Microfinance reform comes to a dead end

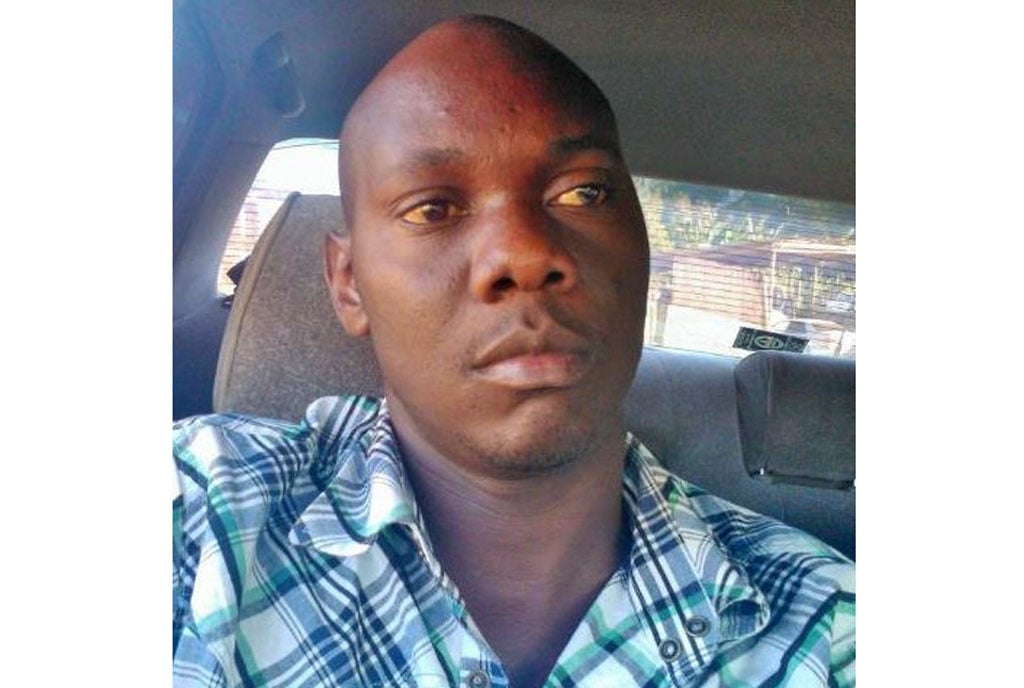

Junior Finance minister in-charge of Microfinance Haruna Kasolo addresses residents of Wakiso District on Emyooga money recently PHOTO | FILE

A tiny sliver of lawmakers on the Budget Committee have objected to the decision to appropriate Shs35b to the Microfinance Support Centre (MSC) in the Budget for Financial Year 2022/2023.

In a minority report, the five lawmakers claim that “MSC operations are marred with massive irregularities and without adequate supervision.” They go on to add that “it has veered off its operational guidelines.’’

The five lawmakers led by Shadow Finance minister Muwanga Kivumbi allege that the MSC funds benefit the wealthy over primary target beneficiaries such as boda boda riders, carpenters, tailors, welders, fishermen, taxi, vendors and salon operators.

Other primary target beneficiaries include journalists, market vendors, veterans, produce dealers and persons with disabilities (PWDs).

According to the cash rollout arrangement, each constituency is entitled to at least Shs560m.

“Continued budget allocation to the entity exposes the scarce public resources to the risk of further abuse,’’ the report reads, naming 10 Saccos that scooped huge sums anywhere between Shs700m and Shs3b.

The lawmakers’ concerns echo those of Auditor General (AG) John Muwanga, who called into question operations of the MSC in his latest report.

Mr Muwanga raised the red flag on 6,326 Emyooga Saccos that were financed through the MSC. The AG revealed that these lacked operation licences from the Uganda Microfinance Regulatory Authority.

“This violated the Tier 4 Microfinance Institutions and Money Lenders Act (2016) and Sacco Regulations (2020),’’ Mr Muwanga noted in the report published in February after scrutinising financial reports of government agencies in the year 2020/2021.

Mr Muwanga’s findings indicated that seed capital was disbursed to the 6,326 Saccos without entering a Memorandum of Understanding with the MSC. To compound matters, Shs.34.71b was disbursed as grants to various constituency Saccos. These, however, remained inaccessible by the beneficiary Saccos.

In one field visit in Kayunga, it was revealed that Shs500m was disbursed by various Saccos to non-traceable beneficiaries. There were also no loan agreements and ascertaining evidence of existence of borrowing associations.

High default rate

The AG also pointed out that 140 Saccos that were sampled had received Shs3.52b. They had, Mr Muwanga added, defaulted to a tune of Shs2.49b—a staggeringly high default rate of 70.74 percent.

