Bankers tipped on anti-fraud measures

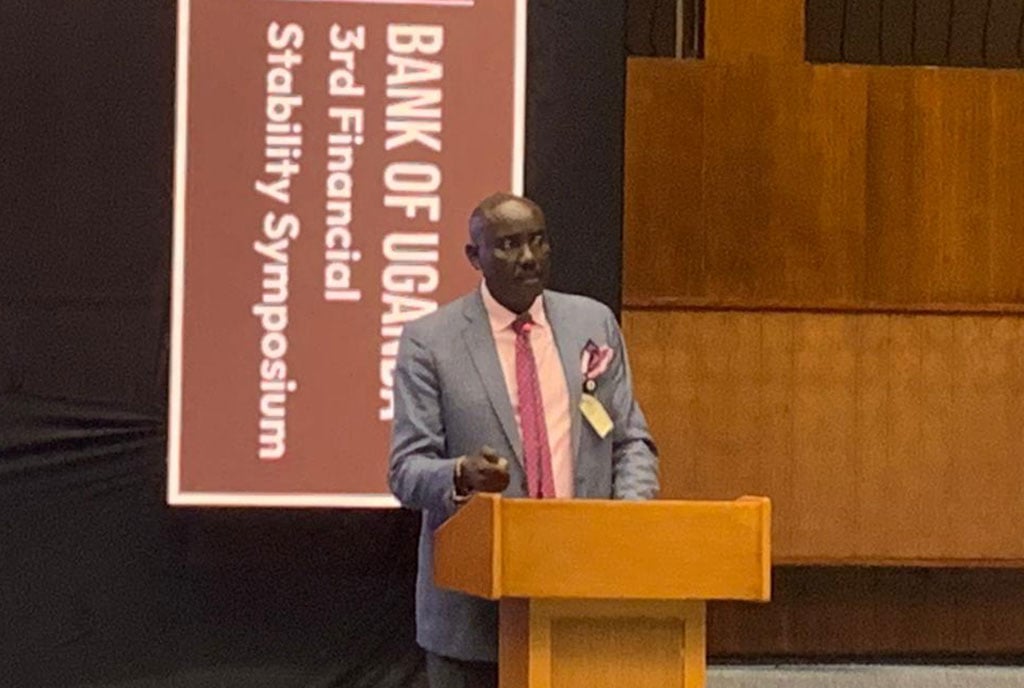

Dr Michael Atingi-Ego, the deputy governor of Bank of Uganda. PHOTO/HANDOUT

To fight the rise in fraud across Uganda’s financial sector, bankers have been advised to increase public awareness, ensure the highest standards of integrity, including robust internal controls while strengthening collaboration among themselves.

Speaking during the launch of the Banking Industry Guidelines for Mitigation of Fraud; the Revised Code of Conduct in Kampala on February 19, the deputy governor of Bank of Uganda (BoU), Dr Micheal Atingi-Ego, said fraud in the banking system undermines the very trust principle it relies upon.

When customers entrust their hard-earned money to financial institutions and fraud occurs, it erodes this trust, leaving individuals feeling vulnerable, he observed.

Over the past year, the banking industry has seen a growth in the crime through mainly hackers breaking into digital security systems to illegally siphon away cash; questionable insider dealings resulting in account take-overs and the subsequent loss of client money, to outright theft at ATM machines, among others.

“We must educate citizens on emerging digital threats; we must enforce oversight mechanisms to high standards; we must collaborate between banks to track ever-evolving fraud types. And most crucially, we must lead by example - holding ourselves up to the highest benchmarks of transparency, integrity, and accountability,” the banking mandarin said.

The central bank chief told his audience that as the regulator, BoU has taken steps to combat financial fraud, requiring banks to cover potential operational losses from fraudulent activities, which gives banks a good reason to invest in rigorous risk management systems.

Dr Atingi-Ego also pointed out that “the Banking Industry Guidelines for Mitigation of Fraud and the Revised Code of Conduct we launch today are important milestones. But they mark just the beginning. The real test lies in their effective industrywide implementation…”.

Adding: “Together, let us entrench an atmosphere of ethics and consumer protection and make our banking sector the gold standard of trust. This will foster public confidence…Collective responsibility and action are our greatest strengths”.

With cyber/internet-related frauds rising in Uganda, alongside loan scams, impersonation, identity theft, forgeries, and cash suppression, the country’s banker reminded the industry how globally, losses to this sort of criminality amounted to an eye-watering $11 billion (over Shs40.7 trillion) last year.

The chairperson of Uganda Bankers Association (UBA), and also the managing director of Citibank Uganda, Ms Sarah Arapta acknowledged that over the years, the Uganda’s financial sector has grappled with fraud, but the scale and complexity has kept evolving.

“This evolution of fraud trends has been partly brought about by several developments in the market, some of which include: a technological revolution... The market has equally changed with a surge in youth population with a preference for digital solutions and ability to easily pick activities positive or negative from any part of the globe,” she said.