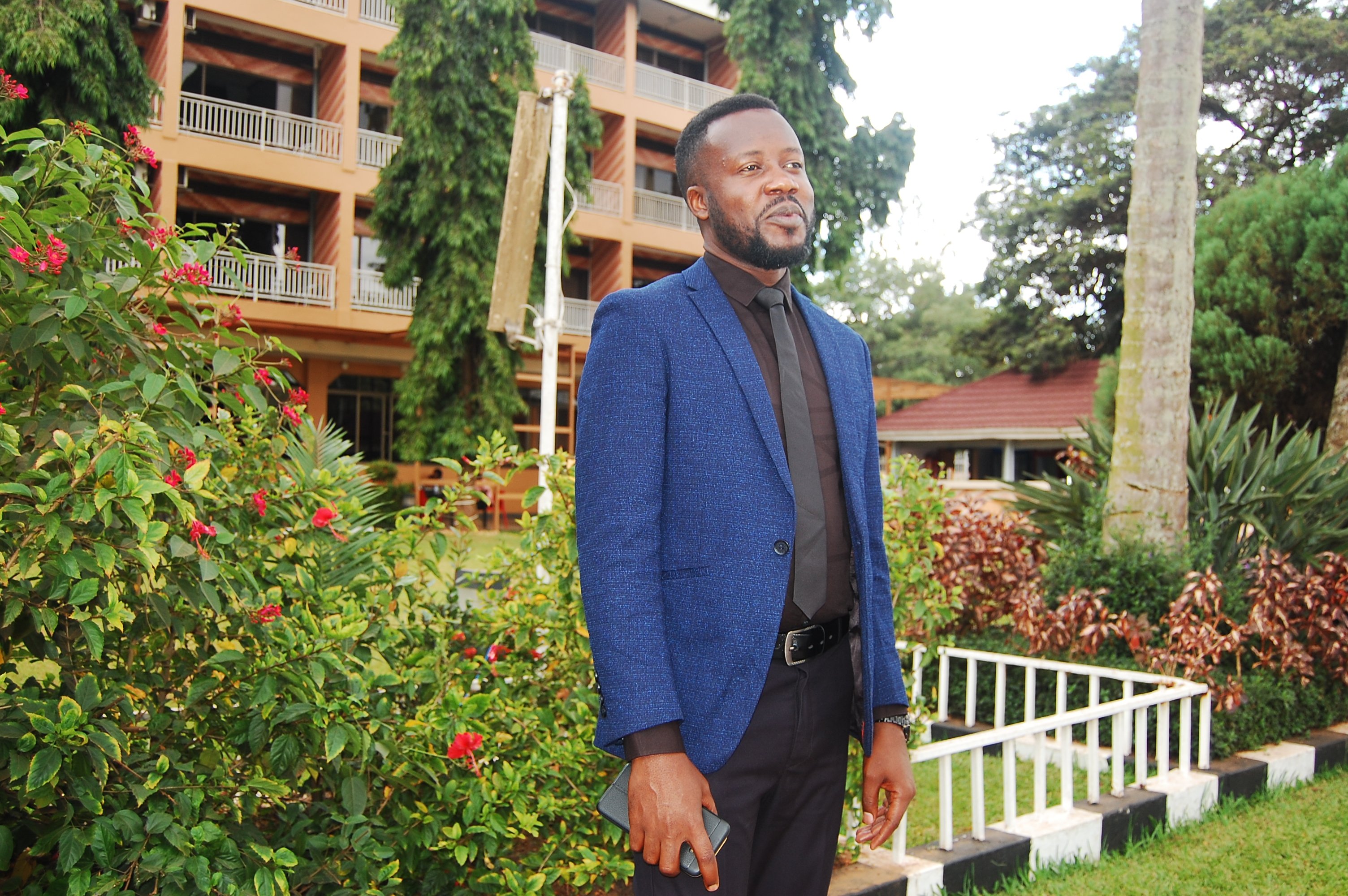

Edward Kayondo, a business consultant says he came into investing in overseas real estate quite by chance.

While on a student visa in Stockholm, Kayondo started sharing an apartment with two of his classmates. After his graduation, he was obligated to first work in Sweden for three years.

During this period, their landlord told them he was ready to sell the three bedroom apartment and was giving them a chance to buy it. The friends pooled funds and bought the property together.

Later, his two friends offered him to buy them out since they needed money to buy homes where they could raise families. He agreed to buy them out but since he had left Sweden, he put the apartment up for rent.

“The apartment was earning me three times what I was earning monthly as a business executive in Uganda. This is what opened my eyes to what a great investment this was,” says Kayondo.

From the rent from that one apartment he has since bought more property in Europe, which he says has given him the financial freedom to pick and choose which contracts he takes on.

“The trick is to make sure each preceding property buys you the next one, if you invest wisely it is possible,” he stresses.

Kayondo says among the many benefits, he is proud to be bringing money into the Ugandan economy from his investments.

Investing in overseas real estate is becoming more and more popular as technology transforms the world into one global community.

With the proliferation of the internet, knowledge about other countries and overseas investment opportunities has become abundantly available to whoever cares.

There are many reasons for investing in overseas property.

While some might be looking for higher return on investment than what is possible at home, others are looking for holiday homes.

Some may invest in overseas property in anticipation of future political turmoil at home, others may just want to expand their investment portfolio to include exotic locations.

Whichever reason it is, there are several variables to consider. Some countries have friendly laws concerning foreign investors, some are known to offer affordable but superb properties, some have friendly tax regimes while others guarantee very high capital appreciation.

For this reason, some countries are preferred over the rest. Some countries are viewed favourably by investors while others are shunned.

For instance, according to Expatriate Group, a company that provides insurance plans for expatriates living and working abroad, the top countries to buy property are Turkey and South Africa respectively.

Monica Ajwang, a Ugandan realtor, who specialises in selling overseas property to Ugandan says Turkey is one of the more affordable countries to invest in real estate.

Ajwang works with Reportage properties Uganda Ltd, a subsidiary of Reportage Properties LLC, headquartered in Abu Dhabi. She says prospective clients can contact them through their website or visit the company offices in Kampala and they will be introduced to an agent who will take them through the process.

Foreigners who wish to purchase property in South Africa must have a valid passport, a permanent residence permit, any valid visa, or an endorsement in their passport allowing them to reside in South Africa.

Investing in Dubai

Steven Opolot, a Ugandan-realtor in Dubai says investing in Dubai requires no annual property tax, income tax, rental value tax, or value-added tax.

The city’s strategic location between major business centres in Asia, Europe, and Africa makes it an ideal location for businesses and property investors.

Tourism is booming in Dubai and driving demand for hotel, resort properties and holiday homes.