“MSC had not undertaken monitoring and evaluation of the performance of beneficiary Saccos. Some Emyooga Saccos were charging interest rates as high as 60 percent contrary to the target of at least eight percent per annum but not exceeding 12 percent per annum,” Mr Muwanga noted.

In regard to conventional lending, Shs56.89b had been disbursed by the close of the financial year against a full release of Shs77.72b. This translated into a disbursement rate of 44 percent.

Perplexingly, loans were extended to beneficiaries beyond the maximum threshold of Shs400m. This is contrary to the MSC Credit and Operations Manual 2017.

The report also notes that loans totalling Shs5.3b bypassed the Management Loans Committee and were illegally waived from presenting requirements such as tax clearance certificates and licences.

Other sums that popped eyes include Shs13.10b that was disbursed without the perfection of securities by the legal department.

Elsewhere, a loan of Shs2.2b was disbursed to related parties; contrary to the Policy on Credit Concentration.

Equally questionable is why Shs1.4b was advanced to clients who already had outstanding nonperforming loans.

Shs2.5b was extended to individuals, while policy states the beneficiaries are supposed to form a Sacco of between seven and 30 members. These then register through the district community development officer (DCDO), and must open a bank account on which the money is deposited.

Mr John Peter Mujuni, the executive director of the MSC, declined to comment on the matter when Sunday Monitor contacted him over the irregularities illuminated by reports from the AG and the House. He referred us to “my assistant”, who was unaccessible by press time.

In July 2020, the government launched the much-vaunted Emyooga as a poverty alleviation scheme.

Junior Finance minister in-charge of Microfinance, Mr Haruna Kasolo, traversed the country in a sensitisation exercise meant to teach intended beneficiaries the ropes of accessing funds.

During the launch, which played out in Wakiso and Entebbe, Mr Kasolo and a team from the MSC made it clear that the scheme targeted Ugandans trapped in the informal sector. The scheme was managed by the MSC under the auspices of the Finance ministry.

Work to be done

Ms Jane Nalunga, the executive director of the Southern and Eastern Africa Trade Information and Negotiations Institute (SEATINI), opines that politicking has dogged the government’s poverty alleviation programmes.

She adds that it does not help matters that government officials undertake such projects without adequate preparations.

“I think the challenge is that government is just throwing money at problems, which isn’t right. We are not planning as a country. We need to have a clear direction on where we want to go and achieve and thereafter, we can put resources around that,” Ms Nalunga told Sunday Monitor.

It has not helped matters, Ms Nalunga adds, that the government has no clear recovery measures, particularly “of punishing defaulters and officers who run away with the money.”

“Let us hold accounting officers personally liable for the money lost as opposed to charging the institutions,” Ms Nalunga said, adding: “May be that would send a message to others to know that maybe government is serious about fighting corruption.”

While the minority report of the parliamentary Committee on Budget recommends that funds not be released to the MSC pending an audit, economist Fred Muhumuza says this is self-defeating.

“If there are operational oversight issues at the institutional level, you don’t fix those by cutting because that would harm the intention,” Mr Muhumuza offered, adding that the government can continue funding the MSC as an audit is undertaken.

In the past, government programmes such as Naads, Prosperity For All (Bona Bagagawale), Operation Wealth creation, and Youth Livelihood Programme have all been dogged by tenuous monitoring and evaluation mechanisms. The authors of the minority report calling the MSC to order believe the time to make a statement is now.

“We are calling for transparency in this. And because there is a lack of dissemination of information, you find that the would-be beneficiaries are left ignorant about the scheme,” Ms Goretti Namugga (Mawogola County), who signed the minority report, said.

She added: “Therefore, officials in government and those close to those managing such end up benefiting only the rich people, which completely fails and defeats the intended purpose of the money.”

Ms Namugga has also challenged MSC to show its will to clean up the institution by naming and shaming individuals found to be culpable.

Some of the wealthy beneficiary Saccos

Beneficiary Amount (Shs)

URA Staff Sacco 3b

Torget lmpex (U) Ltd 3b

Katebe Farm Ltd 3b

Out Media international Ltd 2.5b

Bugisu Cooperative Union 2.4b

Joctar Enterprises Ltd 2b

Yudimo Miners Ltd 1.5b

Johpro Green Acres Ltd 1.5b

Great Lakes Contractors 1.59b

lnspire Africa Establishments 1.02b

lnspire Africa Establishment Ltd 1b

Universal Apostles F Church 1b

Rise Shine Investments Ltd 800m

Potrina Enterprises Ltd 800m

Enterprise Support & Com Devt 750m

Swozi Highland Teo Company Ltd 741m

Morkburridge Guest Forms Ltd 500m